You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Accounting help required: Can I learn in a week?

- Thread starter Pate

- Start date

More options

Thread starter's postsCaporegime

- Joined

- 13 May 2003

- Posts

- 34,601

- Location

- Warwickshire

Yes, you can definitely learn that in a week.

Use your discount tables to get each year's discount factor, or do 1.08^-1, ^-2, ^-3 etc.

Then multiply each year's cash flow by the discount factor and add them all up to get the NPV.

If the cost of capital is ex-inflation then you need to strip out inflation.

Then the rest is just guff . Problems with the method include the assumption that the cost of capital will remain constant (beta of the firm's risk will remain the same), that no projects with better opportunities will present themselves, ignores the 'fit' of each project with the current strategy of the firm, ignores staff's ability to operate / be trained on machinery, etc.

. Problems with the method include the assumption that the cost of capital will remain constant (beta of the firm's risk will remain the same), that no projects with better opportunities will present themselves, ignores the 'fit' of each project with the current strategy of the firm, ignores staff's ability to operate / be trained on machinery, etc.

Also the project's riskiness might not be consistent with the firm, so the cost of capital of the firm migth not be a fair reflection of the cost of capital of the projects.

Measuring the CoC is also inherently problematic.

For bonus marks mention sensitivity analysis, i.e. how much the cash flows would be affected if the CoC changed by x %.

Use your discount tables to get each year's discount factor, or do 1.08^-1, ^-2, ^-3 etc.

Then multiply each year's cash flow by the discount factor and add them all up to get the NPV.

If the cost of capital is ex-inflation then you need to strip out inflation.

Then the rest is just guff

. Problems with the method include the assumption that the cost of capital will remain constant (beta of the firm's risk will remain the same), that no projects with better opportunities will present themselves, ignores the 'fit' of each project with the current strategy of the firm, ignores staff's ability to operate / be trained on machinery, etc.

. Problems with the method include the assumption that the cost of capital will remain constant (beta of the firm's risk will remain the same), that no projects with better opportunities will present themselves, ignores the 'fit' of each project with the current strategy of the firm, ignores staff's ability to operate / be trained on machinery, etc. Also the project's riskiness might not be consistent with the firm, so the cost of capital of the firm migth not be a fair reflection of the cost of capital of the projects.

Measuring the CoC is also inherently problematic.

For bonus marks mention sensitivity analysis, i.e. how much the cash flows would be affected if the CoC changed by x %.

I've ****ed away my degree so far and this is my only salvation. Haven't ever been to this lecture/seminar.

*Awaits barrage of abuse*

Go to lectures ffs!

Soldato

- Joined

- 13 Dec 2006

- Posts

- 3,253

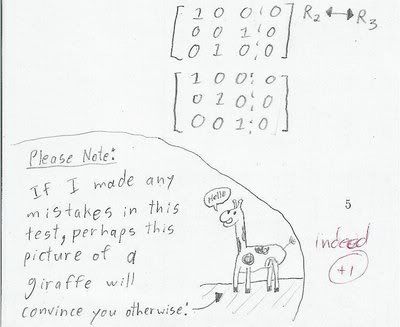

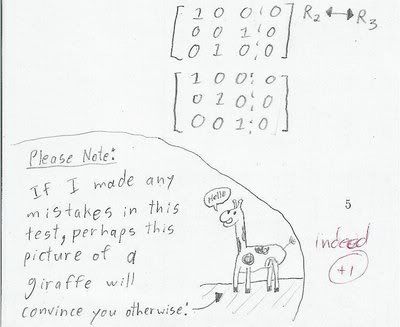

I think you need to employ the skills this kid did...

Caporegime

- Joined

- 13 May 2003

- Posts

- 34,601

- Location

- Warwickshire

[TW]Fox;18626256 said:THat sort of question usually ignores inflation as well making it even easier.

kenmare's problem said:inflation is assumed to be 5% per annum

Soldato

- Joined

- 13 Dec 2006

- Posts

- 3,253

Says it has already been accounted for in the figures as well though, so you don't really have to think about it.

Caporegime

- Joined

- 13 May 2003

- Posts

- 34,601

- Location

- Warwickshire

Says it has already been accounted for in the figures as well though, so you don't really have to think about it.

Wrong.

The cost of capital, unless specified, does not normally include an allowance for inflation. Therefore if he applies 8% to those figures he will get an incorrect result. He either has to strip out inflation from the cash flows, or add it onto the cost of capital, in order to perform the NPV / DCF calculations.

Soldato

- Joined

- 13 Dec 2006

- Posts

- 3,253

Fail on my part

I should know this as well <how embarrassing>

I should know this as well <how embarrassing>

I actually think thats a rather easy bit of work and 2000 words is a doddle. If theoretically you split the allocation of words equally between the 4 options then thats only 500 words per option + a summary and recommendations and it'll fill your quota but as said if you're not going to lectures and obviously not showing an interest in your education why continue?

Soldato

- Joined

- 20 Feb 2010

- Posts

- 4,503

- Location

- Darkest Worcestershire

Whey you write your 2000 word bit, maybe you could go off on a tangent and talk about Joanna and her fetish with big objects.

That would at least make it a more interesting read

That would at least make it a more interesting read

Hmm I don't know.....You could always try going to classes.

I actually think thats a rather easy bit of work and 2000 words is a doddle. If theoretically you split the allocation of words equally between the 4 options then thats only 500 words per option + a summary and recommendations and it'll fill your quota but as said if you're not going to lectures and obviously not showing an interest in your education why continue?

I don't have a clue what to write haha, today is going to be a long day alright.

In regards your comment about continuing education, I agree entirely. It was to easy to get into the swing of doing nothing and before you know it.....

If I can get through this set of assessments this term, its going to be a different story. Less drink + attending lectures + working through Easter will hopefully see me right.

Whey you write your 2000 word bit, maybe you could go off on a tangent and talk about Joanna and her fetish with big objects.

That would at least make it a more interesting read

It would indeed be interesting.