Deleted member 66701

Deleted member 66701

So, essentially, me and my wife are not planning on having children, ever. It's our choice as is the choice to have kids.

Should we not have a tax discount because we are not going to be clogging up doctors, removing money via child benefit, using 'free' educational services, etc.

It's an interesting argument and I don't see any discounts for just married couples it's all about families (i.e. child benefits, working families tax credit, etc).

M.

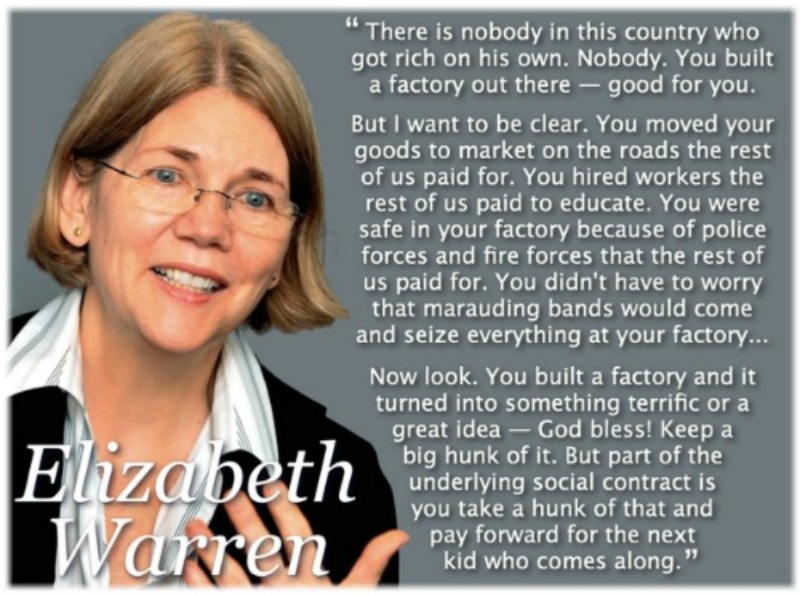

If anything, you should be paying more tax, as having children that later turn into productive members of society puts far more back into the economy than they ever take out. We also need children to maintain an adequate labour force. We're already having to turn to immigration to offset a labour shortage in some sectors.

Some people say it's selfish to have children. Another viewpoint is that's it's selfish not to

BUT council tax charges you more or less locally based on the house you live in, it doesnt even attempt to look at ability to pay

Yes it does - check out the sections on exemptions for single occupancy and discounts for students, disabled and second adult rebates (low income households).

Last edited by a moderator: