You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mortgage Rate Rises

- Thread starter glenimp617

- Start date

More options

Thread starter's postsNah, the NHS will just become a core service with a lot of things being paid for.

The NHS was never envisaged to cover half the services it does now. Originally intended to make health services free at the point of need and 99% concentrated on sickness and injury it now has a much larger part in our lives. Whether this is good or bad is outside this scope but everyone must be prepared to pay more anyway through taxation or directly.

Last edited:

It's going a little off topic now, but I agree that we'll just see more and more care costs being removed from the NHS in a similar way to dentistry. Or you'll be expected to subsidise at point of service, increase in prescription costs etc.

I don't see us moving to a US style of medical care, but nor can I see the "free forever" model surviving either.

I don't see us moving to a US style of medical care, but nor can I see the "free forever" model surviving either.

Honestly if people weren't doing their rank best to make it crumble through poor lifestyle choices it would be fine.

There is this.

I go out on my mountain bike. Should I pay for any injuries? Its completely a life choice.

But services will have to be cut. The slide to the USA style system I think is inevitable. People seem to love the NHS. But also low taxes. Can't have it both ways. Low taxes will win out.

After all. Tax is all the time. NHS?

"I'm not getting the benefits now, so why would I want that?"

Same reason as don't like paying up for environmental savings. It's too far in future for us to want to sacrifice the now.

It is not about the environment it is about profits and control.There is this.

I go out on my mountain bike. Should I pay for any injuries? Its completely a life choice.

But services will have to be cut. The slide to the USA style system I think is inevitable. People seem to love the NHS. But also low taxes. Can't have it both ways. Low taxes will win out.

After all. Tax is all the time. NHS?

"I'm not getting the benefits now, so why would I want that?"

Same reason as don't like paying up for environmental savings. It's too far in future for us to want to sacrifice the now.

The environment impact of electrical cars is greater, the amount of mining for minerals is crazy. The toxic dust being produced by this mines will create its own problems.

lithium extraction is the worst.

freshwater and land contamination.

Last edited:

There is this.

I go out on my mountain bike. Should I pay for any injuries? Its completely a life choice.

But services will have to be cut. The slide to the USA style system I think is inevitable. People seem to love the NHS. But also low taxes. Can't have it both ways. Low taxes will win out.

After all. Tax is all the time. NHS?

"I'm not getting the benefits now, so why would I want that?"

Same reason as don't like paying up for environmental savings. It's too far in future for us to want to sacrifice the now.

Exercising is good for you and fundamentally leads to a healthier life and less cost to the taxpayer in almost every case. Being morbidly obese, never exercising and drinking or smoking have absolutely zero upsides to the NHS unless you happen to drop down dead when you are young.

I understand what you are saying but they are completely different scenarios.

Just had the quotes from my second broker , to see what they can provide as a re-mortgage, still quite high!

Please see below best taking into account fees

All fee free, no valuation fee, product fee or legal fees

£495 broker application fee payable on submission

Remortgage for £137500

25 year term

2 year fixed 4.59% £772 per month

3 year fixed 4.34% £754 per month

5 year fixed 4.1% £734 per month

2 year tracker currently 4.5% (0.5% above base) £465 per month

All deals have decreasing early repayment charges and permit 10% overpayments each year

the above 2 3 and 5 year and 2 year tracker are from different lenders, so you would have to select one of the above and choose either 2, 3 or 5 from that lender.

Still doesnt help me decide tbh, is this similar to what other people are getting % rate wise?

are people extending (adding on some years for mortgage length) during this period until they renew next then bringing it back down ?

Please see below best taking into account fees

All fee free, no valuation fee, product fee or legal fees

£495 broker application fee payable on submission

Remortgage for £137500

25 year term

2 year fixed 4.59% £772 per month

3 year fixed 4.34% £754 per month

5 year fixed 4.1% £734 per month

2 year tracker currently 4.5% (0.5% above base) £465 per month

All deals have decreasing early repayment charges and permit 10% overpayments each year

the above 2 3 and 5 year and 2 year tracker are from different lenders, so you would have to select one of the above and choose either 2, 3 or 5 from that lender.

Still doesnt help me decide tbh, is this similar to what other people are getting % rate wise?

are people extending (adding on some years for mortgage length) during this period until they renew next then bringing it back down ?

Last edited:

Soldato

- Joined

- 23 May 2006

- Posts

- 7,907

ok sorry for being monumentally dumbRemortgage for £137500

25 year term

2 year fixed 4.59% £772 per month

3 year fixed 4.34% £754 per month

5 year fixed 4.1% £734 per month

2 year tracker currently 4.5% (0.5% above base) £465 per month

but how is

4.59% £772

4.34% £754

4.1% £734

and 4.5% £465

what am I missing? is 465 a typo and actually 765?

Last edited:

You don't say your LTV, but Nationwide with a 20% LTV will offer me right now 4.59/4.59/4.18 on a 2/3/5 year fix. Double your broker fee in product fee though so your offers look decent enough at first glance.

I too don't understand the monthly payment on the Tracker option you quoted unless that's interest only or something.

I too don't understand the monthly payment on the Tracker option you quoted unless that's interest only or something.

Last edited:

Just had the quotes from my second broker , to see what they can provide as a re-mortgage, still quite high!

Please see below best taking into account fees

All fee free, no valuation fee, product fee or legal fees

£495 broker application fee payable on submission

Remortgage for £137500

25 year term

2 year fixed 4.59% £772 per month

3 year fixed 4.34% £754 per month

5 year fixed 4.1% £734 per month

2 year tracker currently 4.5% (0.5% above base) £465 per month

All deals have decreasing early repayment charges and permit 10% overpayments each year

the above 2 3 and 5 year and 2 year tracker are from different lenders, so you would have to select one of the above and choose either 2, 3 or 5 from that lender.

Still doesnt help me decide tbh, is this similar to what other people are getting % rate wise?

are people extending (adding on some years for mortgage length) during this period until they renew next then bringing it back down ?

Are you paying for a broker??

Are you paying for a broker??

I have reached out to two brokers , to do a quote search , not proceed at this point

the first broker responded back with some quotes back end of Jan 2023 - he charges £250 and he was the one that done my FTB mortgage 5 years ago,

the second broker who gave me the quotes above, they charge twice as much on application (mentioned above £495 broker application fee payable on submission) which tbh id rather not have to pay

I have reached out to two brokers , to do a quote search , not proceed at this point

the first broker responded back with some quotes back end of Jan 2023 - he charges £250 and he was the one that done my FTB mortgage 5 years ago,

the second broker who gave me the quotes above, they charge twice as much on application (mentioned above £495 broker application fee payable on submission) which tbh id rather not have to pay

I mean, unless you have special circumstances they're are plenty of free ones. For my remortgage I just went on a comparison website and went direct to lloyds. The broker (free) was no better and going direct got me 750 cashback

I mean, unless you have special circumstances they're are plenty of free ones. For my remortgage I just went on a comparison website and went direct to lloyds. The broker (free) was no better and going direct got me 750 cashback

Yeah, i used Trussle which was free but included ~£150 cashback. £750 would've been ace!

I will maybe take the quotes i had from the second person and go back to the first broker and see if they can do a better deal, also i though the point of a broker is they get better deals with the lender rather than you trying to approach direct?

Yeh there are free brokers about who just get their money back off the lender, i have not found any good free ones though,

Yeh there are free brokers about who just get their money back off the lender, i have not found any good free ones though,

Last edited:

Yeah, i used Trussle which was free but included ~£150 cashback. £750 would've been ace!

The broker gave me the identical deal as lloyds but without the cashback.

I suspect lloyds offer the cashback to us that the brokers would claim. I assume that's how it works.

I will maybe take the quotes i had from the second person and go back to the first broker and see if they can do a better deal, also i though the point of a broker is they get better deals with the lender rather than you trying to approach direct?

Yeh there are free brokers about who just get their money back off the lender, i have not found any good free ones though,

At least have a look. Going direct might get you a better rate!

You see I had the flip side -- broker was offering £700 through QuidCo, Nationwide was offering jack all.The broker gave me the identical deal as lloyds but without the cashback.

I suspect lloyds offer the cashback to us that the brokers would claim. I assume that's how it works.

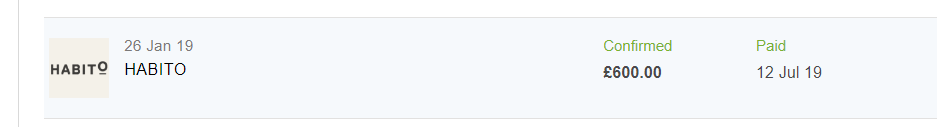

Edit: same deal back when Habito was king:

Last edited: