HL are ok for funds I think, they rebate some of the cost but also charge a fee monthly. The problem with any advice on pension related is it needs your specific details, literally how much money and what age are you. HL charges a % fee so its not the cheapest if you got a lot in the SIPP, I think anyone close to retiring is often best served by an actual IFA but then you need to know one. Going to a bank isnt really a IFA, I standing for independent. moneysavingforum goes over a lot of these questions

I use Fidelty for ISA, its going to be cheaper then my last broker is all I know

Premium bonds is better then cash but its not a good return though its tax free its just good for that gamble factor I think

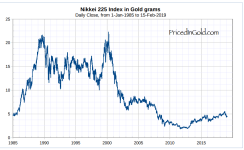

Beautiful melt down on this gold miner stock, commodities are really awesome like that. I think the military dictatorship that owns half the company is the effect seen in the price, but imo its just fine for speculators because its so evident why mainstream money would be apprehensive.

The news it fell on was something like 480k ounces not the 530k expected and it was a projection anyway and of course the gold price is changing every day in any case.

I think its a decent buy still so long as Egypt stays stable but also I should have been selling/trading it more after its prior gains, for risk management.

Of course it was tipped twice in newspapers just days before the fall