You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mortgage Rate Rises

- Thread starter glenimp617

- Start date

More options

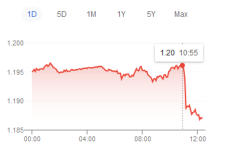

Thread starter's postsAgreed, having done a quick assessment it looks like a lot of people are long on both the GBP/USD and GBP/EUR pairings.I wouldn't read too much into a knee jerk reaction on currency markets today, look what happens over the coming weeks for a clearer picture.

- Joined

- 30 Sep 2005

- Posts

- 16,717

But by increasing the value of the pound, our buying power increases, lowering interest rates or qe do the opposite, how else do you propose we get more value into peoples hands? Ultimately the BoE are unable to affect the cost of gas and oil. It's far from a silver bullet but it is a tried and tested way to get a handle on things.

This is probably (I'm not an economist) due to the stark warning in writing of a recession.

For what its worth I'm just as worried as everyone else, my mortgage product ends Dec 23, it's a worrying time as I'll either be okay if what I think will happen, happens, or it'll be awful.

July '23 for me

£90k left at 2.2%, so not too bad. It's around £40 extra a month right now with the rate rises, which isn't the end of the world, but still....£40 is £40

Gas/Elec is the killer as my fix rate ends Nov '22 lol

230k for me, all I can do is funnel as much cash into home improvements as possible. Thankfully my house I managed to buy at about 30k under market value at the time (October 21) and it hadn't been touched since the 1960/70s so there's plenty of places to add value... Hope that I can then get it revalued and use that to increase equity!July '23 for me

£90k left at 2.2%, so not too bad. It's around £40 extra a month right now with the rate rises, which isn't the end of the world, but still....£40 is £40

Gas/Elec is the killer as my fix rate ends Nov '22 lol

I fixed my energy in June so I feel a bit better with that on a 1 Yr fix.

Soldato

- Joined

- 25 Mar 2004

- Posts

- 15,980

- Location

- Fareham

Buy the rumour sell the news I guess, I think it will be a case of see how it goes over the next few days. I think BOE made the right move on this occasion.

the batteries are still murder on that idea last i checked. Bringing the loft insulation up to snuff and sorting the door/window seals is this summers job realistically.

Solar value depends a lot on your usage too. I think you really want to be using/consuming as much of the generation as you can.

I'm so so glad I paid my erc fee to refix.

Advisor suggested waiting. That would have been a fail

Both with mortgage and energy advising professionals said 'do not fix' both times wrong. These are life changing sums in the near term too.

Advisor suggested waiting. That would have been a fail

Both with mortgage and energy advising professionals said 'do not fix' both times wrong. These are life changing sums in the near term too.

Last edited:

- Joined

- 30 Sep 2005

- Posts

- 16,717

I'm so so glad I paid my erc fee to refix.

Advisor suggested waiting. That would have been a fail

Both with mortgage and energy advising professionals said 'do not fix' both times wrong. These are life changing sums in the near term too.

Nobody knows what the future holds. It certainly doesn't look good that's for sure.

Ouch to the interest rate increase. Luckily we managed to get onto a new fixed rate yesterday afternoon.

I went with a Tracker in March because i didn't want an ERC due to a proposed move which might have happened in under 2 years.

The interest hikes from then to now are probably going to add on more in Interest than an ERC would've been, and due to delays in processing Irish citizenship applications it's looking like it'll be more than 2 years anyway

The ERC did play on my mind as we want to downsize in a few years and clear the mortgage. But I'll probably just take the hit if we do that, or take the mortgage to the new house and just overpay the maximum amount until the fixed rate ends.I went with a Tracker in March because i didn't want an ERC due to a proposed move which might have happened in under 2 years.

The interest hikes from then to now are probably going to add on more in Interest than an ERC would've been, and due to delays in processing Irish citizenship applications it's looking like it'll be more than 2 years anyway

Annoyingly the new rate is (obviously) higher than the old fixed rate. It's by about the same amount we were overpaying each month. So worst case we just stop overpaying for a while to absorb the new cost.

Did the same as you my fix wasn’t due to end til June next year, paid erc to get out and fixed for 10 years. Hoping it’ll all blow over by then lol.I'm so so glad I paid my erc fee to refix.

Advisor suggested waiting. That would have been a fail

Both with mortgage and energy advising professionals said 'do not fix' both times wrong. These are life changing sums in the near term too.

And there's the text from my bank saying my mortgage will increase....let's see how long it is before I get the email to tell me my savings rate is increasing too

Hah, it's one reason I like the Coventry Building Society for saving with, I just got an email about the BOE rate rise from them too and how my rates will be increasing shortly

Soldato

- Joined

- 11 Apr 2006

- Posts

- 7,116

- Location

- Earth

I owe my mortgage advisor a case of wine or something. Managed to sort out my mortgage in principal before '5pm rate rises' that others have been saying. It's still at a high rate compared to where it would have been a few months ago but still under the value I budgeted for in this move. 3.59% 5yr fix

Flushing out zombie companies that have been on life support since 2008 is a good thing in the end. Why waste even more money keeping them afloat? People working for those companies will of course lose their jobs - it happens unfortunately.why are they increasing interest rates?

It seems like a big no no?

What am i missing? The bank of england seem tobe shooting us in the head with this?

Many will lose there homes or struggle to pay the bills. Businesses will go and job losses too.

How is this good? What am i missing?

Why are they increasing interest rates and now telling us to expect a recession in the next few months?

Low interest rates encourage reckless lending/behaviour. Those living outside their means will feel it the most.

The problem the central banks have today is tightening into a recession. They got us into this mess in the first place with QE and emergency interest rates since 2008. Anyone half switched on should have seen the train lights in the distance getting closer.

People shouldn't be too worried about depositing money with banks they've never heard of. Just do your research and don't deposit more than £85k at each.

In savings, I have just over £600k spread out across multiple banks, but not more than £80k at any one. Not worried one bit, although I do have a lot invested elsewhere as wouldn't want to rely solely on just cash or anything else for that matter.

Maximise the higher rates available for various 1 year fixed bonds as currently you can get around 2.7% - 2.85% interest, although personally I'd hold off a bit as rates are going to increase further over the coming months. A few 3 month notice accounts are probably the place to be at the moment as a sort of holding ground.

In savings, I have just over £600k spread out across multiple banks, but not more than £80k at any one. Not worried one bit, although I do have a lot invested elsewhere as wouldn't want to rely solely on just cash or anything else for that matter.

Maximise the higher rates available for various 1 year fixed bonds as currently you can get around 2.7% - 2.85% interest, although personally I'd hold off a bit as rates are going to increase further over the coming months. A few 3 month notice accounts are probably the place to be at the moment as a sort of holding ground.

I think the important bit to tell people here is to make sure that the bank they've never heard of is covered by the FSCS...People shouldn't be too worried about depositing money with banks they've never heard of. Just do your research and don't deposit more than £85k at each.

Of course. I'd steer clear otherwise.I think the important bit to tell people here is to make sure that the bank they've never heard of is covered by the FSCS...

Soldato

- Joined

- 4 Aug 2007

- Posts

- 21,990

- Location

- Wilds of suffolk

The FSCS is per banking group not per "highstreet" bank so you need to avoid placing large amounts with multiples within the same group

Unless they have recently changed it that is

Unless they have recently changed it that is

Well this is the issue isn't it, the decision is stupid, inflation as they understand it is caused by an economy flush with money pushing up prices, but that is just not the case this time. It really beggars belief, inflation caused by global demand is not going to be controlled by UK interest rates.Flushing out zombie companies that have been on life support since 2008 is a good thing in the end. Why waste even more money keeping them afloat? People working for those companies will of course lose their jobs - it happens unfortunately.

Low interest rates encourage reckless lending/behaviour. Those living outside their means will feel it the most.

The problem the central banks have today is tightening into a recession. They got us into this mess in the first place with QE and emergency interest rates since 2008. Anyone half switched on should have seen the train lights in the distance getting closer.

Actually, the real reason is to shore up the pound and maintain confidence in the pound, if that is the case, there is a lot more pain to come.

Pretty sure this isn't the case, I believe it is per brand.The FSCS is per banking group not per "highstreet" bank so you need to avoid placing large amounts with multiples within the same group

Unless they have recently changed it that is