Soldato

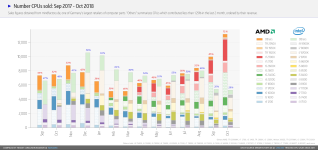

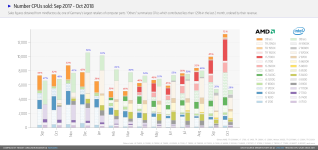

Though kinda disappointed with AMDs inability to convert Intels shortages into their own benefit

???

Things don't happen overnight, and it's been like a month since Intel announced shortages. It's going to take a while for those who were waiting on the 9000 series to decide if they're jumping ship to Ryzen, but that doesn't influence server buyers who are already flocking to EPYC.

And let's be honest, AMD benefiting from Intel's shortages is entirely reliant on customers buying their stuff; shortages or not, AMD can't gain market share if nobody buys AMD.

I was expecting 3rd quarter numbers to be at least flat compared to last quarter. After all, Zen has been on the market for quite a while now. I would expect AMD position to improve with each quarter, which wasn't the case yesterday, was it?

I was expecting 3rd quarter numbers to be at least flat compared to last quarter. After all, Zen has been on the market for quite a while now. I would expect AMD position to improve with each quarter, which wasn't the case yesterday, was it?