Okay so after having been interested in bikes, I'm now moving over to a car. I don't have a massive budget and obviously because my insurance will be high that limits what I can get in terms of performance. However I've seemingly narrowed it down to two cars which have about the best performance I can get without paying silly insurance premiums, get good writes ups in terms of practicality, handling, build quality etc. and would be a car I would be happy to own.

They are;

2003 BMW 316TI SE/ES 1.8L

and

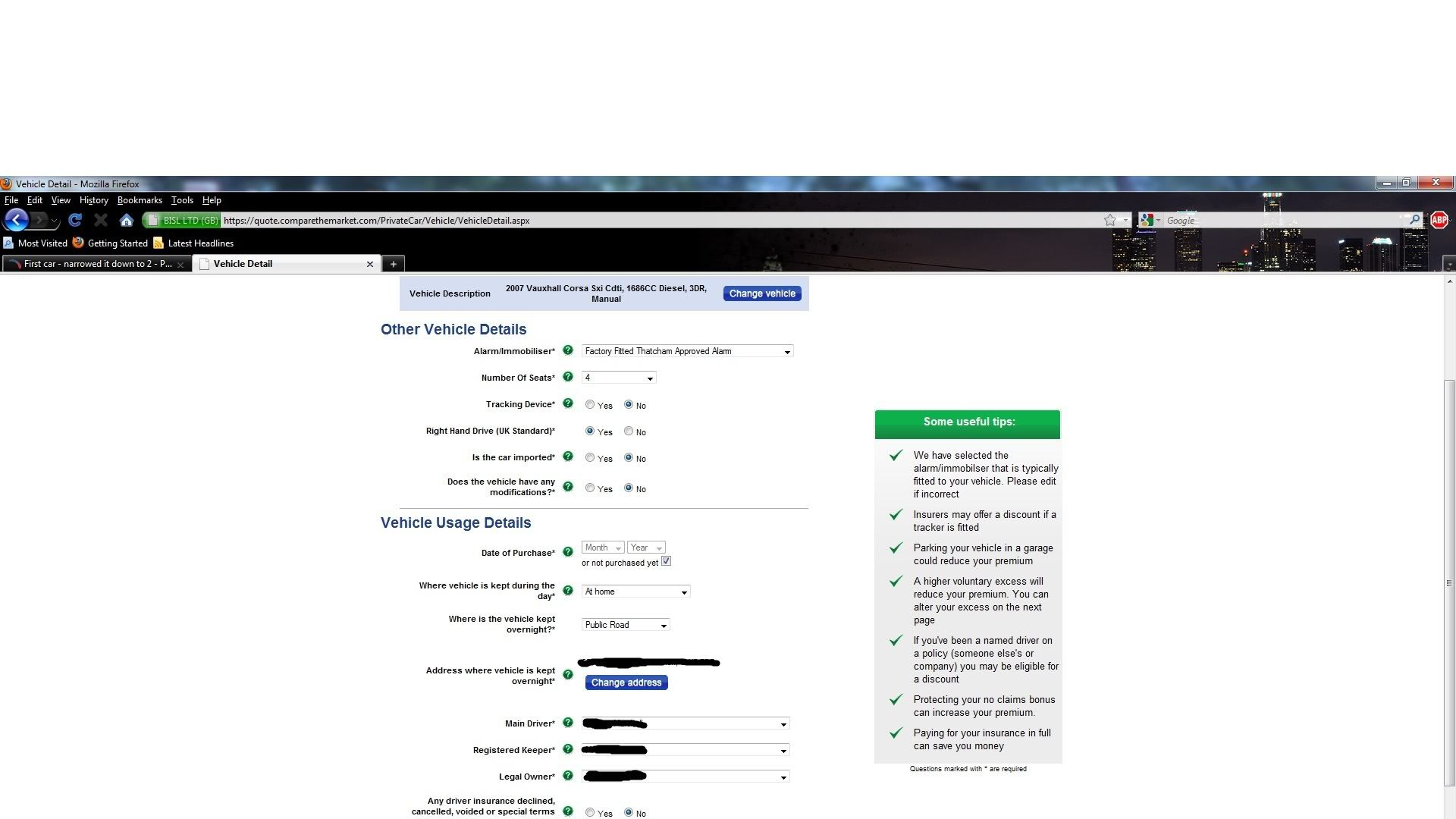

2007 Vauxhall Corsa SXi CDTi 1.7L

The BMW costs roughly £2500 to buy and £3800 to insure, whilst the corsa comes in at a more hefty £4800(ish) to buy but £3000 to insure. The figures point to the BMW as it would be at least 3 years before the cheaper insurance on the corsa had made up for the heftier purchase cost (ignoring the fact that my insurance would go down), but I'm wondering what others think? whether you think there's anything better either, although I've checked every other car I can think of - none of which are either reasonable on purchase price/insurance or meet the performance of these two. Personally I'm leaning towards the BMW regardless of the fact it's initially cheaper, due to the fact I think it's a nicer car?

Thanks.

They are;

2003 BMW 316TI SE/ES 1.8L

and

2007 Vauxhall Corsa SXi CDTi 1.7L

The BMW costs roughly £2500 to buy and £3800 to insure, whilst the corsa comes in at a more hefty £4800(ish) to buy but £3000 to insure. The figures point to the BMW as it would be at least 3 years before the cheaper insurance on the corsa had made up for the heftier purchase cost (ignoring the fact that my insurance would go down), but I'm wondering what others think? whether you think there's anything better either, although I've checked every other car I can think of - none of which are either reasonable on purchase price/insurance or meet the performance of these two. Personally I'm leaning towards the BMW regardless of the fact it's initially cheaper, due to the fact I think it's a nicer car?

Thanks.

Last edited: