yes indeedThink you need to swap bear and bull there ...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading the stockmarket (NO Referrals)

- Thread starter mcast123

- Start date

More options

Thread starter's postsIndeed because all big ex-us companies rely on the US economy. Also, FX is important and even if you purchase an ETF in GBP, it is likely actually all USD so when USD goes down because you end up doubly exposed.It's very interlinked though.

I have VWRP which whilst global is still very USA heavy.. That's down 0.86 today.

I also have VEUA which is only Europe and UK... That's down 0.83 today.

Indeed because all big ex-us companies rely on the US economy. Also, FX is important and even if you purchase an ETF in GBP, it is likely actually all USD so when USD goes down because you end up doubly exposed.

I think VEUA trades in € underlying, but you buy it in £.

So it's more than just the relative strength /weakness of USD against the £ at play.

Last edited:

Soldato

- Joined

- 14 Jun 2004

- Posts

- 7,811

just curious but do you think if there were a correction there would be the possibilities of the Asia Market becoming dominant ?

Trump is unfortunately doing everything he can (not that he appears to realize) alienate other nations. So nations are looking for more stable partners. Indo NOT know the stock market, but I know what this nationalist line will lead to if it keeps up, and thats giving China more influence and power.

just curious but do you think if there were a correction there would be the possibilities of the Asia Market becoming dominant ?

Tough question.. I was looking at Asia Pacific ETFs when I bought VEUA as a counter balance to VWRP.. Maybe I should get a third ETF along those lines but they are a bit choppy.. Maybe for a very long term hold but they looked pretty volatile with not great returns when I looked.

just curious but do you think if there were a correction there would be the possibilities of the Asia Market becoming dominant ?

Possibly, which is why all world trackers are favoured by long term investors.

Possibly, which is why all world trackers are favoured by long term investors.

I guess the problem with all world funds is they are still very USA heavy, for good reason obviously, but if the USA cacks itself, then by the time the ETF is readjusted /re-weighted, the losses are already baked in, so you'll be a bit late to the party.

Not dominant as in a majority of the world index no. But those regions may outperform the USA in terms of share price returns over the next decade or so. Historically when stocks are this expensive in the US future returns over the next decade are poor.just curious but do you think if there were a correction there would be the possibilities of the Asia Market becoming dominant ?

Soldato

- Joined

- 14 Jun 2004

- Posts

- 7,811

gotta start some were  take the time to learn and dont rush

take the time to learn and dont rush

take the time to learn and dont rush

take the time to learn and dont rush

Last edited:

Not dominant as in a majority of the world index no. But those regions may outperform the USA in terms of share price returns over the next decade or so. Historically when stocks are this expensive in the US future returns over the next decade are poor.

A lot, if not all of the S&P 500 companies are global companies now. Some of them may not even HQ or do the majority of their business in the US. They just happen to float in the US stock market.

Soldato

- Joined

- 25 Nov 2007

- Posts

- 5,583

- Location

- London

the red is what tests the weak haha!I've done it before, I'm not doing it again. I sold when it dropped before because it was scary but the reality is, I'm not planning to take anything out for years so current status is irrelevant really, sensible side would tell me to sell and run but that's not really how investments work, unless they're short term. So in my opinion, if you're in it for a long ride, just continue riding it out. World is unstable as so markets flap around like crazy.

When you sold before was it an index ETF.

Its worse when you have individual stocks and they crash, and then you are thinking, why did i buy this worthless company.

was a pie of individual stocks so it felt like it hit me hard, can’t remember the exact number but was around 15% loss on the pie.. so not a lot yet I felt like it’ll sink to the floor and sold it and kept cash for a bit.. if I kept that, I’d be good 100% up nowWhen you sold before was it an index ETF.

Its worse when you have individual stocks and they crash, and then you are thinking, why did i buy this worthless company.

Soldato

- Joined

- 24 Sep 2007

- Posts

- 6,039

Live and learn. No one can time the market.was a pie of individual stocks so it felt like it hit me hard, can’t remember the exact number but was around 15% loss on the pie.. so not a lot yet I felt like it’ll sink to the floor and sold it and kept cash for a bit.. if I kept that, I’d be good 100% up now

For any long term investment I would be buying companies with a solid track record, that I can see continuing to have a solid track record. Or an index fund.

Exactly that! Live and learn.. and agreed, depends on your risk appetite.Live and learn. No one can time the market.

For any long term investment I would be buying companies with a solid track record, that I can see continuing to have a solid track record. Or an index fund.

Soldato

- Joined

- 14 Jun 2004

- Posts

- 7,811

i think im looking out for Vast Space IPO for future - public / private space station, i can see a future there for other areas and jump of points.

out of interest i got an email from one of the companies i was using for investment about the next financial frontier being the moon.

rare earth elements (REEs),

which makes sense, those REE companies may in future have a huge price increase.

so lots of potential movment.

out of interest i got an email from one of the companies i was using for investment about the next financial frontier being the moon.

rare earth elements (REEs),

which makes sense, those REE companies may in future have a huge price increase.

so lots of potential movment.

Last edited:

i think im looking out for Vast Space IPO for future - public / private space station, i can see a future there for other areas and jump of points.

out of interest i got an email from one of the companies i was using for investment about the next financial frontier being the moon.

rare earth elements (REEs),

which makes sense, those REE companies may in future have a huge price increase.

so lots of potential movment.

someone already beat everyone to it

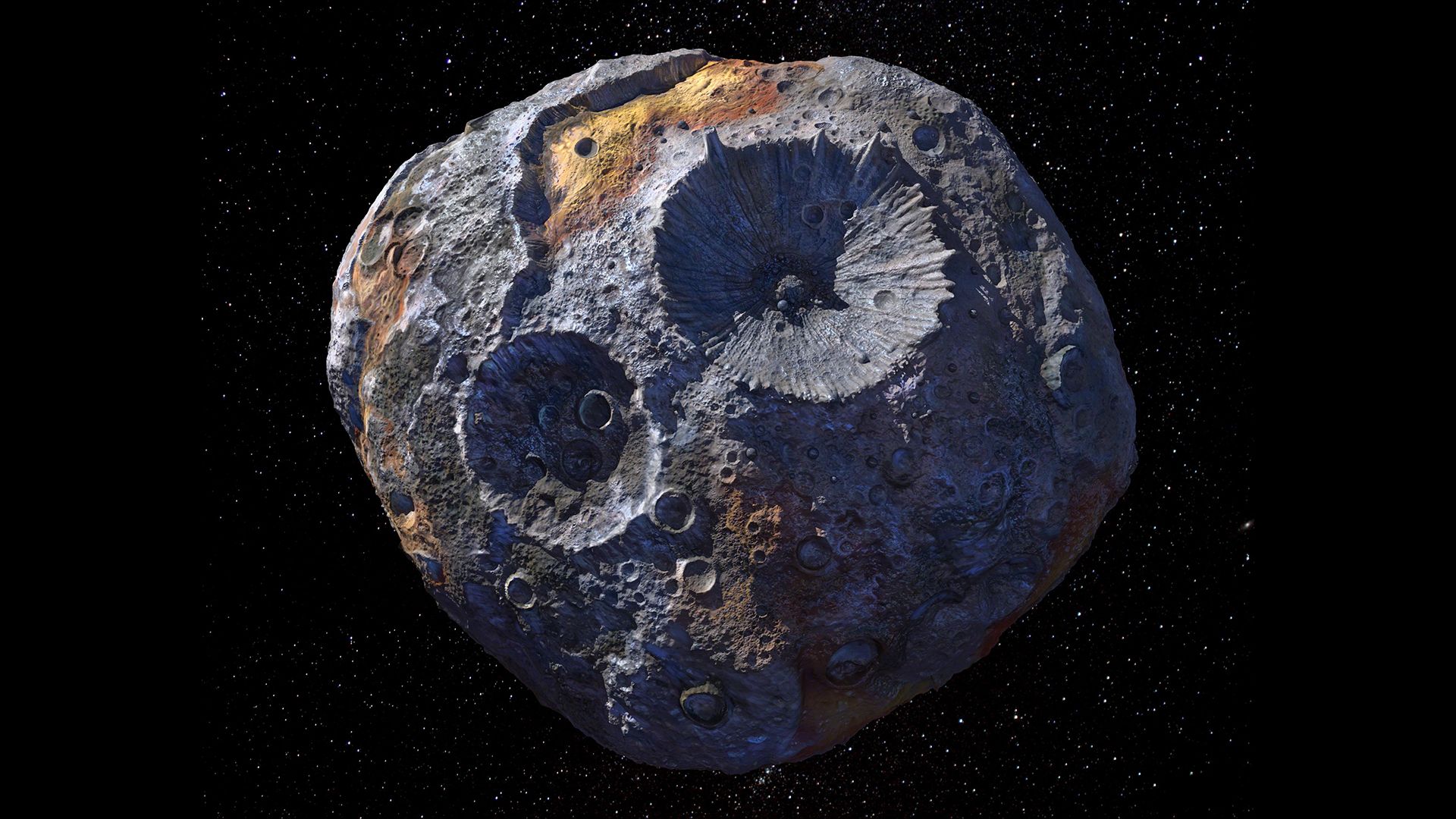

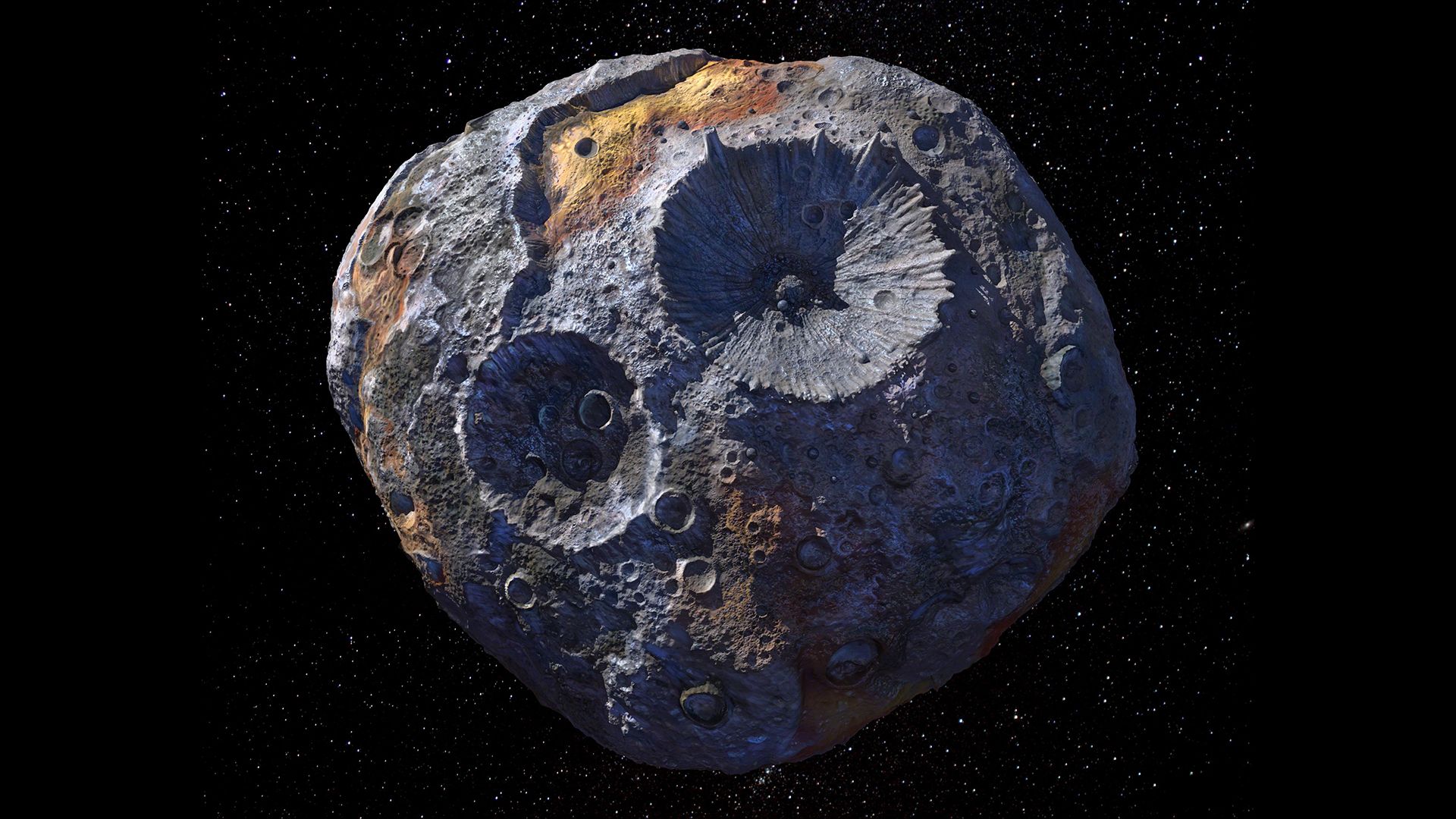

ain't no one mining the moon btw... easier to grab asteroids

but if you want serious space stocks, mine are rocket labs and $LUNR

Last edited:

Soldato

- Joined

- 14 Jun 2004

- Posts

- 7,811

not convinced its real, or at least enforcable.

i think i remember reading about this some time ago.

someone laid claims to the sol system and no one refuted it :

Yes, individuals have claimed ownership of celestial bodies, but these claims have no legal standing because international law states that space is the "province of all mankind"

. A notable example is Dennis Hope, who claimed to own the Moon and other planets, based on his interpretation of a loophole in the Outer Space Treaty that bans countries but not individuals from claiming ownership. He has sold "deeds" to lunar and other planetary land, though these sales are not legally recognized

i think this was the one

www.vice.com

www.vice.com

its going to be interesting how laws are maintained and or enforced. let alone once the lawyers get involved..

watch this space (so to speak) in the coming years

i think there are going to be a host of stocks all tied together like Spacex, rocketlabs vast space and space mining companies.

who ever get here:

www.livescience.com

first could have both a lot of power and resources.

www.livescience.com

first could have both a lot of power and resources.

Note that the entire Moon is not for sale; only about 2% of the Lunar surface is being offered. Prominent craters and other major geographic features, as well as historic landing sites, are protected from development.

If you are interested in purchasing claims to properties not currently listed for sale, the base fee is US$2400 for initial registration, plus a per-acre registration fee of US$10/acre, in addition to any applicable premium fees for that location. A US$1200 deposit (non-refundable) and a minimum 500-acre initial claim purchase is required.

i think i remember reading about this some time ago.

someone laid claims to the sol system and no one refuted it :

Yes, individuals have claimed ownership of celestial bodies, but these claims have no legal standing because international law states that space is the "province of all mankind"

. A notable example is Dennis Hope, who claimed to own the Moon and other planets, based on his interpretation of a loophole in the Outer Space Treaty that bans countries but not individuals from claiming ownership. He has sold "deeds" to lunar and other planetary land, though these sales are not legally recognized

i think this was the one

The Man Who Says He Owns the Moon

Becoming a planet owner is a lot easier than you might think. All you have to do is take a quick glance at an astronomical map, pick out whichever planet or moon tickles your fancy, tell everyone you own it, and you’re set. It’s a little like telling a man in a bar that you […]

its going to be interesting how laws are maintained and or enforced. let alone once the lawyers get involved..

watch this space (so to speak) in the coming years

i think there are going to be a host of stocks all tied together like Spacex, rocketlabs vast space and space mining companies.

who ever get here:

There's an asteroid out there worth $100,000 quadrillion. Why haven't we mined it?

While asteroids are rich sources of precious and valuable materials, scientists still haven't fully committed to mining them.

Last edited: