I didn't at first but I remember it checking out.

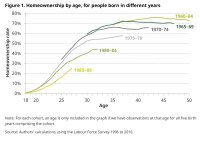

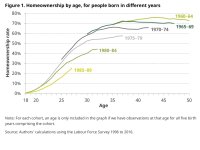

Have you adjusted for age?

What you're missing is that the poor are getting richer too.

Housing pressure is created by increasing population. The UK's population was 49 million in 1951 and an estimated 69 million today. That's a 40% increase. Absent immigration the population is now naturally declining, so this is a problem that will resolve itself over the next century or so.

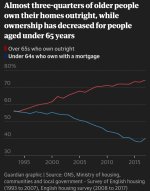

Age adjusted.

It's impossible for home ownership to keep up of prices are acceleration above earnings

It's going to be an interesting one when the population starts to decline and has an effect.

I believe in the west they think it will take a while as we will need and attract immigrants.

But further into the future who knows. At that time tech will have progressed so far it life will either be amazing with robot slaves for everyone and even further, can't even fathom.

Or we'll carry on as we are and get a mega elite utopia for a few super rich vs slums for everyone else.

But that's too far away for me to worry about!

Not sure if the poor are getting richer too. But the divide is growing. And inflation is always there.

Easy to do when it's for 2yrs. Try it for 10yrs as a FTB now!

Easy to do when it's for 2yrs. Try it for 10yrs as a FTB now!