- Joined

- 21 Jun 2006

- Posts

- 38,372

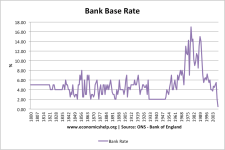

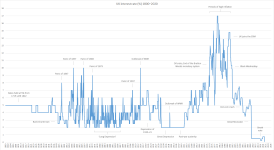

Tracker, I've gone for one every time since my first ever mortgage (which was a 2yr fix) and have yet to lose out. Currently paying 0.79%

Problem is currently trackers are more expensive than fixed and would have to be considerable movement downwards to benefit.