So what's your point, then?

It where the money going, too whom and the constant development of taxes.

So what's your point, then?

So what's your point, then?

It where the money going, too whom and the constant development of taxes.

I'm not so sure about the significant correction. As I write this and reflect on COVID as a global phenomenon, it’s clear that Trump also represented a significant global event. By the looks of it, much of the volatility has been shaken out of his policies, although it will likely take another 12 to 18 months to fully understand the impact on the US economy and beyond.i do want to point out this whole thread is about speculation.

Weather Tram is right or wrong only time will tell.

we believe a correction is over due, which usually means to a crash of some sort, what impact new and changing technology have on that is another issue and how much it will effect

Sensible but perhaps what we are seeing is a weakening of demand for AI services as growth slows, inflation remains stubborn and debt increases.I'm not so sure about the significant correction. As I write this and reflect on COVID as a global phenomenon, it’s clear that Trump also represented a significant global event. By the looks of it, much of the volatility has been shaken out of his policies, although it will likely take another 12 to 18 months to fully understand the impact on the US economy and beyond.

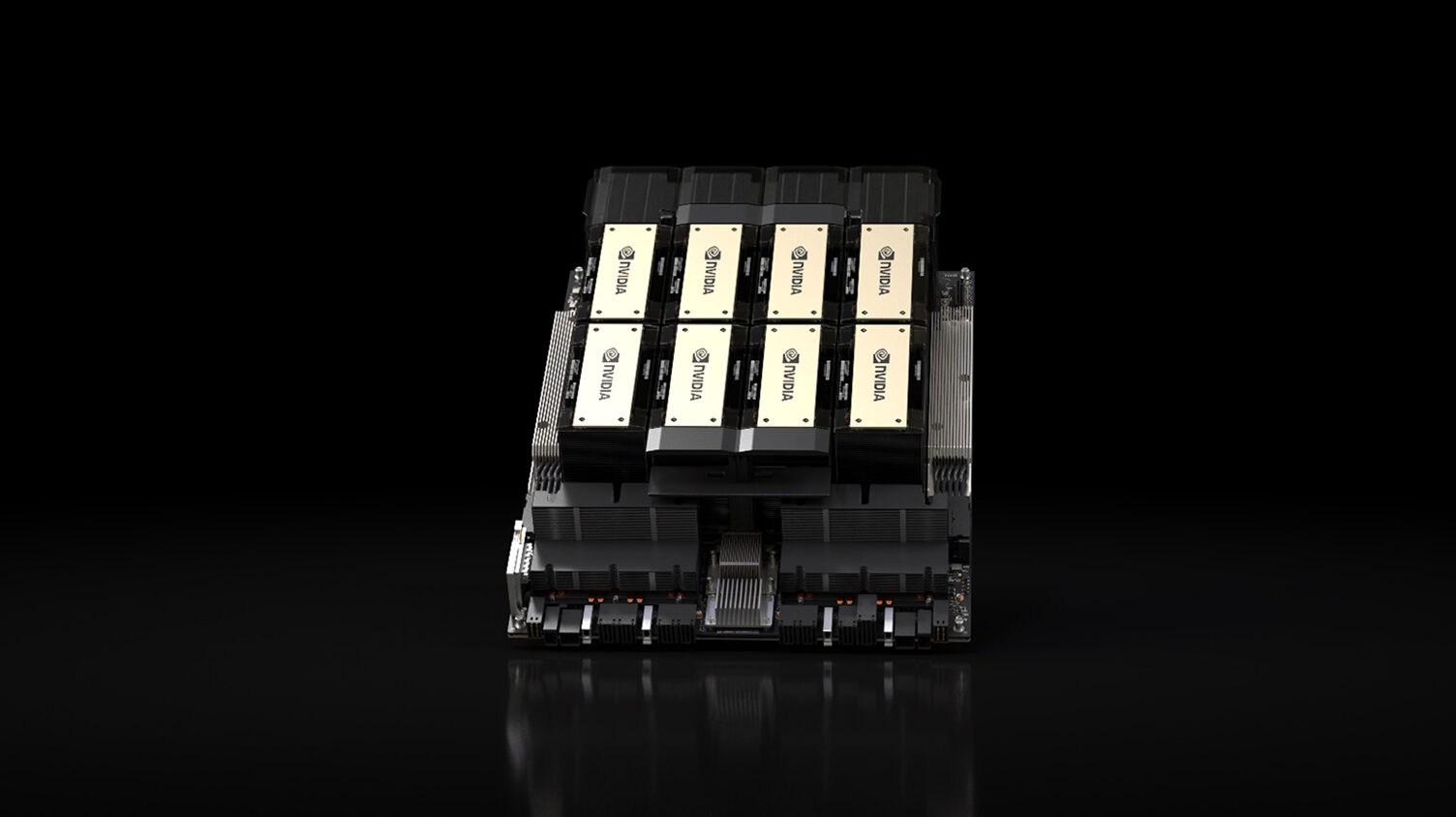

I’m also slightly perplexed by the focus on AI infrastructure investment, particularly given the debate about whether AI is viewed as a scam, a bubble, or something else entirely. Globally, increased computing power will be required for automation, regardless of whether AI is at the forefront or not. Therefore, this investment will not be wasted.

i do want to point out this whole thread is about speculation.

Weather Tram is right or wrong only time will tell.

we believe a correction is over due, which usually means to a crash of some sort, what impact new and changing technology have on that is another issue and how much it will effect

Currently though the black market seems to be strong in China for NV chips, thought it was funny that even with the China ban, AI chips were just smuggled from other countries

Is anyone suprised? These companies are pouring money into AI, of course they are the top customers.Meta and Microsoft are their “secret” AI customers apparently make up around 30% AI business.

Why do they need to be constantly replaced? I’ve not being paying attention but aren’t they still on their 18 month release cycle or whatever it was?NVIDIA is still printing money but things could change quickly

Meta and Microsoft are their “secret” AI customers apparently make up around 30% AI business.

H20 chip to China, if pushback from Chinese government to not take NV sloppy seconds and design their own chips (let’s face it they probably have a lot of “borrowed” tech info)

Currently though the black market seems to be strong in China for NV chips, thought it was funny that even with the China ban, AI chips were just smuggled from other countries. Think Philippines went from 0 to 20% of total AI cards. So will be interesting to see the official china numbers next quarter if/when allowed to.

They do have the massive benefit currently though of just selling bigger better shovels for the AI craze, and the shovels have to be constantly replaced.

Better business than the gold rush least their shovels lasted longer!

invest in germany, apparently AFD is going to take over, leave the EU, drop the euro and start a new alliance of like minded people, and that doesn't include FranceSo what's your point, then?

Interesting to see what Trump is announcing today and if it affects the markets.

invest in germany, apparently AFD is going to take over, leave the EU, drop the euro and start a new alliance of like minded people, and that doesn't include France

AFD as in African diamonds?

I usually stick to equities rather than commodities.