This would be amazing if they could achieve good efficiency

Intel had 22 core chips coming out of TSMC at 80watts. Intel win by default on the desktops, so the focus remains elsewhere.

Please remember that any mention of competitors, hinting at competitors or offering to provide details of competitors will result in an account suspension. The full rules can be found under the 'Terms and Rules' link in the bottom right corner of your screen. Just don't mention competitors in any way, shape or form and you'll be OK.

This would be amazing if they could achieve good efficiency

really happy with iGPU updates

not because i want to game on it, but just because I can get a new work laptop that actually supports my monitor at home - I'm currently stuck with 59hz refresh on my home monitor when it can go up to 175hz, because the Intel iGPU in this Dell XPS can't go higher than that on my Ultrawide monitor

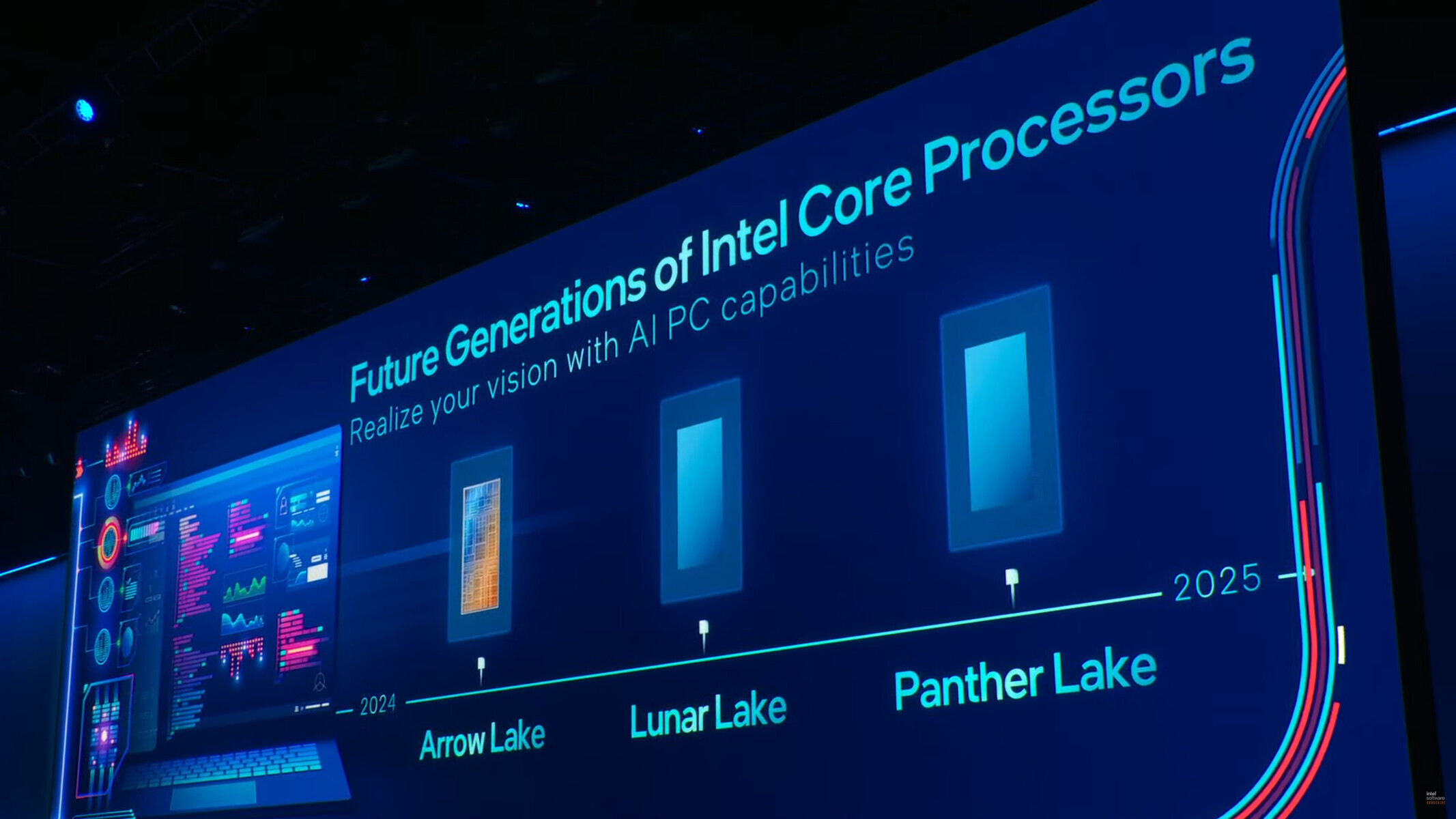

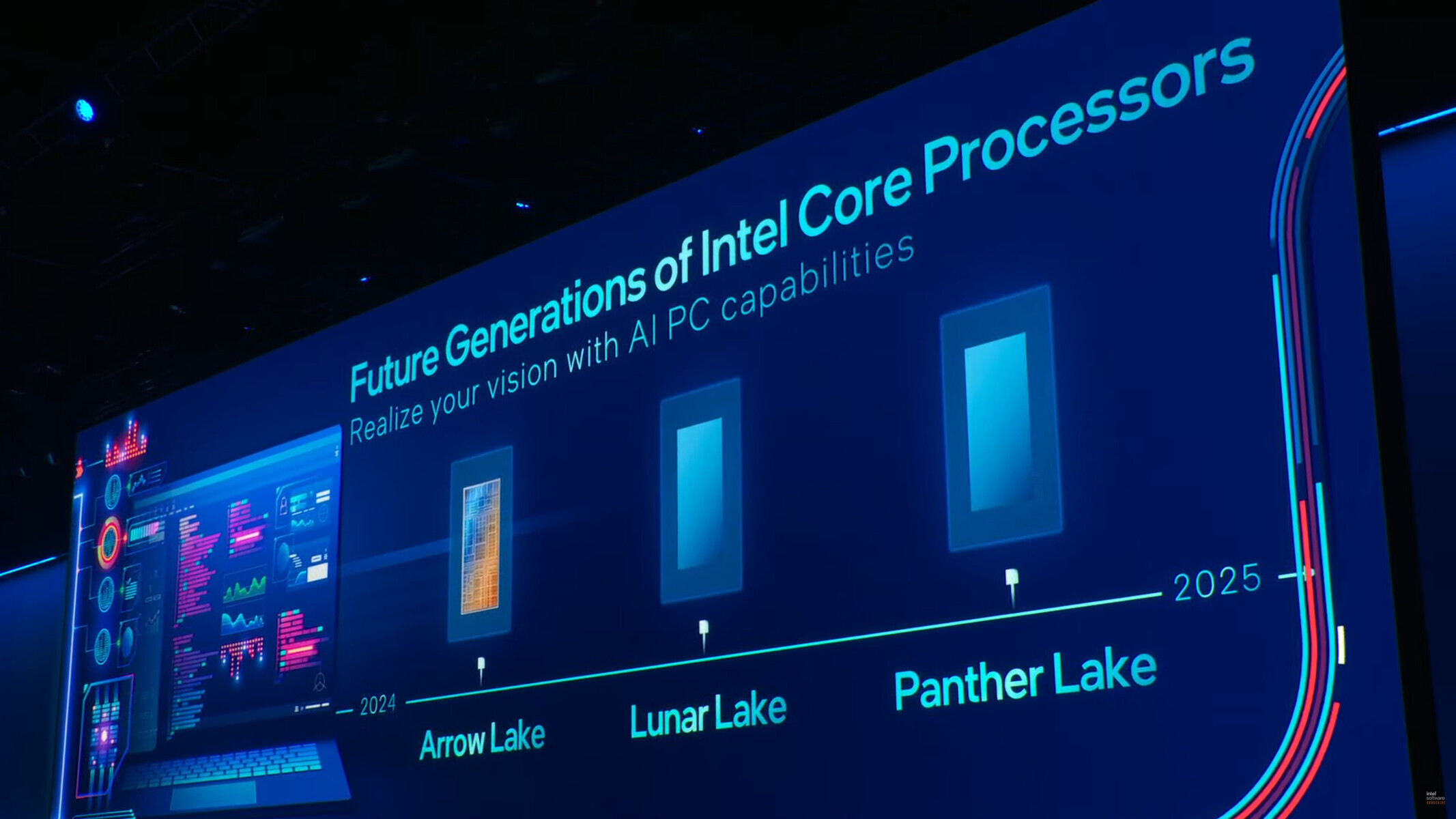

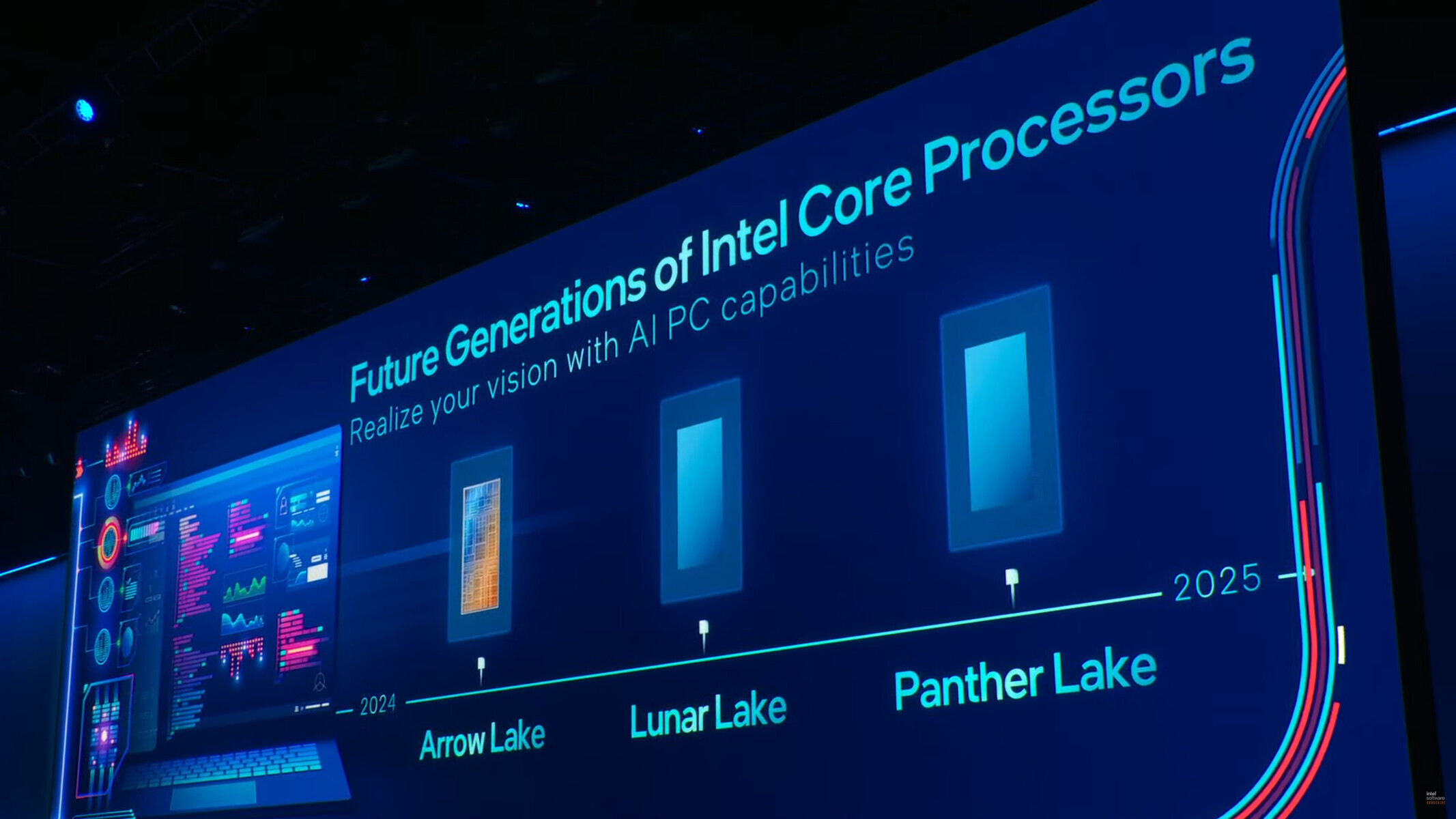

Techpowerup said:Intel CEO Pat Gelsinger engaged with press/media representatives following the conclusion of his IFS Direct Connect 2024 keynote speech—when asked about Team Blue's ongoing relationship with TSMC, he confirmed that their manufacturing agreement has advanced from "5 nm to 3 nm." According to a China Times news article: "Gelsinger also confirmed the expansion of orders to TSMC, confirming that TSMC will hold orders for Intel's Arrow and Lunar Lake CPU, GPU, and NPU chips this year, and will produce them using the N3B process, officially ushering in the Intel notebook platform that the outside world has been waiting for many years." Past leaks have indicated that Intel's Arrow Lake processor family will have CPU tiles based on their in-house 20A process, while TSMC takes care of the GPU tile aspect with their 3 nm N3 process node.

That generation is expected to launch later this year—the now "officially confirmed" upgrade to 3 nm should produce pleasing performance and efficiency improvements. The current crop of Core Ultra "Meteor Lake" mobile processors has struggled with the latter, especially when compared to rivals. Lunar Lake is marked down for a 2025 launch window, so some aspects of its internal workings remain a mystery—Gelsinger has confirmed that TSMC's N3B is in the picture, but no official source has disclosed their in-house manufacturing choice(s) for LNL chips. Wccftech believes that Lunar Lake will: "utilize the same P-Core (Lion Cove) and brand-new E-Core (Skymont) core architecture which are expected to be fabricated on the 20A node. But that might also be limited to the CPU tile. The GPU tile will be a significant upgrade over the Meteor Lake and Arrow Lake CPUs since Lunar Lake ditches Alchemist and goes for the next-gen graphics architecture codenamed "Battlemage" (AKA Xe2-LPG)." Late January whispers pointed to Intel and TSMC partnering up on a 2 nanometer process for the "Nova Lake" processor generation—perhaps a very distant prospect (2026).

Intel CEO Discloses TSMC Production Details: N3 for Arrow Lake & N3B for Lunar Lake

Intel CEO Pat Gelsinger engaged with press/media representatives following the conclusion of his IFS Direct Connect 2024 keynote speech—when asked about Team Blue's ongoing relationship with TSMC, he confirmed that their manufacturing agreement has advanced from "5 nm to 3 nm." According to a...www.techpowerup.com

Boring news! I really hoped we'd see performance leaks from engineering samples before March. If Arrow Lake does launch in 2024, I think it'll be delayed to Q4 at this rate.

Zen5 will have a field day!

Intel CEO Discloses TSMC Production Details: N3 for Arrow Lake & N3B for Lunar Lake

Intel CEO Pat Gelsinger engaged with press/media representatives following the conclusion of his IFS Direct Connect 2024 keynote speech—when asked about Team Blue's ongoing relationship with TSMC, he confirmed that their manufacturing agreement has advanced from "5 nm to 3 nm." According to a...www.techpowerup.com

Boring news! I really hoped we'd see performance leaks from engineering samples before March. If Arrow Lake does launch in 2024, I think it'll be delayed to Q4 at this rate.

Zen5 will have a field day!

Could be close to the mark, noticed over the years when intel have something they are quite proud of there are leaks all over the net and when there's next no leaks its less than impressive.+/- 5% CPU performance. 10-15% better IGP performance.

I know, I’m really out on a limb…

Its really weird.... Intel are going all in on TSMC, and being very vocal about that, while at the same time Pat is talking up wanting to make Nvidia and AMD chips.

For context Nvidia and AMD also use TSMC, why would they, especially AMD use Intel's foundries while they don't even use their own foundies for their most advanced products? If they don't make their own products on their own foundies, are instead making them at TSMC, why would AMD move from TSMC to Intel?

Perhaps Intel just want to use their significant buying power to take a large % of available supply of TSMC wafers from AMD and other competition. The more wafers Intel buy, the less wafers there are for AMD and others. This may then force the competition to buy less advanced wafers from Intel's custom foundry's.

Perhaps Intel just want to use their significant buying power to take a large % of available supply of TSMC wafers from AMD and other competition. The more wafers Intel buy, the less wafers there are for AMD and others. This may then force the competition to buy less advanced wafers from Intel's custom foundry's.

Nvidia could buy Intel with Jenson's pocket shrapnel.

Nvidia: $1.95 Tr and rising.

AMD: $312 Bn and rising.

Intel: $182 Bn and falling.

A couple of years ago AMD spent more than $50 Bn on buying two companies.

When it comes to buying power even AMD crush Intel.

Intel just want some of that dosh.

Intel can still buy capacity from TSMC that AMD could have otherwise bought, forcing AMD to have supply issues or use Intel foundry.

If this does happen, surely regulation agencies will get involved.

Nvidia could buy Intel with Jenson's pocket shrapnel.

Nvidia: $1.95 Tr and rising.

AMD: $312 Bn and rising.

Intel: $182 Bn and falling.

A couple of years ago AMD spent more than $50 Bn on buying two companies.

When it comes to buying power even AMD crush Intel.

Intel just want some of that dosh.

These valuations don't tell the full picture. It's easy to look at that and be fooled into thinking AMD is now the big dog over Intel. These high market valuations for amd and Nvidia are based on investors expecting some future growth that will deliver profits and not actually based on current financials - for example Intels annual revenue is double AMD's so Intels value should be double AMDs at $600 billion but it's not because AMD has a hype train. Fundamentally if you only look at the real financials, AMD looks like a meme stock, as does Nvidia

If Intel want to get in to a buying power war with AMD Intel would lose.

Seriously these arguments that Intel could bully AMD out of anything these days is daft, they have already tried with servers and lost.

AMD market cap now $330 Bn, up from $312 Bn 12 hours ago.

There's a finite capacity of chips for sale from TSMC though. Apple gets the most advanced and greatest quantity as they pay the most. The rest? Up for grabs from highest bidder.

Even if Intel only buy a few thousand wafers - this will mean less wafers for AMD.

I'm not an expert in terms of the exact dynamics of purchasing power of both Intel/AMD, though the metric below seems important:

Intel cash on Hand as of December 2023 : $25.03 B https://companiesmarketcap.com/intel/cash-on-hand/#:~:text=Cash on Hand as of December 2023 : $25.03 B

AMD cash on Hand as of December 2023 : $5.77 B https://companiesmarketcap.com/amd/cash-on-hand/#:~:text=Cash on Hand as of,accessible money a business has.