Problem its a global economy, both Russia and China have a hand in all sorts of companies you wouldnt expect. The UK should aim not to import energy in any case.

The sanctions hopefully help instigate some change and apprehension to further negative moves against the free world but there is no absolute way to do it. AAL have done well I think because they own assets outside of Russia that will do better with that now restricted supply.

I remember ages ago reading death squads going after the BP head, end of an era they fought long over. Putin will remain their for decades possibly, when he took over from Yeltsin (who promoted him) he immediately ignored and froze him out of policy and so his view to end any term of power will expect the same and he wont go easily I guess. I thought too of China having some kind revolution but its not especially likely

https://finance.yahoo.com/news/chesapeake-energy-corporation-reports-fourth-210100602.html

Chesapeake doing very well, seems far too cheap relative to prospective earnings but it has a lot of fear from its former troubles. Slightly below estimates in its earnings but good forecast, its about 8x earnings. Its rated by hedge funds apparently, I will probably reduce take some profits to hold some longer term.

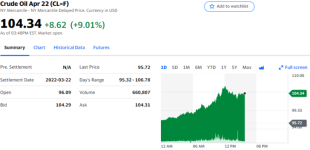

Good break up anyway on the chart. Big day for oil

https://youtu.be/izJtkpTJ4nU?t=660 Shel RU