£125k is the point where you receive no non-taxable income, not £100k.

I didn't claim otherwise, seemingly you were unaware of this until I posted though. It is 100k where the 60% marginal rate starts and the marginal rate is what I specifically referred to.

Also, whilst there is a steep increase in the amount of tax paid between £100k and £125k you would still be around £10,000 better off on £125k vs £100k. At no point do you pay 60% tax on your earnings. Also, please keep in mind than less than 2% of the population make £100k or more, anyone that's lucky enough to be affected by this is very much in the minority.

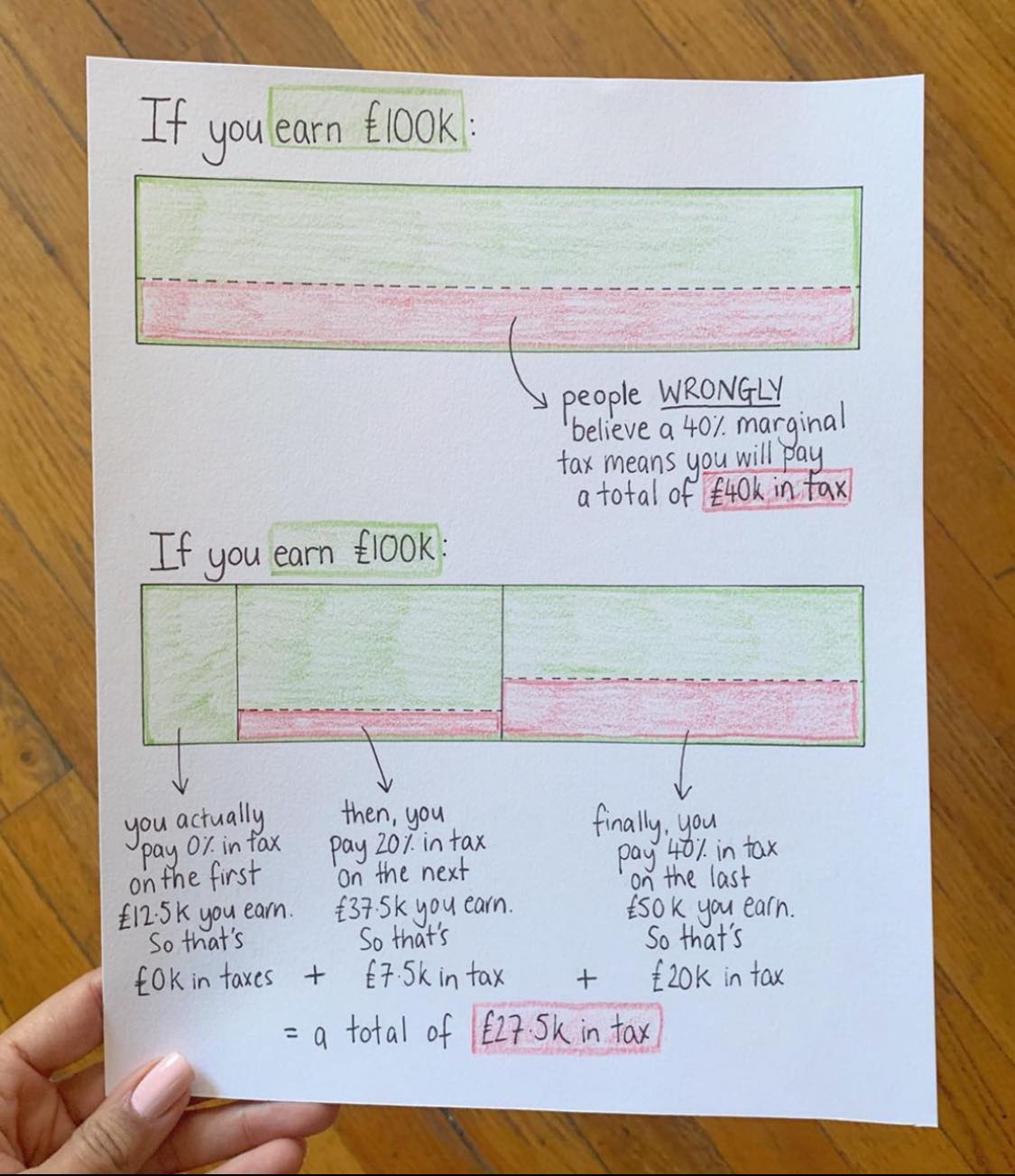

Are you not following what a marginal rate is? Of course you pay 60% on your earnings that fall into that marginal rate... to use the same example as earlier if a GP earning 100k a year decides to put on a twice monthly Saturday clinic and gets an extra 10k in return then he'll, currently, pay 6k tax on that additional 10k. He only takes home 4k from the 10k he earned... and that's before any NI + any potential future tax increases form Labour....

There could come a point where he just decides that actually, he's already giving away more than he earns from running the Saturday clinics, Comrade Corbyn is going to hit him with another "only X % hike" and he'll just not bother with them in future.

You have that sweet spot hitting some of the most productive workers we have and quite frequently hitting them exactly where their overtime or bonuses fall. I don't think it is either fair or particularly helpful to structure things that way.