Soldato

- Joined

- 25 Mar 2004

- Posts

- 15,976

- Location

- Fareham

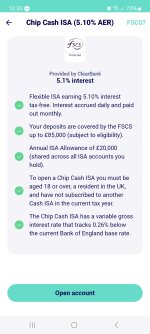

Goal for now is to simply beat the 1% mortgage rate with a 5% savings rate, and then dump one into the other when the rates inevitably swap over.

If I can get get into a situation where the mortgage is getting cleared then I can put more into savings/investments for sure, just want to get my mandatory payments down monthly to give more flex on earnings.

If I can get get into a situation where the mortgage is getting cleared then I can put more into savings/investments for sure, just want to get my mandatory payments down monthly to give more flex on earnings.