Associate

- Joined

- 3 Oct 2014

- Posts

- 1,780

That EUR/USD going to go lower.

1.123 at the moment.

1.123 at the moment.

My IAG shares are soaring, nearly £3k profit

Should bank it but might hold on a bit, yearly results out next month. Sure it go down afterwards.

4:28 PM - 26 Jan 2015 said:InterMarketAnalysis

@Trader_Aadil

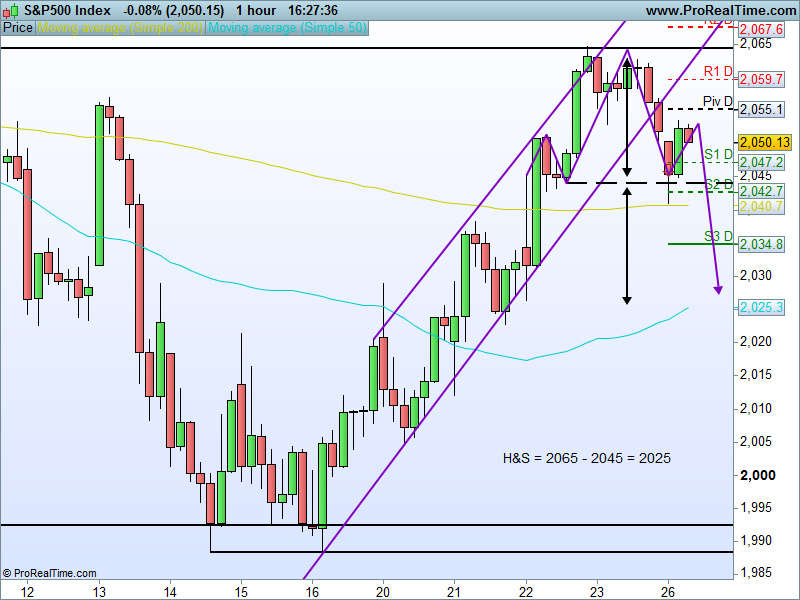

Giving you all a heads up on this S&P 500 pattern I expect to play out

H&S target = 2025

$SPY $SPX #ES_F #markets

Why is /IAG doing well, capturing growth from asia ? benefits from oil maybeMy IAG shares are soaring, nearly £3k profit

Should bank it but might hold on a bit, yearly results out next month. Sure it go down afterwards.

The shares currently trade on 13.7 times forecast earnings of 32p per share. That compares with about 13 times forecast earnings at European rivals Deutsche Post DHL and Belgian operator Bpost.

Royal Mail could benefit from the hidden value in its London Development Portfolio, which contains surplus sites the company has identified for potential sale or redevelopment. In October, Royal Mail sold its former sorting office at Paddington for £111m, which was higher than the estimated £71m analysts at Berenberg expected.

The postal group still retains its two biggest sites - at Nine Elms and Mount Pleasant, which could be worth between £600m and £1bn, or 60p to 100p per share.

Royal Mail’s shares also offer a healthy 4.6pc prospective dividend yield, which is covered more than 1.5 times by expected free cashflow.

There is no doubt that Royal Mail faces challenges but investing is about dividend income and long-term returns.

We still like the strength of the business, the balance sheet and the dividend income, and in an uncertain world, how many companies can say that. Hold.

yep it did in fact base. Another kinda utility type share, a small clue was given early december it was more cheaper then weak then. Still thats 2 months to observe wait buy...tsco 7th Oct said:a gap in buyers below 160. Its trying to base round here anyway.

IAG have had the Aerlinug bid accepted in principle. If the merger goes ahead they are going to benefit form more (preferential) slots at airports. Joined up routes, EoS etc.. Got to be good for business in the long terms. Add to that the current cost of kerosene, and they seems to be doing well.

I've been reading for about 2 months now as much information as I can about Forex etc. Going to spend another few months reading/studying/testing etc and see where that leads me too.

I work from home 90% of the time in my day job so it's something I would like to spend time doing. Will wait and see.

Any opinions on the HSS IPO?

Any views on QPP ?

Any views on QPP ?