Pfft, millenial. dO yOu nOt rEmEmBeR tHe nInEteEn sEvEnTiEs

"8% on my colossal £20,000 mortgage!!"

Pfft, millenial. dO yOu nOt rEmEmBeR tHe nInEteEn sEvEnTiEs

Isn't that the plan? 'We' have too much money in our pockets apparently.Im not sure going to 8% is workable. Everyone would be broke.

Frim what i have heard is developers are either renting out properties or pausing current builds and going out buying land and getting planning until all this craziness gets back to normal!Are the developers of new houses slashing prices due to this news? I expect they'll slow down production but are they still shifting current stock?

Are the developers of new houses slashing prices due to this news? I expect they'll slow down production but are they still shifting current stock?

They cannot go much higher anyway without totally ***** everything. Hopefully someone in the BoE has a brain and realises that they are not living in the 80's anymore.

"Mortgage rates of 6.43% today are equivalent to a rate of 25.7% in 1980 -housing is now at its least affordable since records began."

Any higher and no one will be able to afford their mortgage.

No, but a lot of people moved and would have taken out a mortgage during that period.Do you reckon it made that big of a difference? The money just went to the "vendor" rather than the government; prices didn't drop did they, they went up.

Ah yeah I get your point. I think they said 25% of all fixes are ending this year.No, but a lot of people moved and would have taken out a mortgage during that period.

I'm on a new build site. They discounted a few houses but only by 25k and they were already 575k but most have sold. Also they changed slightly what type of properties they are building on the site, less flats. I feel like things have slowed with construction of the third and final phase. Pretty much all of phase 2 was social housing, shared ownership, rented or something, so it was not for sale in the usual sense.They will slow down or even mothball sites if it gets difficult rather than simply sell for less.

A lot of stuff thats hitting the market right now may well have been sold off plan, or deals were done before things got mental. There's a lot of in flight construction jobs that will finish, but it's going to be a challenging time. A lot of jobs that were planned - but not yet started will not commence in the current circumstances. Jobs where the building is 30m+ are currently facing challenges as well due to the second staircase rules that have come in (building need to be redesigned and planning needs dealing with again).Are the developers of new houses slashing prices due to this news? I expect they'll slow down production but are they still shifting current stock?

The Gov could do stuff without working against the BOE policies, if they could pull down energy and food costs it would help. But there's no overnight fix - would be 6 months plus to feel the effects, probably more.What's the alternative to fixing the inflation without increasing the interest?

Gov could do stuff without working against the BOE policies, if they could pull down energy and food costs it would help. But there's no overnight fix - would be 6 months plus to feel the effects, probably more.

Maybe I'm missing something here - but I thought the idea of raising interest rates was supposed to be both a carrot and stick to help deal with inflation.

The banks seem very keen to whack up the interest on mortgages - however interest rates on savings accounts haven't budged at all.

If banks aren't going to pass on better interest rates for customers - it's not going to encourage people to save at all.

I have a solution take out a mortgage for that mortgage. It should workout lol.My mortgage is currently about £2k a month at 3.09%

It’s an extra £500ish a month for every 1.5% (which is what we’d be paying if we fixed now).

At 6% it would be £3000 a month.

9% would be £4000 a month - ouch!

I can definitely see people being put off moving house (or paying a lot for a house) if rates continue to rise.

those people haven't taken out 100% loans (they have some deposit) so that's inaccurate.Can't trust banks with the numbers.

The editors calculations

Average wage in 1980 was ~ £5k knock off 1k for 20% tax, NI etc so ~4k disposable income = ~ 50% of income assuming you can trust any other numbers.

That would make the current 6.5% approx equal to 15% back in the day

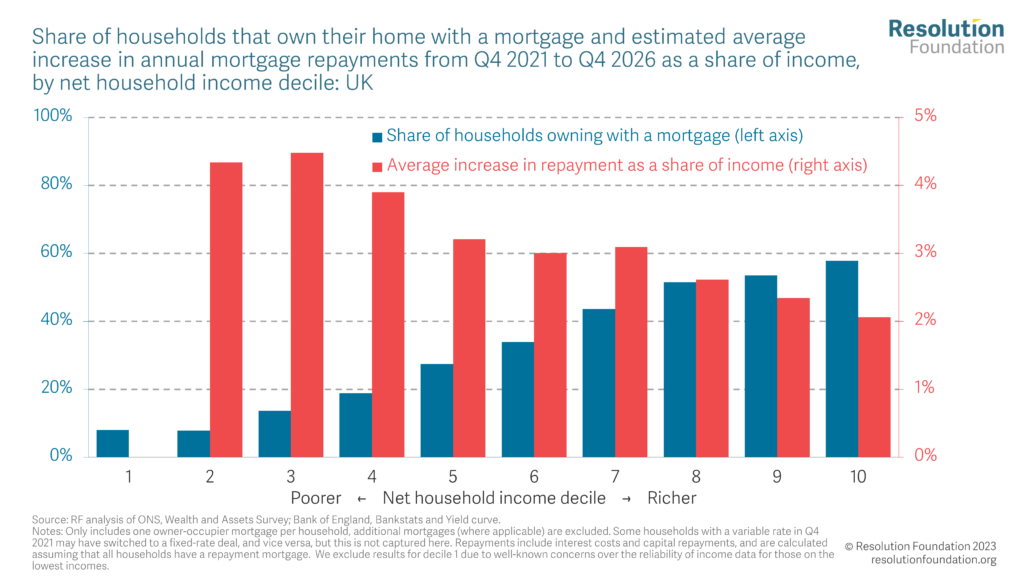

putting some figures on mortage increase it's average 3% hit on income - for many that will be offset by payrises,

so when you view it in perspective of there needs to be pain and we have to realise we are poorer - it doesn't seem outlandish

The Macroeconomic Policy Outlook Q2 2023 • Resolution Foundation

www.resolutionfoundation.org

I find it annoying people keep saying its only mortgage payers, the majority of LLs who pay a mortgage will pass this on to their tenants (at least some of it). This isnt aimed at you specifically, but I would say it affects anyone who isnt a social housing tenant, or doesnt outright own their home.The objective is to stop people spending. So the same could be achieved, probably faster, by lifting certain taxes. For example vat, fuel, income tax. This would also enable better targeting so the less well off suffer less.

It's terrible government putting all this on the BoE and making mortgage holders take all the pain.

stop spending money on food, water and a roof over our heads?The objective is to stop people spending. So the same could be achieved, probably faster, by lifting certain taxes. For example vat, fuel, income tax. This would also enable better targeting so the less well off suffer less.

It's terrible government putting all this on the BoE and making mortgage holders take all the pain.