Soldato

- Joined

- 6 Jan 2013

- Posts

- 22,177

- Location

- Rollergirl

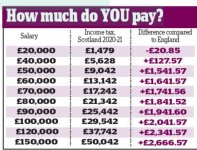

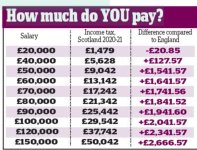

There's new income tax rates inbound in Scotland for next year and those sites may not be updated with the details:

Yea, but I wouldn't expect those rates to be reflected in the 2022/23 figures which is what I'm looking to compare.

Even less money in your pocket. Got to pay for indyref 2, 3, 4... somehow.

I've got no issue paying the rates, I can see what we get for it compared to rUK.