That's a shame, i made a similar error once and Amex waived the interest.

I know, I was so sure I was right! Perhaps if it were Amex they would have been more sympathetic. In anyway, since it's a cashback card I'll earn enough to cover the interest so I haven't technically lost anything, just not made anything.

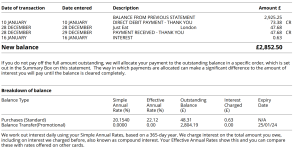

It was an interesting error of assumption in my spreadsheet rather than a calculation error, that any payments go to the highest interest element of a balance which is by law. However it doesn't apply to purchases made after the statement date and any overpayment will go a different balance, the 0% element in my case. In my spreadsheet any overpayment stayed with the purchases incorrectly which led to calculating the minimum incorrectly. The purchase I missed compounded the error.

I had an MBNA 0% card. I maxed out the 0% side of the card and wanted to spend £30 on some food or something. I paid the minimum payment + £30. They charged interest on the full £30 less a marginal amount. I did say that the first half was 0% and the payment should clear the highest interest paying stuff firstly - but apparently they calculate that on a pro-rata basis. So x% of the 0% and x% of the £30 --- rather than 100% of the interest applicable stuff and anything else chips the 0%.

Was that before the law changed? They must pay apply any payment to the highest interest element first at the time of the statement date. If they were to say take 60% of your payment towards purchases and 40% towards the 0% balance, they wouldn't get away with that nowadays. Perhaps you mean they charge you interest at different rates per element if the payment doesn't cover the minimum?

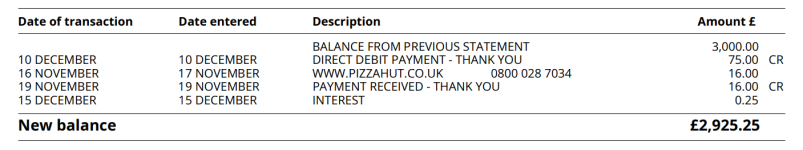

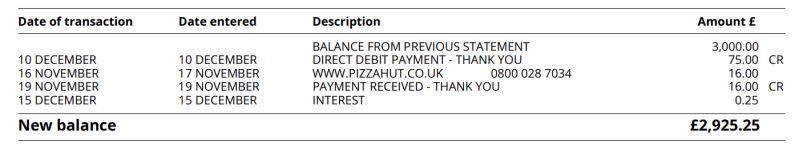

Using some arbitrary numbers for clarity, imagine there is a 0% element of the account of £5,000. You make purchases of £125 which makes the total balance of the account £5,125 at the statement date. The minimum payment (3%) is £123.75 which is less than the purchases you made by £1.25 so they charge you interest on the full £125.

If you would have paid £200 (minimum payment + £76.25) then the £75 (payment - purchases) part will go to the 0% element of the account and not any purchases made after the statement date.

The statement date is critical as the balance on that day must be used to calculate how much to pay to avoid interest.

Taking the above example, the balance on the statement date is £5,125, the minimum payment is £123.75 and purchases of £125. You only need to pay an additional £1.25 to clear the purchases to avoid interest. I've made a payment of 10p to clear the balance before!

.

.

. Remember, if you spend £1,000.00 and only pay back £999.99 of it on time, they'll charge you interest on the whole £1,000.00.

. Remember, if you spend £1,000.00 and only pay back £999.99 of it on time, they'll charge you interest on the whole £1,000.00.