Soldato

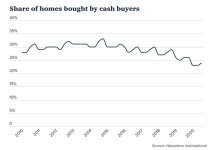

With all that cash sloshing around, I guess their is not much chance of a property downturn anytime soon.

Which TBH is a good thing for the majority

What we could really do with is decades (like 2-3 minimum) of virtually unchanging house prices.

2-3 decades would likely see a roughly halving in effective real world cost.