Soldato

Looks like polymetal stocks have been suspended?

most platforms stopped the buying of Russian stocksLooks like polymetal stocks have been suspended?

you can still sell them at a huge loss if you had them before the dump though, probably directly to the broker

you can still sell them at a huge loss if you had them before the dump though, probably directly to the brokerStill holding my failing Easyjet and UIPath stocks. What a shambolic decision to buy those.

I have bought through the downs though, so my average price is decent on that now.

I have bought through the downs though, so my average price is decent on that now.

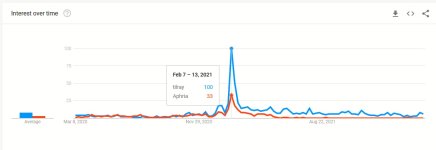

I saw that earlier this week! I bought mine a while back, pre these announcements. I just figure the world will one day legalize all this and it'll come rocketing, but who knows! hahatilray was a WSB favourite meme stock

I like free shares. I got a couple from BUX for referrals and I got pelaton (-12%), air france (-0.55%) and GoPro (+8.79%!!)@randomshenans Tilray was my free share from T212, would have never heard of it otherwise. Looks like i was lucky!

it was a meme stock long before that back when the GME thing happened.I saw that earlier this week! I bought mine a while back, pre these announcements. I just figure the world will one day legalize all this and it'll come rocketing, but who knows! haha

Ah I hadn't seen that far back to be fair, so they completely outdate me. I bought about Jan this year!it was a meme stock long before that back when the GME thing happened.

@randomshenans Tilray was my free share from T212, would have never heard of it otherwise. Looks like i was lucky!

Yea, I considered a clean energy ETF, but wanted a bit of a balance between current demand and future, so slapping them in my own seemed decent. I can't say I know many of them well, I spent a day researching online different companies tipped this year for both sides and these were the names that kept coming up. That was good enough for meOPEC and all the other political factors makes it difficult, just going via a fund and the FTSE itself is ok for me mostly.

Dont know the other names; energy will do well either way I think so long as world GDP expands and some vast economies much bigger then the west develop usefully requiring all commodities. Regular invest and not relying on one name in particular sounds good to me

Noob question — what’s the best way to take profits?

I’ve DCA’d on a stock — 10 instalments of 25 shares each time.

In total, I’m up 87% — I was going to wait until it had doubled and then take out my original investment.

Should I:

1. Sell my cheapest shares so that I need to sell fewer shares to take out my original investment, even though this will increase my average cost per-share for the shares I’m keeping.

2. Sell my most expensive shares. I will have to sell more of them to extract my original investment but the shares I have left will be at a lower cost average.

3. Split my existing tranches in half (sell ~12 shares at each price-point so my cost average remains the same and I have exactly half the number of shares.

What’s best?

*Edit* Just realised Option 3 won’t work in practice so would have to weight the sale from one end or the other.

not sure why it matters. You're just selling shares, doesn't matter what price you bought them. The only thing that might matter is harvesting capital gains

Apologies if this has been asked a thousand times but what platform do you guys use?

I’ve looked at a couple just wanted some opinions.

It only matters if dividend are issued per share (keep the most shares possible, sell the expensive ones) or capital gains tax is a consideration. If you sell before April 5th or whatever the date is I'd shift the cheaper ones but it may not be an issue for you anyway.I’m thinking about the shares that I leave in-play. Is it better to have more shares at a higher average price or fewer shares at a lower average price?

If I sell the most expensive shares first, the price can dip further before I end up in the red, but I will have had to sell more shares in order to recover my original investment.

I assume there’s a break-even point where it doesn’t matter either way but I thought there might be something I had overlooked.