This really, your not losing anything by selling the flat, you'll roll the capital into the new house, the only thing you have lost is the liability of tenants. Seriously don't, you will regret it. The *only* positive would be for your girlfriend in that if you two go wrong she can get her own place back and leave you

And capital growth. Assuming the new house is the same price regardless of keep or sell and assuming the flat is neither profit nor loss, just covers its own costs over the entire term of ownership:

(Easy round number used for simplicity)

100k flat Let out

200k home

VS

200k home

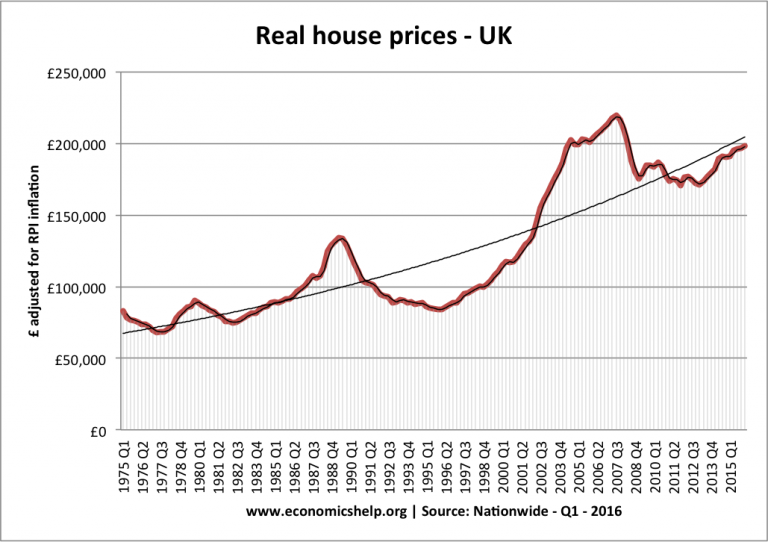

Assume you keep it for 20 years, if the housing market doubles in values (not unreasonable) so a 100% increase you now have:

200k flat let out

400k home

VS

400k home

in the first situation (keeping the flat and buying a new home) you have a value increase of 300k vs the second situation where you only have a 200k increase.. And thats assuming it just washes its face, it wont.... in most parts of the country this will be profitable, so additional income that can be used to pay off mortgage/savings pot/pension/help with living expenses etc.

Its not all good though, you will have to pay tax, you will pay more stamp duty (quickly paid off from rental income!) and if you or the agent get things wrong it can get expensive quickly if you have a problem tenant.

Base all your maths on it being empty for 2 months out of every 12, and assume interest rates will go up to about 5%.. If its still profitable then its definately worth keeping, especially if you think the area is going up in value!

All this is IMO, and I have times where I very seriously consider selling all the rentals and going back to having a simple life.... But when its going right its nice to provide people with a home, deal with issues quickly and correctly and be referred to as the 'best landlord we have ever had'. Dont go into it for the wrong reasons, and dont go in blind. There are legal obligations and things you HAVE to get right and HAVE to do. Know what these are and ensure they are done and done right (regardless if you are managing it or are paying an agent to do it, the agent is acting on your behalf so their mistake IS your mistake!!!)

Would I do it again knowing what I know now? Yes, in a heartbear!