to many planning regs is the number 1 issue. Closely followed by lack of renting regulations. Thirdly the amount you can borrow and the help to buy schemes just artificially keep prices high.Whats the answer then?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Are earnings too low / living costs getting too high??

- Thread starter Buffman

- Start date

More options

Thread starter's postsWhats the answer then?

One of the problems is the housing market isn't affected quite the same way by supply and demand as most if not all other commodities - ultimately someone needs a roof over their head and have a lot less choice in going with other options, going without or going with something cheaper i.e. if they have to have a 3 bedroom house for decency as their kids grow up that doesn't leave them many options and they are much more at the mercy of rising prices. Maybe we should by regulation inject a simulation of demand into the housing market.

Whats the answer then?

Regulation to maintain the property market at stable levels, higher stamp duties, lending controls etc when the market needs cooling off.

Planning reform and whatever else is necessary to get house-building up to the required levels to meet demand.

Rental controls and other increased rights for tenants.

More efforts to divert investment from London outwards.

Sensible building, more European good-sized mixed-use townhouses (increase housing density in towns without going full high-rise or covering the landscape in pointless semi-detached shoeboxes)

Scrap help to buy and other nonsense.

Not rocket science.

Soldato

- Joined

- 22 Nov 2007

- Posts

- 4,209

Regulation to maintain the property market at stable levels, higher stamp duties, lending controls etc when the market needs cooling off.

Planning reform and whatever else is necessary to get house-building up to the required levels to meet demand.

Rental controls and other increased rights for tenants.

More efforts to divert investment from London outwards.

Sensible building, more European good-sized mixed-use townhouses (increase housing density in towns without going full high-rise or covering the landscape in pointless semi-detached shoeboxes)

Scrap help to buy and other nonsense.

Not rocket science.

I am just waiting for a mortgage offer on a shared ownership place. It is not ideal but its the only affordable option at this moment and its cheaper than full rental. I like the things you mention above but will they happen?

UK housing madness mentality summed up in one post. I really wish you could show people what life is like outside the UK property porn bubble, but you just don't see it when you're on the inside.

It's really sad that so many people in the UK just can't comprehend that it's possible to live well, have clothes and holidays and cars and go out, not spend half your life commuting, AND have an affordable roof over your head. Collective insanity.

Please do enlighten me? In your view, what is 'living well'. What is your view of an affordable roof over your head. Then what do you consider to be a good comfortable salary to achieve this wonderful easy existence? Also if the roof you speak of is rented, how are you going to pay the rent when your 65+?

There's no point at all comparing to other countries as we dont live in other countries. Unless you're proposing we all move abroad ?

unfortunately, everyone is left with no option but to just get on with it, the chance of it changing anytime soon is pretty much zero. Most people just see their wealth going up, even though you cant access it and it decreases what most can do in life.I am just waiting for a mortgage offer on a shared ownership place. It is not ideal but its the only affordable option at this moment and its cheaper than full rental. I like the things you mention above but will they happen?

Lots of other factors involved as well with housing:One of the problems is the housing market isn't affected quite the same way by supply and demand as most if not all other commodities - ultimately someone needs a roof over their head and have a lot less choice in going with other options, going without or going with something cheaper i.e. if they have to have a 3 bedroom house for decency as their kids grow up that doesn't leave them many options and they are much more at the mercy of rising prices. Maybe we should by regulation inject a simulation of demand into the housing market.

Cheaper housing might be a long commute out of town but if you are at the poverty lien you might not afford to run a car, or you have 1 car shared but if both parents work that can add a lot of problem given the poor public transport in the UK.

Cheaper huosing is normally lower quality housing and the UK has not control of minimal quality and sizing. A cold damp house with mold problems is not a healthy environment to raise children.

Because of the UK's under-funding of education, cheaper housing may be in areas with poor schools that will negatively impact your children's education.

As you say housing is not a commodity but a basic right like access to water, electricity, health insurance and education. It deserves a lot of control to prevent exploitation.

Please do enlighten me? In your view, what is 'living well'. What is your view of an affordable roof over your head. Then what do you consider to be a good comfortable salary to achieve this wonderful easy existence? Also if the roof you speak of is rented, how are you going to pay the rent when your 65+?

I'm a game developer, which isn't a particularly well-paid career. Here in Germany I can afford to rent a nice 2-bed top-floor apartment in a nice neighbourhood, a 5-minute walk from my office, a 10-minute tram ride to the town centre and also the international airport for getting about. I have money to take several holidays a year, indulge in the odd tech purchase, nip back to the UK regular, eating and drinking out regularly, and still save 500+ EUR a month without really trying.

When I want to start a family I'll take the money I've saved while enjoying life, buy a plot of land and build a place as I see fit. Then maybe retire to a little place in the Black Forest that'll cost 50k or something and cash in the equity from the family home, or let it out.

This is pretty normal. Not like the UK and everyone banging on about the property ladder and boasting about how much of a hero they are because they commuted 4 hours a day and didn't go out for 6 years so they could take out a massive loan on a shoebox.

There's no point at all comparing to other countries as we dont live in other countries. Unless you're proposing we all move abroad ?

On the contrary, given how many people are fed up with the mess the UK is in, and how much better much of Europe is when it comes to property, surely that is exactly where we should be looking?

Housing isn't the issue is it.

People complaining in this thread are at the very least on the internet so I think its safe to assume are also housed.

Yes, it is, this is what the thread is about.

This is a problem.

For comparison....a somewhat more crude but also insightful comparison :

http://www.globalpropertyguide.com/Europe/germany/price-gdp-per-cap

Last edited:

Housing isn't the issue is it.

People complaining in this thread are at the very least on the internet so I think its safe to assume are also housed.

Personally I'm not at all struggling - but I see what many of the people around me have to deal with and TBH some of the posts on here are quite insulting towards those people - many of whom are making sacrifices and/or other efforts to try and better their situation, etc. my perspective is a little skewed though as in the immediate area I live house prices have risen at twice the national average.

The problem is from both angles, not just housing that's expensive but wages are low. Huge overheads hiring people leading to the rise of contractors. Go look at wages in the US for employee / contractor, barely a difference because there aren't humongous punishing overheads for employees. Just crap from every direction in this country.

Caporegime

- Joined

- 13 Nov 2006

- Posts

- 26,146

Regarding low earners and people in poverty, there actually hasn't been too drastic a change in relative costs in recent years, well, nothing like the 80's! In fact, since 1992 the trend is downwards although it is predicted to rise. Source: http://www.poverty.org.uk/03/index.shtml

Interesting video here:

https://www.youtube.com/watch?v=9JxJQUSUoGI

How do I embed a YT video on this swanky new forum?

Interesting video here:

https://www.youtube.com/watch?v=9JxJQUSUoGI

How do I embed a YT video on this swanky new forum?

Last edited:

I have shown you. you can buy a flat in Scotland for £10K a 2 bedroom for £15K, yes they aren't buckingham palace or in nice areas but it shows you, that you can buy a flat on less than 1 years wage.

Im from Glasgow also, i can tell you those places are awful areas and the price indicates that.

I appreciate moving to get better earnings (I did it, both to Cambridge and now Warwickshire). However, there's no point in significantly lowering your quality of life and moving away from all your family/friends at the same time. It's also situation dependant, eg not easy to do with kids.

Also, you keep talking about random careers eg make up which pays £300 a day, but don't consider the amount of research and past experience etc required behind a day rate. Eg I could say "become a Thai boxer/gas engineer/professional dancer for £300 a day". It's a bit of a naive statement/outlook.

I'm finding sonnys posts confusing, it's not as black and white as you say it is, easy to do this job blah blah, what I find amusing is your life is based on being tight as a ducks arse, I think your the one who is mixed up on things.

Associate

Yes, it is, this is what the thread is about.

This is a problem.

For comparison....a somewhat more crude but also insightful comparison :

http://www.globalpropertyguide.com/Europe/germany/price-gdp-per-cap

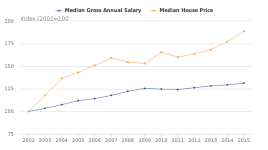

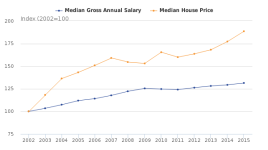

To be fair, interest rates have gone from 4% in 2002 when your graph starts to 0.25% currently. Deposit aside (which is definitely an issue, and one which there have been various attempts to counter), the payments on a mortgage would be a lot closer than your graph indicates. e.g asssuming 10% deposit A tracker at 1.5%+base rate would be £553/month for a 100K house in 2002 or £667/month on a 180K house now. That is actually less than the median gross annual salary increase in your graph.

Associate

- Joined

- 20 Mar 2014

- Posts

- 2,361

To be fair, interest rates have gone from 4% in 2002 when your graph starts to 0.25% currently. Deposit aside (which is definitely an issue, and one which there have been various attempts to counter), the payments on a mortgage would be a lot closer than your graph indicates. e.g asssuming 10% deposit A tracker at 1.5%+base rate would be £553/month for a 100K house in 2002 or £667/month on a 180K house now. That is actually less than the median gross annual salary increase in your graph.

Interest rates will rise eventually.

To be fair, interest rates have gone from 4% in 2002 when your graph starts to 0.25% currently. Deposit aside (which is definitely an issue, and one which there have been various attempts to counter), the payments on a mortgage would be a lot closer than your graph indicates. e.g asssuming 10% deposit A tracker at 1.5%+base rate would be £553/month for a 100K house in 2002 or £667/month on a 180K house now. That is actually less than the median gross annual salary increase in your graph.

Interest rates are hurting me more than anything else at the moment

savings and other investments are making a fraction of what they used to.

savings and other investments are making a fraction of what they used to.Caporegime

- Joined

- 13 Nov 2006

- Posts

- 26,146

Interest rates are hurting me more than anything else at the momentsavings and other investments are making a fraction of what they used to.

Hence why people are putting their £ into property.

Associate

Hence why people are putting their £ into property.

Totally agree with this, give a decent interest rate, people would stop investing in property. Property is hard, but delivers a return in the absence of interest on accounts etc.