What is a reasonable rate?

Given how interest rates are rock bottom at the moment, maximum RPI.

Plan 1 was £3k pa fees and 1% interest rate.

Plan 2 is £9k pa fees and 5.6% interest rate (and will rise as inflation expectations now are much higher)

What is a reasonable rate?

I'd politely suggest that perhaps accountants and HMRC understand these things rather more than you give them credit for. I'd also politely suggest that you may not understand the bigger picture, particularly given your suggestion would lead to some hilariously simple tax avoidance.

Fair enough, I’m not an accountant, I’m curious though, how so?

Edit: I waffled a bit, so the TLDR is: make the share option worthless and the resulting share valuable.

First off the basis premise is that an employee is taxed on everything of value they've been given in return for their services.

Sorry but I disagree here, the first example is some rather arbitrary clause that I don't think does make the option worthless, it would certainly be objectionable if they tried to claim it did - you're just throwing in some knockout event that screws over an employee if they're sick or pregnant (rather discriminatory and so potentially illegal). Alternatively, if they leave the company before then then meh...

The second condition isn't necessarily artificial either, such an option *should* have a lower value... if the company doesn't get sold before they expire then they're worthless. I don't think this clause would generally be attractive to employees thus defeating the point of granting these options.

The value of the option is its premium, what it would be worth if you simply bought it... so surely the tax you'd otherwise pay on the income you'd need to earn to buy the thing you're given as part of your income is what ought to be applicable. Just as it would be for gym membership or health insurance etc.. or maybe a company decides that after 10 years of employment an employee gets to be awarded an expensive watch or something, that would need to be taxed and/or the employer might throw in some additional cash so as to cover that too.

Say some employee has options that expire in 4 years, the company does spectacularly well, instead of simply paying tax and NI on the value of the options when they were earned, the employee is taxed on the gain, from the strike price to the, now much higher after 4 years, current value.

Two issues - first of all, HMRC is collecting income tax and NI on a speculative gain that occurred long after the thing of value was earned, that seems to go completely against the premise you mentioned and is more what CGT is for (which obvs applies here too in addition to income tax and NI should they sell the shares).

Secondly, this additional speculative gain has accumulated over several years but is taxed, as income, in a single tax year. Hello higher tax bracket for even lowly paid QA, admin staff or support guys and goodbye personal allowance for otherwise not yet on 6 figures, early-career developers/engineers etc..

In the latter case I could perhaps see the argument that, where because you have say the presence of some clause that the employee is locked into working for the company for the 4 years then maybe it could be considered income across 4 years and somehow taxed as if the total gain was earned across 4 tax years, though I still think that is a fudge as it still involves the taxing of additional speculative gains as income.

I think you're missing the point of the clause. It isn't to screw over the employee. It's to screw over the valuation. My example is a bit silly, but the principle of it is sound (and the principle gets abused even now with current rules).

Anyway, obviously you don't like the fact share options are taxed in this way and that's fine. But I can absolutely guarantee you it's not because HMRC/accountants don't understand options. Which was the important part why I posted!

- Yes higher rates of income may be payable. But, and this is important in this thread as well, that's what happens when you gets lots of money from your employer.

- Tax doesn't necessarily care whether something is earned over a number of years. In this context, all that is important is the asset was earned by reason of your employment. Sometimes there are exceptions to this rule (looking at you Top Slicing Relief).

Given how interest rates are rock bottom at the moment, maximum RPI.

Plan 1 was £3k pa fees and 1% interest rate.

Plan 2 is £9k pa fees and 5.6% interest rate (and will rise as inflation expectations now are much higher)

I'm a graduate on the plan 2 student loan, im about 5 years into employment and earning a 'high' salary relative to most (c£70k). However any additional income I now earn is taxed at >50% despite only being in the 40% tax bracket. This is due to the student loan which is effectively an additional tax.

Even though I pay around £4k pa. on my student loan, due to the interest rate of RPI plus 3%, I'm not paying anything against the capital, only interest.

For example, I got my bonus of £6900 this month and my take home from that bonus was £3400.

Where is the incentive to earn more? Why is the government charging ludicrous rates of interest. Only the extremely high earners can afford to pay it off early, whereas the lower income don't pay anything at all, and like most of the time, the middle income earners pay the most of it.

I understand if people feel like I'm being selfish when im on a decent income, it just feels so demotivating to try to work harder when you get less than half of it in return.

Anyhow

High interest rate on student loan resulting in me paying more tax for a longer period than if the rate was reasonable, such as it was under plan 1. That's all.

You could always blame your parents for not conceiving you a few years earlier that would have allowed to you attend university under plan 1*.

*i jest of course

My student loan interest was basically 0% interest after I graduated and started earning I think it was mostly gone after ~6 years, I think my uni fees were the last year of £1000 per year.

The current system is a complete scam. I think as a country we pay as much towards education as we did 10 years ago since much of the debt gets written off anyway, so why don't we just make the whole system fairer if it costs us the same anyway?

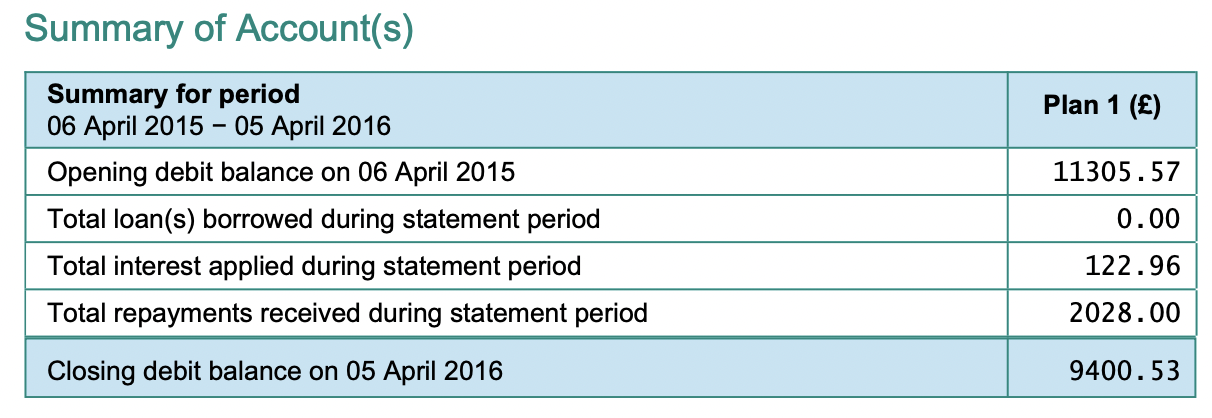

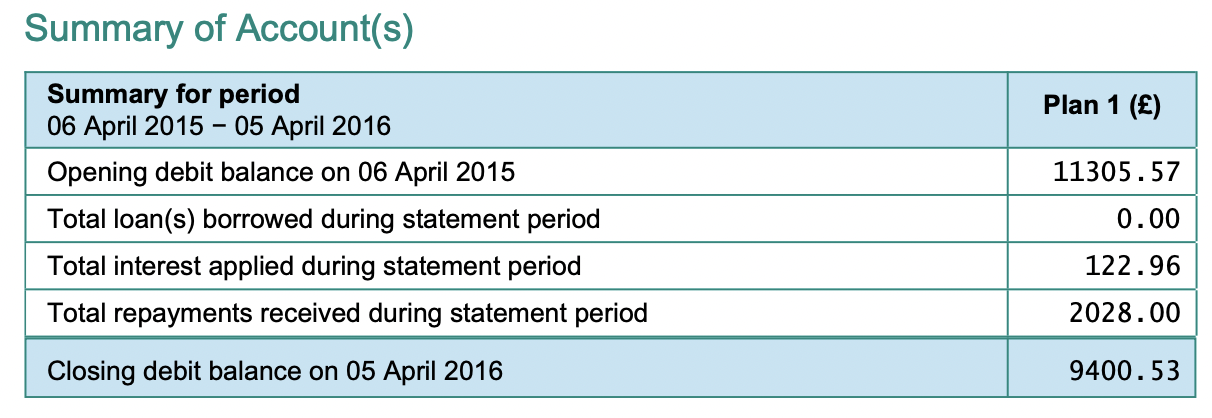

Here's my plan 2 for comparison:

OP did come across quite badly and is in a fortunate position compared to an average graduate like me, but some of the responses in this thread attacking him are missing the point of how absurd the system is. I'd need to more than double my salary (although it has gone up a bit over the last year already, humblebrag) to have any hope of paying it off before the 30 years is up, which is do-able in my line of work but why shouldn't I legally arrange my finances in a way to minimise what I pay back, after the past year of acceptable, blatant corruption by the people who decide those rules?