Cash or gold.

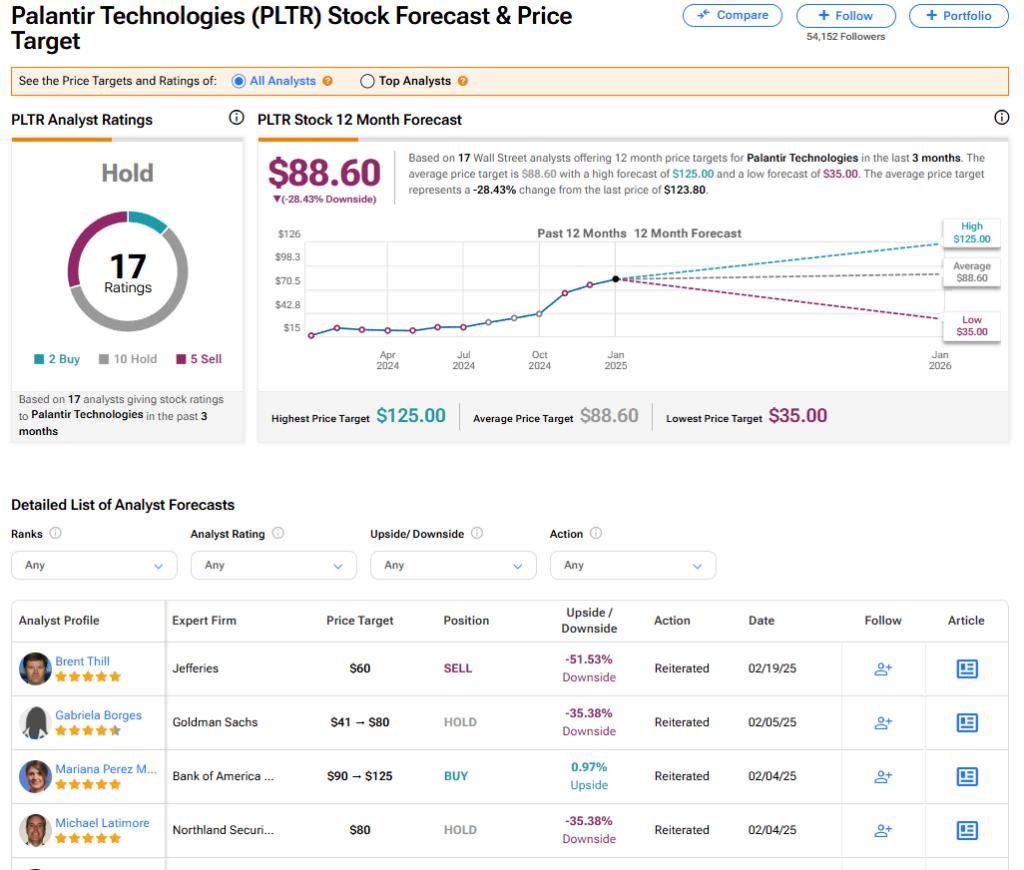

Even before Trump I had some concerns about valuations (plantir is on 500-600 PE), stocks are hyped up on AI.. And China keeps popping out surprises undermining western valuations.

If Trump plunges Europe into chaos.. That's a hell of a lot of revenue to lose.

Tariffs, sanctions, war.

There's so much uncertainty.. Even cash right now might not be a bad idea.

What we have potentially have coming could be once in a decade or worse. I'm happy to miss out on some gains if it blows over.

We haven't really had a huge drop since I've been investing. But could have one soon enough.