for buying and selling, they pay a small fee to execute and clear a transaction on your behalf then charge you for that service and in the process make a profit

You've not really provided any details - if you don't think they're doing anything then why not close your account?

Do you have the physical share certificates in your possession for example?

Late reply, I know. I haven't got an account with anyone yet just trying to open account with someone but looking at fees etc first.

Thats what my point is. If I own x shares in a company, don't I own them and they have no input or management with them? Or do I have to get a physical certificate saying that first.

Out of curiosity, could anyone explain what this means for a Stocks and Shares ISA?

"How much would I like to subscribe"?? and How Often and When would I like them taken?

What is it talking about? Subscribe to what. Is it asking me what I intend to deposit or what? If so... by selecting "One off payment" shouldn't the 'date' option be blanked out?

Just checking and making sure I am not filling in the wrong thing here.

Maybe a tenth of that would be ok

Maybe a tenth of that would be ok Primary reasoning was students liked it - wow

Primary reasoning was students liked it - wow Shares

Shares

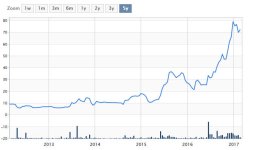

Thomas Cook was the one that got away from me.

Thomas Cook was the one that got away from me.