You'd need business for that.

As Armageus points out, you'd be fine with commuting there as you don't need to travel to your home address for work. If you WFH most of the time, but had to travel into multiple offices, then i'd argue that's when business insurance would be required.

After a quick skim over this thread I need a lobotomy!

It's not complicated and it's your responsibility to ensure you're covered. In the same way it's your responsibility to ensure you have renewed the policy and entered the right registration/car.

SDP + Commuting + Business - Driving for work, to work and general use

SDP + Commuting - Driving to work and general use. No driving within work hours.

SDP - General driving. No driving to/from work and no driving within work hours.

Adding in time restrictions seems to complicate things, i've never been asked what hours i drive my car, although some on here have mentioned they have. For example if you were retired, ergo not needing a commuting policy, there's nothing to say you're not allowed to be on the road during typical rush hour (it would be great if that would be the case mind!). Same with the SDP+Commuting and not driving within work hours, what if i'm driving to the shops during my lunch hour, i'm not conducting any business, this would be purely domestic.

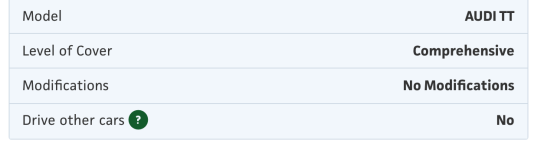

It'll be because of your specific occupation (something where you are far more likely to use other vehicles), or recent convictions.

Most people with Admiral will have DOC.

If you don't get DOC on one policy, it is to do with your characteristics, and so it is unlikely you would get it on other policies. I'm not aware of how motorbike insurance works.

I always had DOC as standard when i was insured with Admiral, i don't recall even being given the option to add/remove it.