TBH I would recommend using a rewards credit card for most of your spend anyway, so debit card functionality has never been a thing for me.

I'm with COOP who give me £1/mo for free (down from about £2quid IIRC) and 2p each time I use the card up to 50 transactions. Much rather take money out of the system than have a designer app!

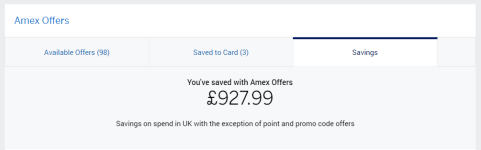

Spend with credit card, then pay off the credit card using Curve connected to Chase, so it still gives you the cashback, top-up your Chase account in 50 transactions from COOP. That's how you take money out of the system

Far simpler.

Far simpler.