You might very well think that, you might very well be right, but the first statement isn't based upon fact, it is conjecture. What we have is an economy in its current position, and a population who don't want money spent on benefits, and who are in general quite happy with things like benefits caps, and reduction in government spending.

We'll see if they change their minds in the next two years of hard austerity, they might. Labour whining on about not overspending will keep them unelectable, as austerity to 'balance the books' the same thing all the muppets have spoken regarding is necessary. If these books must indeed be balanced.

While labour claim not to overspend, and the Tories squeeze harder to 'balance' who do you think the public believe when even with squeezing the books remain unbalanced?

They will not believe the 'we need to spend more' crowd. As that's how is is phrased, rather than we need to invest for the future with our thirty year plan to sort NHS and education that they should try spouting instead.

I agree the message Labour put across was pathetic, mostly because they lacked a single decent public speaker who can eloquently explain the causes.

Investment is the key as you say & how it should be phrased, investment in infrastructure, education, healthcare - working it as 'spending' makes it sound like the UK was purchasing 500,000 games consoles a week.

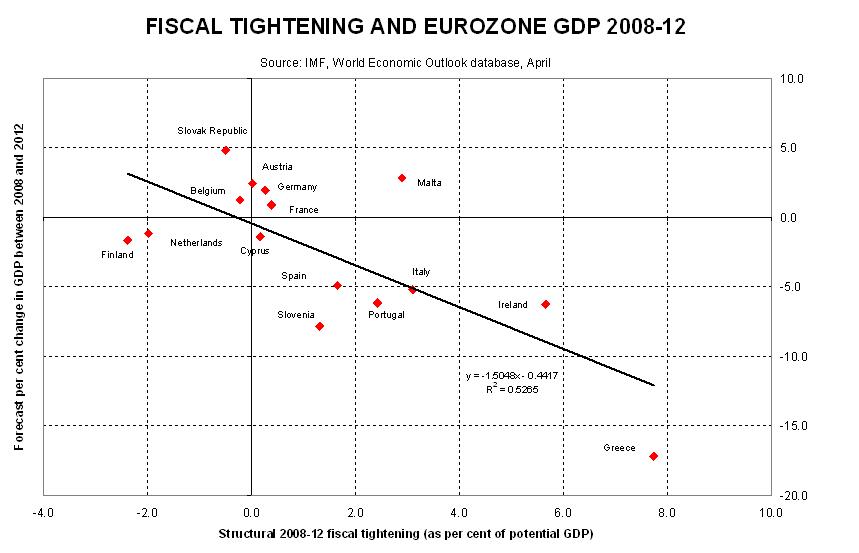

"Economist Martin Wolf analyzed the relationship between cumulative GDP growth in 2008–2012 and total reduction in budget deficits due to austerity policies (see chart at right) in several European countries during April 2012. He concluded, "In all, there is no evidence here that large fiscal contractions [budget deficit reductions] bring benefits to confidence and growth that offset the direct effects of the contractions. They bring exactly what one would expect: small contractions bring recessions and big contractions bring depressions." Changes in budget balances (deficits or surpluses) explained approximately 53% of the change in GDP, according to the equation derived from the IMF data used in his analysis.[54]

Similarly, economist Paul Krugman analyzed the relationship between GDP and reduction in budget deficits for several European countries in April 2012 and concluded that austerity was slowing growth. He wrote: "this also implies that 1 euro of austerity yields only about 0.4 euros of reduced deficit, even in the short run. No wonder, then, that the whole austerity enterprise is spiralling into disaster"

"Around 2011, the IMF started issuing guidance suggesting that austerity could be harmful when applied without regard to an economy's underlying fundamentals. In 2013 it published a detailed analysis concluding that "if financial markets focus on the short-term behavior of the debt ratio, or if country authorities engage in repeated rounds of tightening in an effort to get the debt ratio to converge to the official target," austerity policies could slow or reverse economic growth and inhibit full employment. Keynesian economists and commentators such as Paul Krugman have suggested that this has in fact been occurring, with austerity yielding worse results in proportion to the extent to which it has been imposed"

http://en.wikipedia.org/wiki/Austerity#Eurozone

It's no secret that the government has failed to hit every single target

they set, it's not my standards they are failing on but their own.