Anyone on here do this

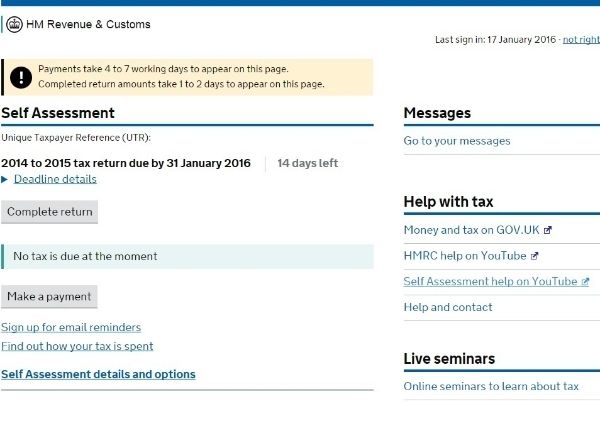

I let a house out and the tenant moved in around May 2015 time, so im new to this game. However i have registered online for self assessment. The last tax year started on 6 April 2014 and ended on 5 April 2015, so i have had no income in that year from the property.

But i think i read somewhere i still need to file a return as i am registered even though i had no income from the property in that tax year.

Anyone any experience, do i just submit it with zero income ?

I let a house out and the tenant moved in around May 2015 time, so im new to this game. However i have registered online for self assessment. The last tax year started on 6 April 2014 and ended on 5 April 2015, so i have had no income in that year from the property.

But i think i read somewhere i still need to file a return as i am registered even though i had no income from the property in that tax year.

Anyone any experience, do i just submit it with zero income ?

Last edited: