You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading the stockmarket (NO Referrals)

- Thread starter mcast123

- Start date

More options

Thread starter's postsSoldato

- Joined

- 13 Jul 2004

- Posts

- 20,344

- Location

- Stanley Hotel, Colorado

with BP. its hard to tell as they have had to pay out so much money. If nothing else i am sure one of the Oil Majors has to be looking at a take over bid by now.

The court award for damage is known now and I think they missed the worst per barrel cost for deliberate negligence. Its gotten a lot worse now out of line with actual news I think, its just the low price of oil thats the problem now.

I guess those lousy Iraq fixed pay per barrel royalty contracts worked out after all

Iran has sold no oil onto market yet, legally. In theory they could drop the price more but its a known factor and Iran cost of production is high. Saudi has 800bn in reserves before selling cheap is a no goIs the bottom in sight with Iran possibly about to affect the price?

Last edited:

Hi guys,

I want to put money in index funds, I tried to open an account with vanguard but it says I have to be a U.S. Resident, how do I go about buying index funds, I want the lowest fees possible, so I want to deal with as few people as possible.

I'd like to put down about 7000gbp then 1000 gbp a month for the next 30+ years, I have already emailed some brokers but some of your advice would be great!

P.S in case you guys were wondering if the oil prices are having an effect in the Middle East they are! Petrol went up by 25% overnight, electricity, water and gas all similar rises, our AC went up by 70% and now talk of taxes here in the UAE.

Thanks

I want to put money in index funds, I tried to open an account with vanguard but it says I have to be a U.S. Resident, how do I go about buying index funds, I want the lowest fees possible, so I want to deal with as few people as possible.

I'd like to put down about 7000gbp then 1000 gbp a month for the next 30+ years, I have already emailed some brokers but some of your advice would be great!

P.S in case you guys were wondering if the oil prices are having an effect in the Middle East they are! Petrol went up by 25% overnight, electricity, water and gas all similar rises, our AC went up by 70% and now talk of taxes here in the UAE.

Thanks

Last edited:

Soldato

- Joined

- 13 Jul 2004

- Posts

- 20,344

- Location

- Stanley Hotel, Colorado

Quite a blip there. BP is really unpopular but so is Shell. BG and DGO have buy out offers already, its a fair theory for BP though I would guess they sell off divisions. [I think I'm looking CNA as they start to import cheap gas from USA]

Apple went 94 and regained all losses, mostly tech is up and oil still down. BT hit 400 though, RMG more solid overall

Its a fund you can get with HL and a few others broker types here. Its just packaging for the index. Theres a lot of hot air (QE) in many stocks imo, either price deflates as we saw today or the dollar sterling loses value from dilution

Apple went 94 and regained all losses, mostly tech is up and oil still down. BT hit 400 though, RMG more solid overall

vanguard

Its a fund you can get with HL and a few others broker types here. Its just packaging for the index. Theres a lot of hot air (QE) in many stocks imo, either price deflates as we saw today or the dollar sterling loses value from dilution

Last edited:

Hi guys,

I want to put money in index funds, I tried to open an account with vanguard but it says I have to be a U.S. Resident, how do I go about buying index funds, I want the lowest fees possible, so I want to deal with as few people as possible.

I'd like to put down about 7000gbp then 1000 gbp a month for the next 30+ years, I have already emailed some brokers but some of your advice would be great!

Thanks

This is all you need to read - http://monevator.com/category/investing/passive-investing-investing

- Joined

- 9 Dec 2012

- Posts

- 1,457

lloyds tesco share for my win. but hold out from buying till tomorrow.

Last edited:

Soldato

- Joined

- 13 Jul 2004

- Posts

- 20,344

- Location

- Stanley Hotel, Colorado

These guys are global dealers, should handle you

https://www.interactivebrokers.co.uk/en/main.php?red=1

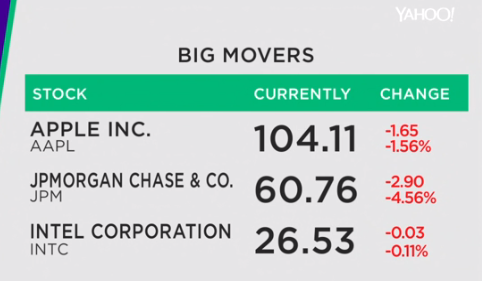

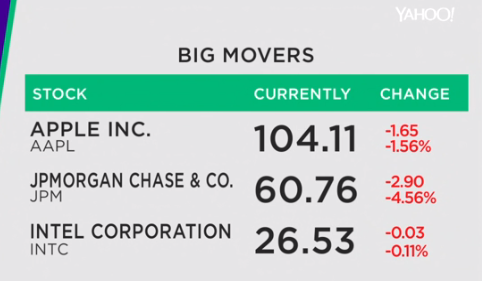

Since we're a tech forum, should probably post these more often. For a while Apple rose on the day

Tesco chart doesnt inspire me, they can bring it back Im sure but not easily. I will look again 170

BHP just gave out results, bad but also saying they will pay, maintain the dividend as a matter of policy. Also very high yield

http://www.ft.com/cms/s/0/899c377e-4afc-11e5-b558-8a9722977189.html#axzz3jqlagKz9

I think they will but of course Lloyds had a dividend policy for years and events overtook it. But presuming BHP have been sensible or BP for that matter in balancing their risk (obviously many doubt bp now) I would guess they can and will pay dividends for years and for the duration of the share price being unpopular

GLEN lowest ever, I think I prefer BLT here and graph gives some positive divergence to the year start low. Also BG to RDSB deal looks to go ahead looks a reasonable buy then, outlined by the Telegraph

Egypt biggest gas find ever, makes a positive overall hopefully and maybe a Centamin buy

Good summary imo, ignore picture if you like: https://www.youtube.com/watch?v=To-hVOcr7eI

https://www.interactivebrokers.co.uk/en/main.php?red=1

Since we're a tech forum, should probably post these more often. For a while Apple rose on the day

Tesco chart doesnt inspire me, they can bring it back Im sure but not easily. I will look again 170

HCPG @HCPG 26m26 minutes ago

188 hold gave confidence to the bulls $SPY Our job is done for now, passing baton to our chinese counterpart for tonight

Up? its at 346p now, ridiculous 7.55% Divi yield.

BHP just gave out results, bad but also saying they will pay, maintain the dividend as a matter of policy. Also very high yield

http://www.ft.com/cms/s/0/899c377e-4afc-11e5-b558-8a9722977189.html#axzz3jqlagKz9

I think they will but of course Lloyds had a dividend policy for years and events overtook it. But presuming BHP have been sensible or BP for that matter in balancing their risk (obviously many doubt bp now) I would guess they can and will pay dividends for years and for the duration of the share price being unpopular

GLEN lowest ever, I think I prefer BLT here and graph gives some positive divergence to the year start low. Also BG to RDSB deal looks to go ahead looks a reasonable buy then, outlined by the Telegraph

Egypt biggest gas find ever, makes a positive overall hopefully and maybe a Centamin buy

Good summary imo, ignore picture if you like: https://www.youtube.com/watch?v=To-hVOcr7eI

Last edited:

Anyone use https://www.degiro.co.uk ? Seem incredibly cheap!

Currently holding Kainos and African Potash. Kainos has moved up solidly over the last month. African Potash has sky rocketed over the past week. I am up 37 percent in a few days on that one and have added to my holding. I remain confident about both positions and believe they have further to go given my research.

My aim is to significantly boost my savings after an expensive year getting married/honeymoon etc. Having geeked up on stock market investing and made some initial mistakes I think I am getting the hang of it. Research research research, plus not worrying about every small fluctuation. Have opened a spread betting account with IG. The information on it is quite handy for guaging market sentiment at the beginning of a day. No intention of betting on it for the time being with real money.

My aim is to significantly boost my savings after an expensive year getting married/honeymoon etc. Having geeked up on stock market investing and made some initial mistakes I think I am getting the hang of it. Research research research, plus not worrying about every small fluctuation. Have opened a spread betting account with IG. The information on it is quite handy for guaging market sentiment at the beginning of a day. No intention of betting on it for the time being with real money.

Currently holding Kainos and African Potash. Kainos has moved up solidly over the last month. African Potash has sky rocketed over the past week. I am up 37 percent in a few days on that one and have added to my holding. I remain confident about both positions and believe they have further to go given my research.

My aim is to significantly boost my savings after an expensive year getting married/honeymoon etc. Having geeked up on stock market investing and made some initial mistakes I think I am getting the hang of it. Research research research, plus not worrying about every small fluctuation. Have opened a spread betting account with IG. The information on it is quite handy for guaging market sentiment at the beginning of a day. No intention of betting on it for the time being with real money.

Sxx also doing potash in UK are up for me by 120pc and it was a calculated (but risky) buy

It may skyrocket going forward. I think it ask depends on how they find their project. And how any share dilution might occur

I've been thinking about starting some long term investing in Investment Trusts. Ideally I want to regularly buy shares each month (£500 per month) but I can't work out what the best platform to use is when taking into account price per trade, platform fees, useability of the platform. Does anyone here do this sort of trading, if so please let me know what broker you use! Thanks.

They're probably not the cheapest but I use interactive investor. You can buy shares regularly once a month for £1.50 (if you schedule it). If you want to buy normally it's £10. They have £20 per quarter fees although any trades are deductible against that £20.

Re:African Potash, I quite enjoyed the FT article entitled smoking African Pot. I saw the first RNS come out before the mega rally the shares didn't move from 0.03p for about 4 hours so maybe it's just sour grapes as I could've made 1000% but I do think the market cap looks quite weighty given that the share price has moved so much on RNS's rather than earnings.

Re:African Potash, I quite enjoyed the FT article entitled smoking African Pot. I saw the first RNS come out before the mega rally the shares didn't move from 0.03p for about 4 hours so maybe it's just sour grapes as I could've made 1000% but I do think the market cap looks quite weighty given that the share price has moved so much on RNS's rather than earnings.

I just noticed that HL caps investment trust ISA holdings at £45 per year, which doesn't seem that bad if I can also organise a 1.50 for a regular trade would work out cheaper than iii. I looked at interactive investor but they have some really terrible reviews, I take it you are happy? I may just go with HL its a fairly good service at least.

I don't know much about shares, but for every winner must there be a loser?

if you're ignoring dividends or looking at something like futures, options etc.. then essentially yes, ignoring commissions the total money won and total money lost equal each other... thus some might say it is a 'zero sum game'

if you include commissions then it becomes a less than zero sum game - with less money taken out in profit than put in in losses

though with shares you've also got dividends which changes things significantly... technically you'll get short term price changes around dividends but in the long run they'll have an impact and IMO it isn't a zero sum game