AMD would have made a great buy when it crashed to 9.x the other week, but I didn't have any spare capital to invest (because I didn't top skim, grr) and now I don't have faith it will not fall again.Tempted to get into nVidia as well, already have some AMD which should do ok, but Nvidia are totally dominant in the machine learning arena (the extent of that dominance I hadn't realised until I started studying ML on the side a while back).

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading the stockmarket (NO Referrals)

- Thread starter mcast123

- Start date

More options

Thread starter's postsA lot of tech stocks are expensive, as I said a while back. Nvidia are currently at a P/E of about 48, which is about three times that of an averagely priced stock. So basically, you could choose to buy $3,000 of Nvidia stock, or $1,000 of typically priced companies and expect the same earnings. Still sound a good deal?

Of course, companies prospects do differ. A quickly growing company may be worth more than a P/E of 16. But generally, a figure of 48 is just too high.

Interestingly, Apple have a P/E of 16.8 at the minute, despite not being too far off an all time high. The market is still a it crackers. Alphabet are at 59. Amazon are 229! Even Microsoft are nearly 61. Lot of hype at the moment, despite recent corrections (which are small in the scheme of things).

Of course, companies prospects do differ. A quickly growing company may be worth more than a P/E of 16. But generally, a figure of 48 is just too high.

Interestingly, Apple have a P/E of 16.8 at the minute, despite not being too far off an all time high. The market is still a it crackers. Alphabet are at 59. Amazon are 229! Even Microsoft are nearly 61. Lot of hype at the moment, despite recent corrections (which are small in the scheme of things).

Soldato

So you'd be looking to buy into a company whose shares had just fallen 15-20% without asking questions why?

The market is considered to be in a correction this year, If prices go up, they must come down, the share price of Nvidia went from $32 in Jan 2016 to $250 in Jan 2018, waiting for a few shares to pop back under $200 is not that big a deal for me, if they do come back under $200, they would get snapped up I reckon.

A lot of tech stocks are expensive, as I said a while back. Nvidia are currently at a P/E of about 48, which is about three times that of an averagely priced stock. So basically, you could choose to buy $3,000 of Nvidia stock, or $1,000 of typically priced companies and expect the same earnings. Still sound a good deal?

Of course, companies prospects do differ. A quickly growing company may be worth more than a P/E of 16. But generally, a figure of 48 is just too high.

Interestingly, Apple have a P/E of 16.8 at the minute, despite not being too far off an all time high. The market is still a it crackers. Alphabet are at 59. Amazon are 229! Even Microsoft are nearly 61. Lot of hype at the moment, despite recent corrections (which are small in the scheme of things).

Yeah, I think Nvidia are in an extremely unique position though, they have a monopoly, it changes the dynamic for me, I feel safer with the company basically.

Soldato

https://us.cnn.com/videos/tech/2015...econds.cnn/video/playlists/thats-pretty-cool/

Nvidia should do well if its linked to machine learning but is there any company more applicable or likely to benefit from that sector expanding.

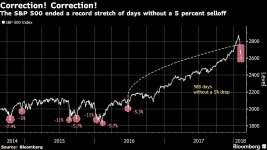

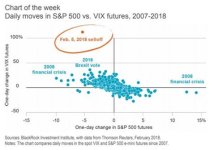

Heres the chart I meant to post the other day. Not just another pullback apparently

Nvidia should do well if its linked to machine learning but is there any company more applicable or likely to benefit from that sector expanding.

Heres the chart I meant to post the other day. Not just another pullback apparently

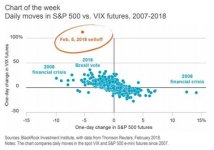

Jamie McGeeverVerified account @ReutersJamie Feb 12

Last week's spike in U.S. equity volatility was literally off the charts. While a return to the "unusually" calm market conditions of last year is unlikely, this doesn't yet represent a regime shift, says Blackrock.

Soldato

That's a great chart, what goes up, must come down.

http://markets.businessinsider.com/...nvestors-flee-stock-selloff-2018-2-1014976403

I expect to see a lot more money flow from the stock market to digital assets.

Very true. The danger comes with dealing costs. Depending on the numbers involved and the platform you use to trade, the cost of actually buying and selling multiple times can really dent your margin.No harm in taking some profits. A lot of people must lose out by not selling at the right time. Yes, a stock may go higher, but a bird in the hand and all that.

Interactive Brokers is thankfully super cheap... even exchanging currencies.Very true. The danger comes with dealing costs. Depending on the numbers involved and the platform you use to trade, the cost of actually buying and selling multiple times can really dent your margin.

Soldato

Nvidia are already back up to their record levels after the "correction". I will surface skim, or maybe even close the position and re-invest, once it gets to around 250.

You think they'll stay up there? I was going to wait till before the summer to review Nvidia but maybe I should do it sooner.

I think their business model and market position are very good and they continue to make money and be at the forefront of their field. They are back up to record levels soon after a correction and this tells me that they have something going for them and I think they will hit 300 by end of year.You think they'll stay up there? I was going to wait till before the summer to review Nvidia but maybe I should do it sooner.

However, if buying at the current price it's worth thinking twice as it is already pretty high.

Soldato

Hmm, yeah, that's why I've waited, they've had 2 years of solid growth, I'm just waiting for that small 3 month period where they have a proper correction.

I think you may have missed the boat...Hmm, yeah, that's why I've waited, they've had 2 years of solid growth, I'm just waiting for that small 3 month period where they have a proper correction.

Soldato

Is there any science behind the belief they'll rise to 300 or is it a gut feeling?

Exactly what 'science' you looking for when I write "I think"? In my previous posts I clearly stated my positive thoughts on their business and profitability.Is there any science behind the belief they'll rise to 300 or is it a gut feeling?

Soldato

That was the point I was getting at - there's no data or fundamental analysis behind picking 300 as a target other than selecting a higher round number that seems emotionally attractive. A dangerous way to invest imo.

That was the point I was getting at - there's no data or fundamental analysis behind picking 300 as a target other than selecting a higher round number that seems emotionally attractive. A dangerous way to invest imo.

That's the way a lot of people roll, sadly. The crypto forum is full of it.

Your way of phrasing your questions was patronising and presumptuous, whether you realise it or not. I never claimed to have any 'scientific' data at all, it is pure opinion and speculation based on Nvidia's recent performance and latest figures. It is also hardly a "dangerous way to invest" for me to invest if I already have stocks that I already bought for a significantly lower price and am leaving them to make gains for the long game, is it? For someone investing now then yes clearly it is a much higher risk, as I stated in the last posts.That was the point I was getting at - there's no data or fundamental analysis behind picking 300 as a target other than selecting a higher round number that seems emotionally attractive. A dangerous way to invest imo.

Many analyst price targets after the recent earnings announcements are also now ranging from $250-$300 (average around $275) so while on the higher side, it is certainly not outside of the realms of realistic possibility. Having followed them closely for years, I have a lot of faith in Nvidia's market leading expertise and innovation.

Soldato

It certainly wasn't meant to be patronising, but is was presumptuous given that you'd provided no more information than a number. Basing on analyst forecast however does show that some thought has gone into the decision. There'll always be some scepticism on a PC tech forum such as this, when people invest in a stock of which they're a consumer, as the emotional pull of 'OMG, this card / CPU is so amazing that it is a no brainer to invest'. Clearly not the case here though.