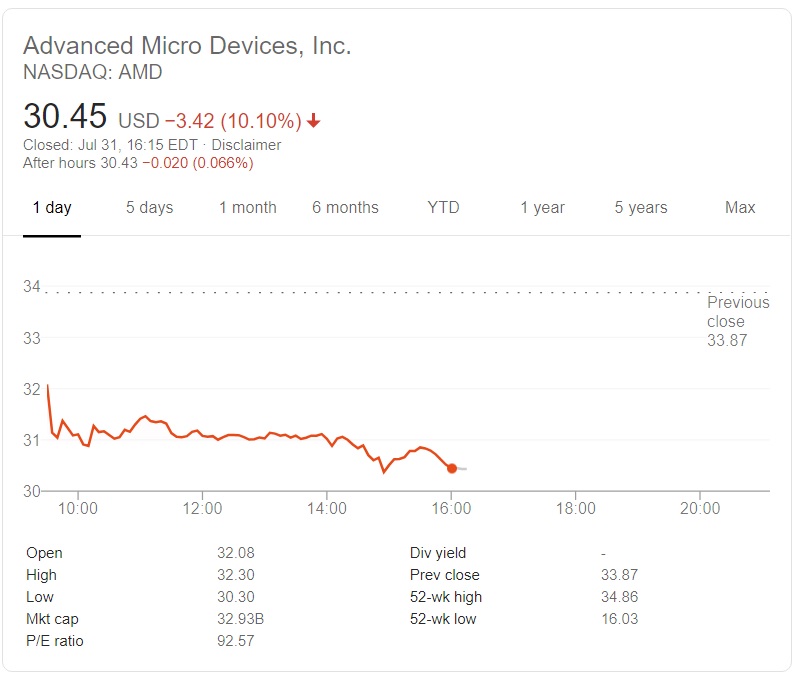

The outlook is poor according to WCCFTECH, Q3 2019 revenue is expected ~$1.8B, instead of ~$1.95B.

https://wccftech.com/amd-meets-earnings-estimates-but-stock-drops-on-poor-outlook/

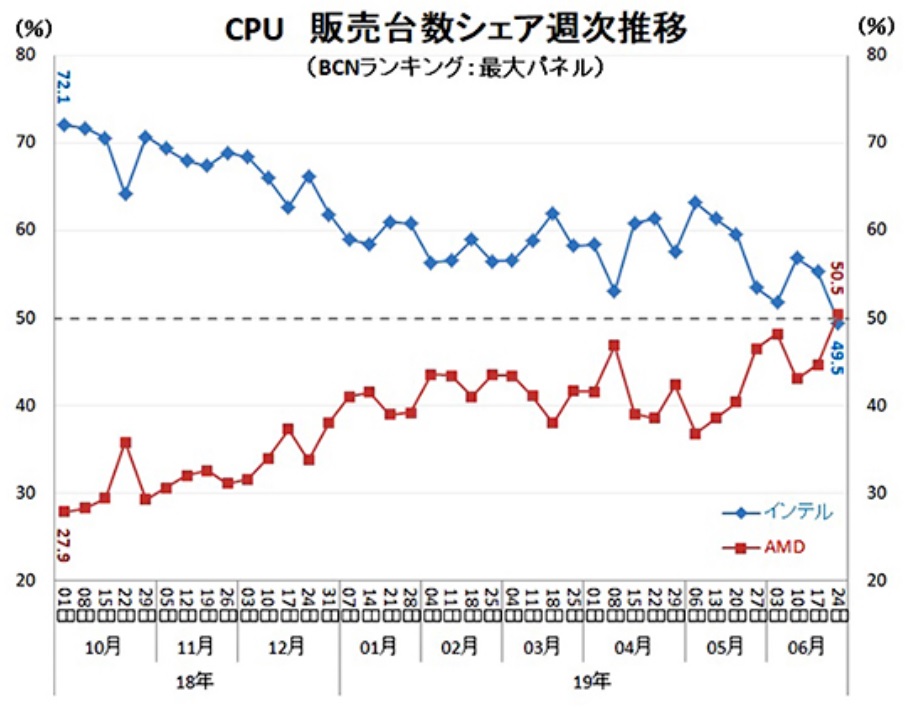

AMD won't make money out of DIY CPU sales, that's for sure. They need to address their weakest segments:

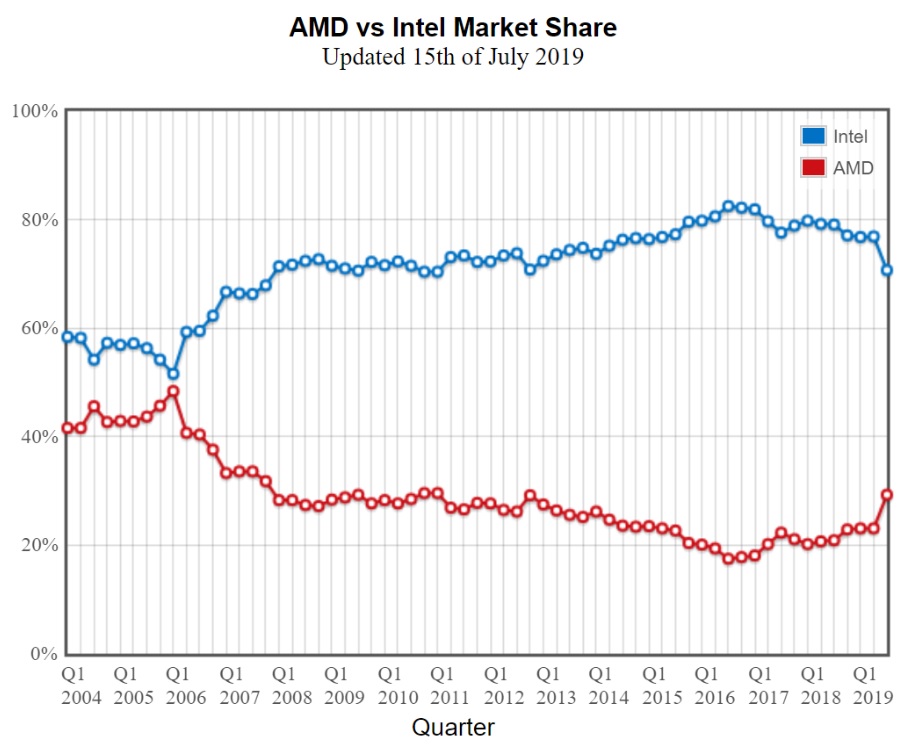

"Where pundits may criticize the company is in market share. Improves margins and cash to debt positions are excellent and certainly are crucial to its long term success, AMD simply must continue to grow its revenue at a quicker pace.

Mobile shipments in laptops and

OEM desktop CPU volumes are still poor and despite

EPYC starting to gain momentum, it is most likely still

<3 percent of the market when it comes to the data center."