RBS has been to 500 or more couple years back. Its a bit like Citibank and AIG recently, back up but nowhere near a proper recovery. Thats the reason why they all rising, in line with USA finance assets, the gov just made a total profit on its bailout which is relatively good news.

The top for RBS would be more like 1200 or something silly and I dont think it can do that but Lloy can be 100 or so. I see their base market of mortgage as much simpler, they only need people to pay back that money and thanks to inflation there is a very good chance?

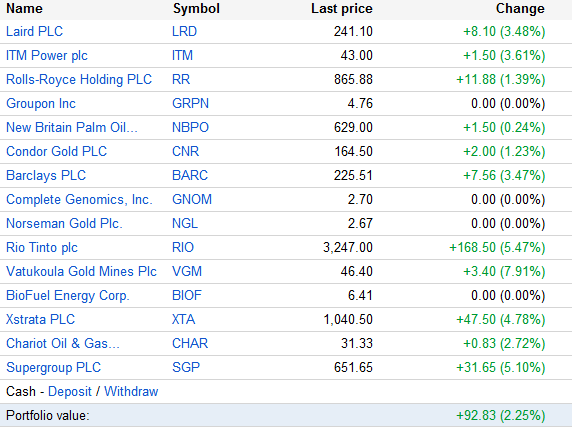

Barc can be 400, its half based in USA so watch XLF which is at highs for this year

[BCS & BARC are the same stock, USA vs UK]

However Iam sceptical of a straight rise. 240 onwards is a nasty brake for Barc as many holders will sell here. Also one of the top 10 investors does not like their new CEO , awkward, inexperienced and unable to manage a global bank was about the sum of it.

He was chosen as safe and uncontroversial I think due to political influence. Bob gone will show as lower profits now

So long as they avoid hitting an iceberg, all the banks are cheap potentially long term. Finance is the most subsidised industry in the world

the other half is thinking

Take some profits. Like we saw with CNR if you cant buy when nobody likes them and gold is looking bad, you lose out massively on all those gains.

I wish I sold more at xmas and bought more recently but I didnt, too bad. Bad newbie thinking is to be absolute, buy all sell all, buy at the bottom sell at the top and its an awful way to think/trade/invest I have found personally.

XEL I think is fair to double but since Ive not done the sums thats just a guess really. They seem more then likely profitable, but the real question would be why them and not BP or Premier or any other explorer with cheap oil and future revenue/profits vs risk of unknown costs.

GKP to leave aim at last ?

Lehman did that, they opened the market on sunday for some

Lehman did that, they opened the market on sunday for some