Soldato

- Joined

- 21 Apr 2007

- Posts

- 6,636

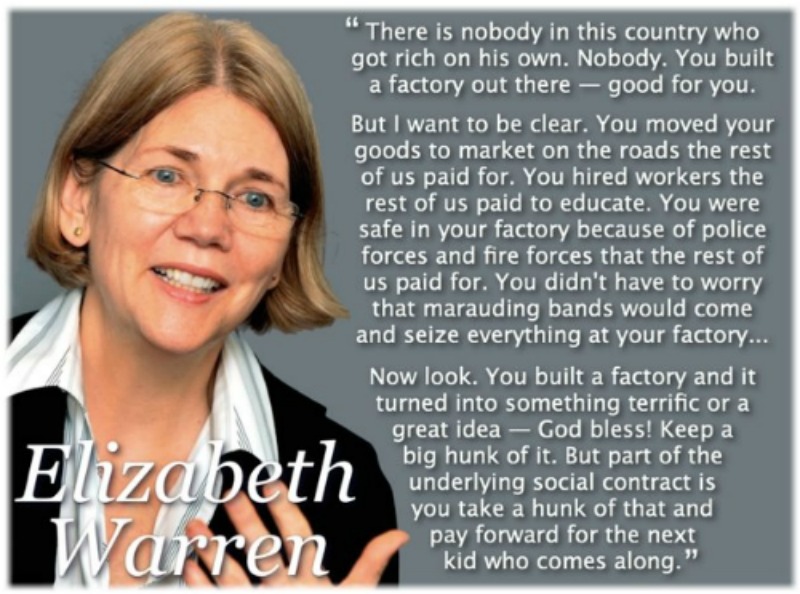

very progressive thinking...

To bad it will just go over most peoples heads.

I'm impressed. Went from talking about tax, to the poor rich divide, to how to perhaps improve it, to UKIP and 'MOSKS' along with democracy. Did I miss something?

LOL I admit total side tangent, but i've seen load of these threads recently how people get things totally wrong. Also believing JSA made up most of the welfare bill...

I actually just facepalm constantly.

But yes I agree totally off topic but how wrong people are on things and then get to vote is what worries me sometimes.