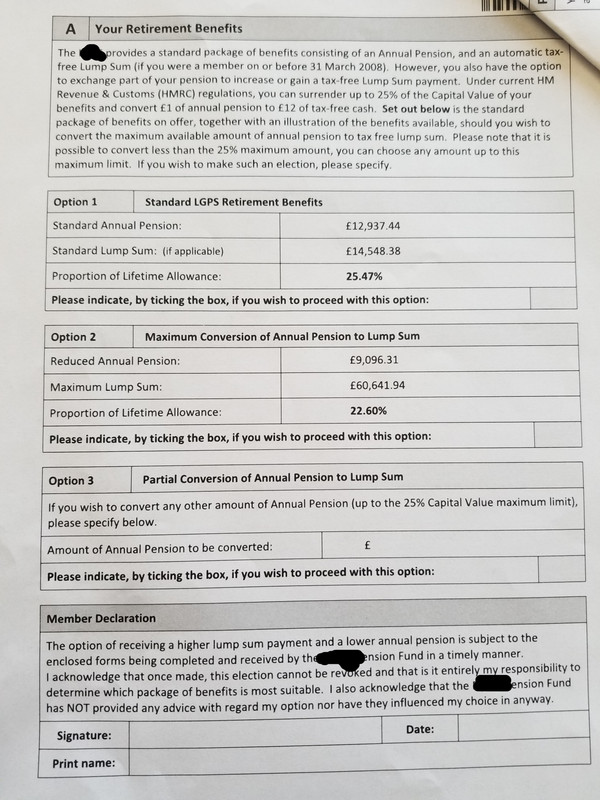

Please remove this thread if it is not ok to post this on the forum.

My old man is just about to retire and has been sent 3 options and he is finding it confusing.

I know this is a vague sheet of paper but obviously i cannot put too many details in public view for security reasons.

If there are any pension experts here that could advise the pros and cons of the options please.

I assume these annual pension figures are including state pension and the lump sum figures are tax free ?

Option 3 is confusing, is there are advantage to using that option.

His health is not that great since he has been a smoker for well over 5 decades so i am thinking option 2 is best maybe.

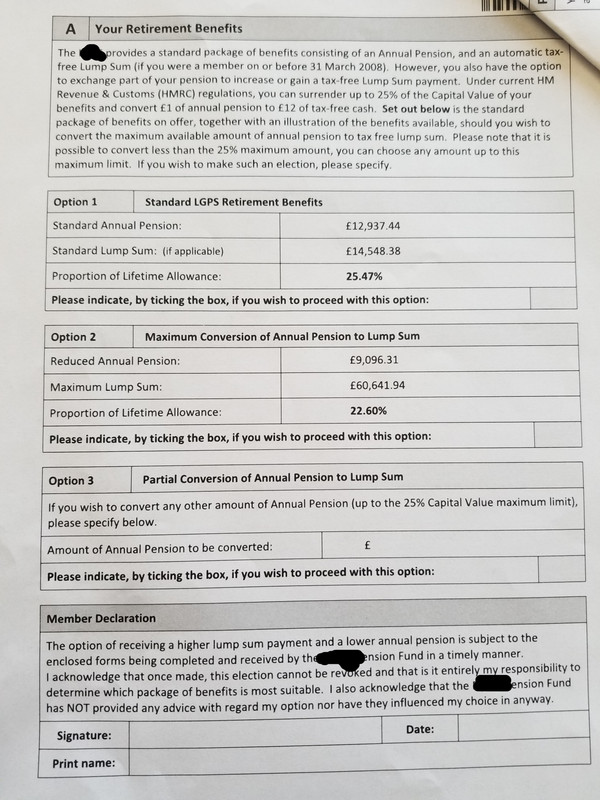

My old man is just about to retire and has been sent 3 options and he is finding it confusing.

I know this is a vague sheet of paper but obviously i cannot put too many details in public view for security reasons.

If there are any pension experts here that could advise the pros and cons of the options please.

I assume these annual pension figures are including state pension and the lump sum figures are tax free ?

Option 3 is confusing, is there are advantage to using that option.

His health is not that great since he has been a smoker for well over 5 decades so i am thinking option 2 is best maybe.