I'm not telling you your job. I'm pointing out that your job comes at a cost, borrowing comes at a cost, assessing the risk of the borrowing and the recommendation you make comes at a cost, and that remortgaging is not magically free compared to other mortgages. It all comes at a cost and the borrower is the only one that pays that cost, either up front or over the term of their loan.

My work involves behavioral finance and decision making. Consumers make irrational decisions all the time, and financial services - mortgages included - are masters at capitalising upon just that.

When made transparent the example you quote above does not 'wash it's own face' for £99. Heck, the CHAPS fees alone will probably be £50. The costs are normally bundled and opaque. Selling a remortgage on the basis that the total cost to the borrower will be just £99 is just plain wrong.

Ahhh ok so are we talking about all advisers or bad advisers? Oh same thing right?

To suggest that it's all just smoke and mirrors is deeply insulting. There are bad in eggs in our industry, as in any industry, to be tarred with the same brush without consideration is just wrong and exceptionally rude.

Also, if we were talking about bond selling for example, I could see your point. How many advisers (banks especially!!) sold bonds with 7% commission hidden in the annual product fees? A lot that's for sure. Did we? Hell no. Our commission (pre RDR) has always been taken up front and made perfectly clear to every single client. We've also never taken more than 3%. Advisers don't stay in the market for touching on 30 years by operating as you describe I can assure you of that.

Now back to the mortgages. As you've pushed me I'm going to have to prove a point aren't I.

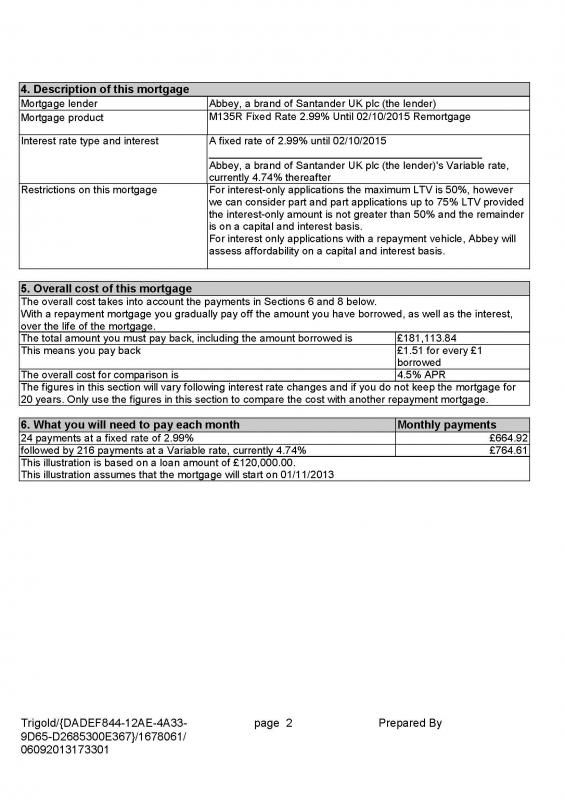

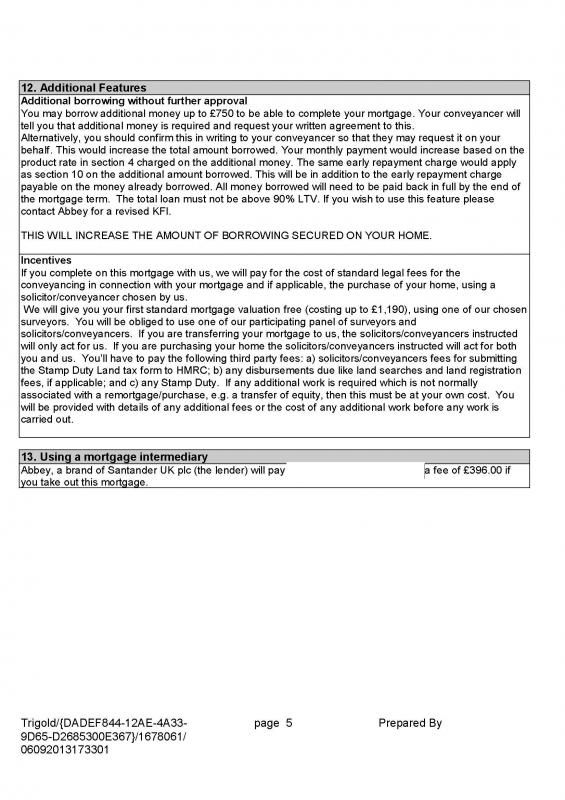

Attached is a Key Facts Illustration for a remortgage. Every single client gets one of these and it explains all the costs and features of a mortgage to ensure the client has the transparency you say is missing.

This is a current product, on the market today and one of many like it.

So perhaps you could point out to me the hidden charges here?

No valuation fee.

Free conveyancing.

No CHAPS fee.

No adviser fee.

The mortgage account fee is extremely standard and will be charged on any mortgage.

I am paid by the procuration fee (commission) the lender gives me for completing. Yes you can argue that this is built into the rate, but if the rate is still competitive it's still competitive. We do not charge seperate fees for arranging mortgages. A LOT of advisers do, but we don't. That's not how our model works.

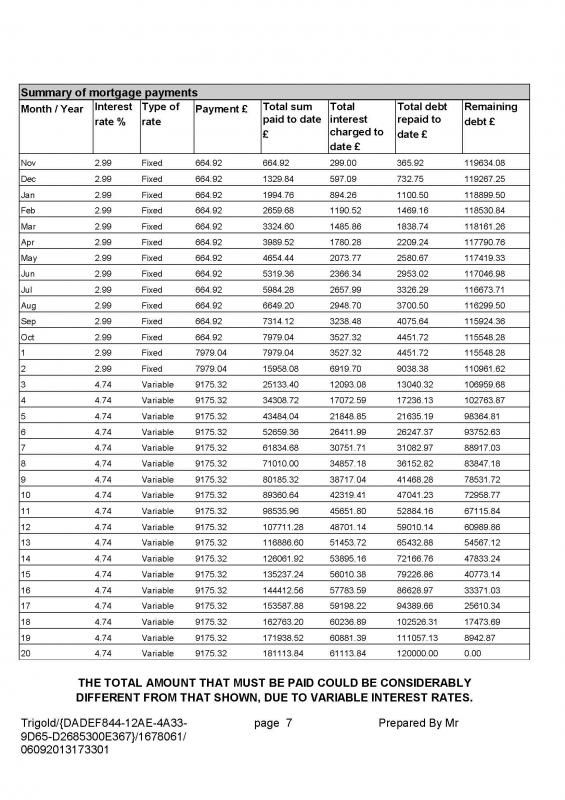

So lets say the client was on the Nationwide SVR at 3.99%, over the same term he would have been paying £735.17.

Over the 2 year fixed period with the lower payments of £664.92 he will save £1,686.

So even if he had to pay a mortgage account fee of £225 under his previous mortgage to close it, he's still £1,461 better off over just two years.

Going back to your original point reference fees:

Waaaay too much. Remortgage fees are akin to those of buying a house (without the stamp duty and all the solicitors costs).

I stand by my comment, nonsense.