http://blogs.barrons.com/techtrader...t-cuts-consoles/?mod=BOL_qtoverview_barlatest

Shares of chip maker Advanced Micro Devices (AMD) are down 12 cents, or almost 6%, at $1.97 following a report yesterday afternoon by Reuters’s Nadia Damouni and Noel Randewich that said the company hired JP Morgan to “explore options,” which was almost immediately followed by a company statement asserting AMD is not shopping itself.

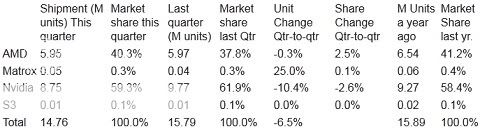

Weighing on the shares today, principally, is the concern that the company lost share to competitor Nvidia (NVDA) in the third quarter in PC graphics processors, or GPUs, according to data released by Mercury Research.

Wong ticks off the things that he thinks the company is doing, or can do, right to improve its position across multiple markets:

AMD is taking appropriate actions to reduce costs and streamline in product development efforts. We think that AMD has done a good job in leveraging its graphics and microprocessor expertise to create its APU product lines. We think that AMD’s opportunity to design and sell chips into game consoles will very helpful in provided a near to intermediate term revenue boost as well as some nonrecurring engineering (NRE) funding for R&D costs […] We suspect that AMD has a contract to develop and manufacture game console processors for either one or two of the large game console maker (perhaps Sony (SNE) and/or Microsoft (MSFT)) systems that may be launching in the second half of 2013.