8% above inflation every year for 20 years would make for a mini me Woodford or Buffet. Thats better then probably the majority of fund managers paid 6 figures. I miss the days of when I could go and get 10% interest on my savings at the PO, that was even offered fixed for five years.

However £1 then is worth like

53p now so it was just headline gain, most obviously shows in house prices.

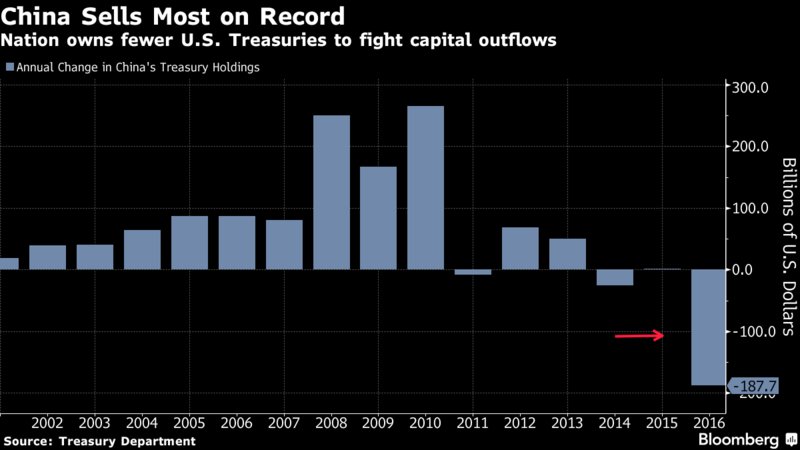

Im sure we havent seen the last of 10% rates etc Its upto China maybe, I'd love to know the new trend ahead of time. I just assume gold will do well or at least retain its value and China is selling dollars buying gold

https://t.co/h3qA4csplc

that sounds like a great way to rip people off

I pretty much agree but he said small trade so % fees are ok then.

Big stinger was sxx dilution. And I should have seen it coming.

Ive not read what kind of yield did they got that debt issued at. It was expensive, not good for shares. I think the bigger worry then would be that the plan works and within budget, investment and debt pays off and the shares will come good.

BT needs its big deals to retain customers and for its control of the uk backbone to continue profitably I guess. I far prefer the other shares you listed longer term

RMG is a utility but depreciating in its use I guess. I think they are mostly ok as they own a good amount of land in excess, asset rich and can still improve efficiency