Hi there,

I work in a job where they pay me weekly.

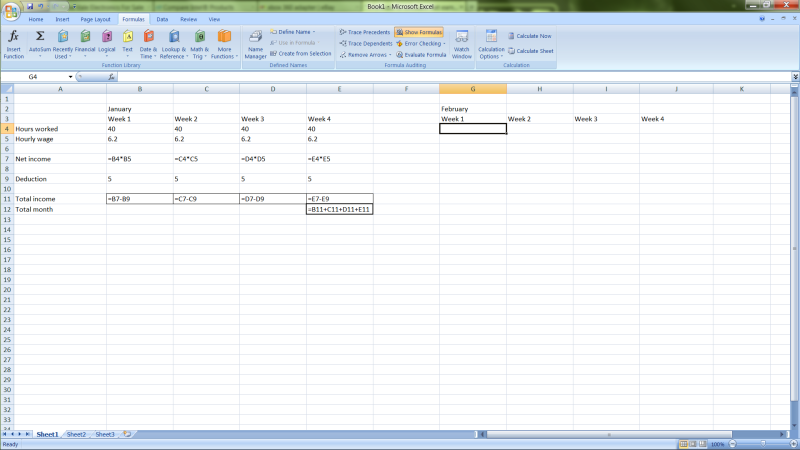

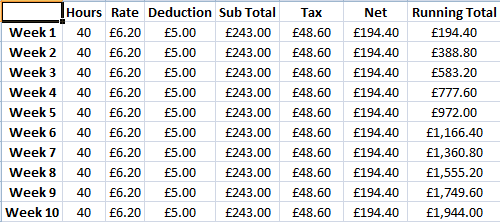

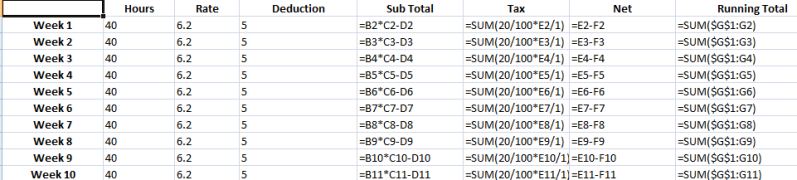

I need to create a spreadsheet to keep tabs on the hours I work and the amount I am due to be paid.

So for example, in week 1, if I work 40 hours, and get paid £6.20 an hour and have a deduction of £5 every week - not taxable. How would I work out the net income from the gross (£248)?

Thanks in advance,

I work in a job where they pay me weekly.

I need to create a spreadsheet to keep tabs on the hours I work and the amount I am due to be paid.

So for example, in week 1, if I work 40 hours, and get paid £6.20 an hour and have a deduction of £5 every week - not taxable. How would I work out the net income from the gross (£248)?

Thanks in advance,