It would need everyone to want its battery tech. Then, the value would explode. But that would take a monumental step in actual battery technology

That's pretty much the opposite of their existing business model. Like Apple, Tesla uses their technology in their own products, but don't become a vendor for others. You won't see Tesla batteries in Toyota or BMW cars.

There are also many competitors to Tesla in battery technology with different focuses (larger car batteries are designed quite differently from phone and laptop batteries, even though they're all Li-on). Building the best battery for a car is very different to building the best battery for a phone or AR glasses.

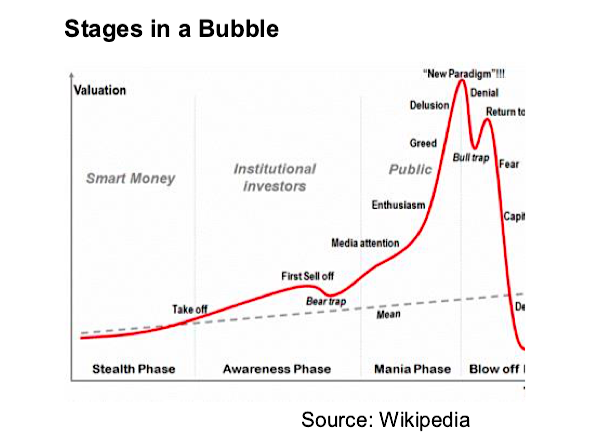

but it's the clearest example atm, with such a massive run up to the high, but other stocks are of course similar. And as said previously, I still have a higher price in mind too, should it reverse from here.

but it's the clearest example atm, with such a massive run up to the high, but other stocks are of course similar. And as said previously, I still have a higher price in mind too, should it reverse from here.