I think some posters are missing the point. Economies are very complex things, but essentially:

BOE rate increase is trying to decrease inflation - this is a given.

Inflation occurs when you have to much money chasing to few goods.

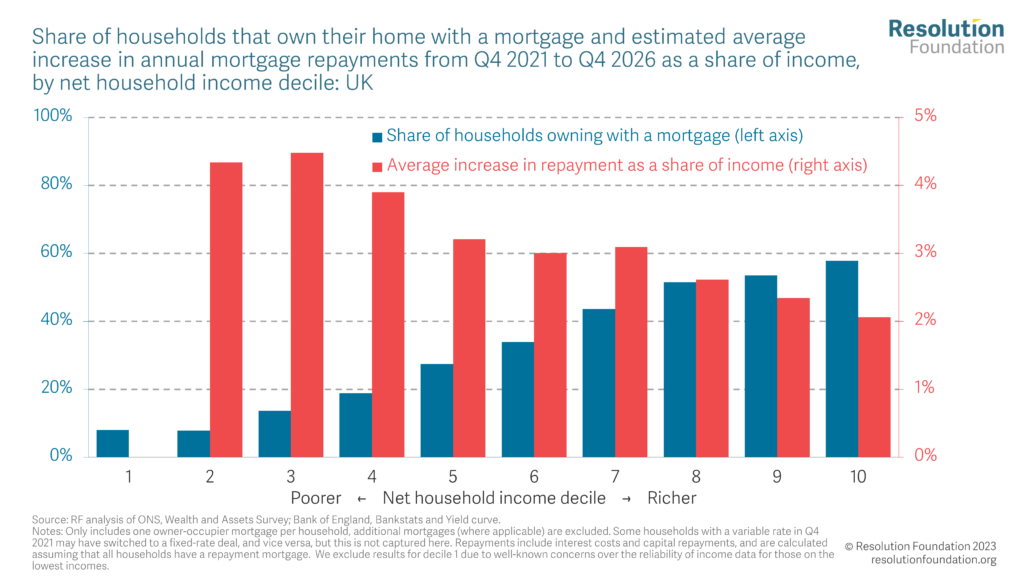

Increasing base rate works - as increasing the cost of borrowing, which among the general public is typically mortgages, reduces the amount of money they have to spend after paying their mortgage, reducing demand on goods, which leads to a decrease in inflationary pressure.

For the BOE to bring down inflation - the base rate is pretty much the only lever to pull, and they will keep pulling it until mortgage and rental costs are high enough that demand for goods has been lowered sufficiently to reduce inflationary pressure.

The question is - how high and for how long can they keep doing this without damaging the economy, more than inflation already is. At some point there's not enough people spending to keep businesses going, which puts people out of work, and a spiral downward in employment could get quicker very quickly indeed (this is probably not a concern for them right now with the current employment numbers). It can also stop businesses being able to invest in new equipment, products and processes - as the cost of borrowing to do it makes it uneconomical, causing businesses to stagnate.

Cue someone replying with a load of other valid points about how inflation should be brought down - I'm sure your correct, and yes there are other factors at play, but the BOE doesn't have an influence over it OR it will delay a reduction in inflationary pressure which goes against their mandate anyway.