I’ve been getting generic emails from HL about it, I know I didn’t directly invest in it but I’ll need to check and see if any of my HL funds were indirectly investing it - wouldn’t be surprised if they were and they were pimping his fund in parallel...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading the stockmarket (NO Referrals)

- Thread starter mcast123

- Start date

More options

Thread starter's postsI saw the panorama documentary on Woodford, seems like it was a shambles. Go compare his holdings to the likes of Terry Smith or Lindsell Train, big difference, you have actually heard of those companies they invest in.

How much do you guys think is needed for retirement? I don't have any pension from my company but if I leave for a (much!) lower paying job I will have about 350K USD in the sp500 at 30yrs old. Putting those figures into calculators gives numbers that don't seem realistic to be honest.

How much do you guys think is needed for retirement? I don't have any pension from my company but if I leave for a (much!) lower paying job I will have about 350K USD in the sp500 at 30yrs old. Putting those figures into calculators gives numbers that don't seem realistic to be honest.

Take a look at your current outgoings, calculate which ones will most likely not be there when you retire and then add in other expenditures that will be. That should give you a target income and capital amounts. Voila - begin saving!

Soldato

- Joined

- 13 Jul 2004

- Posts

- 20,341

- Location

- Stanley Hotel, Colorado

Woodford funds going to Schroders management now. I cant see it'll end badly so long as they arent doing a fire sale, big group has to be fair for chances to return the asset value to the price

Buffet looking very young, 50% gains in a few years sounds like history repeats - https://youtu.be/2Hf1TUfTtd8?t=106

Buffet looking very young, 50% gains in a few years sounds like history repeats - https://youtu.be/2Hf1TUfTtd8?t=106

Funny having a bit of a reflection on what I used to have in investments - Alliance Pharma which I hadn't been feeling for a few months and had been motivating me selling and eventually closing off my remaining investments (a cocktail of trackers, alternatives, etc.) in July ironically has held up OKish while several others have plummeted - one went from 572p when I last sold to 62p just days later. Obviously there is a longer term picture with stock etc. and I was just dabbling anyway.

Random question here, If i wanted to buy shares in , for example, Apple, Google, Fitbit, Microsoft etc ... Do you have to own a whole share / x amount of shares? And how do you actually go about buying them? I've heard of eToro , Plus500 , and Hargreaves Lansdown ... Not interested in buying and selling daily, more want to invest a small amount in each for the future , just don't know how to go about it

Random question here, If i wanted to buy shares in , for example, Apple, Google, Fitbit, Microsoft etc ... Do you have to own a whole share / x amount of shares? And how do you actually go about buying them? I've heard of eToro , Plus500 , and Hargreaves Lansdown ... Not interested in buying and selling daily, more want to invest a small amount in each for the future , just don't know how to go about it

Open a shares trading account which will give you access to the markets you want, Apple, Google are on the New York stock exchange.

You can buy one share in a company if you like, but you cant buy a portion of share, say for example half a share of Apple.

Just bare in mind lots of share trading accounts take commission on each deal you do, so buying one share will make very little sense.

hope that makes sense.

Open a shares trading account which will give you access to the markets you want, Apple, Google are on the New York stock exchange.

You can buy one share in a company if you like, but you cant buy a portion of share, say for example half a share of Apple.

Just bare in mind lots of share trading accounts take commission on each deal you do, so buying one share will make very little sense.

hope that makes sense.

Sort of, I didn't actually mean buying one share, A better way for me to put it would have been, Could i invest £500 in a particular stock, or do you have to buy a whole one, but i guess your answer still applies? Who are the better account providers in the UK ?

Sort of, I didn't actually mean buying one share, A better way for me to put it would have been, Could i invest £500 in a particular stock, or do you have to buy a whole one, but i guess your answer still applies? Who are the better account providers in the UK ?

Your best bet for what you are asking is something like a tracker fund - then you aren't so exposed to any one share performing or buying whole shares.

Get your head around fees early though - can end up wiping out any gains and/or take a long time to realise any return due to them especially buying small quantities can have significant fees relative to the amount you are buying and so on.

Soldato

- Joined

- 19 Oct 2008

- Posts

- 6,032

At least one of the HL "fund of funds" has holding in Woodford's funds.I’ve been getting generic emails from HL about it, I know I didn’t directly invest in it but I’ll need to check and see if any of my HL funds were indirectly investing it - wouldn’t be surprised if they were and they were pimping his fund in parallel...

Not all is lost. Some are talking as if investors have lost everything. They'll get returned what is due once the fund is wound up and everything sold. However, being a forced seller means the best prices won't be had for the illiquid stock.

It's a reminder about past performance not being a guide to future performance and not to have too much money in one holding. He was a bit of a legend. Now made a legendary big **** up. I have money invested, more than I wish I had now, but not enough to be concerned about to be honest. Not sure what to make of the HL side of it. They've stated a few things to cover their own backs but I dunno, they had some concerns a while back but continued to pump Woodfords funds via the Top 50 funds or whatever it's called. They reckon Woodford wasn't straight up with them or something like that....

It's made me reconsider managed funds a bit to be honest. I still use them but will keep a closer eye on them, possibly switch some to trackers.

Last edited:

HL are up to their necks and deeper in it. Their commercial drivers appear to have completely run roughshod over whatever due diligence they have in place. Even St James's Place stopped using Woodford months earlier. At least people should finally be waking up to their best buy Top 50 list or whatever it is, and seeing it as nothing more than a best buy list for HL, not the consumer.

Sort of, I didn't actually mean buying one share, A better way for me to put it would have been, Could i invest £500 in a particular stock, or do you have to buy a whole one, but i guess your answer still applies? Who are the better account providers in the UK ?

You can't buy fractions of a share and no you're not going to invest exactly £500 in a stock unless the share price exactly divides £500

For example BP's ask is/was 489.45 (that's in pence) so say you bought 100 BP shares you'd have spent £489.45 + commission.

Does that make sense?

US shares tend to be much more expensive, just because... no particular reason other than psychologically they're used to shares of big companies being more like XX or XXX USD whereas in the UK it is more like XXX pence so relatively more shares issued (we're a bit weird vs the rest of the world with regards to this - quoting of shares in the subunit). So you might actually buy a single share in a US company if you're investing rather small amounts.

You ask about brokers - it depends on your needs - if you are only talking about small amounts of money then you might want to look at a tracker as Roff mentioned above or an ETF which have historically tended to be cheaper.... but if you really want to invest in individual stocks and staring with small amounts then perhaps take a look at Halifax Share Builder - it is set up for this purpose, you can get a cheap commission rate (£2) as they essentially lump together orders... granted this is for investments you're looking to schedule in advance, not for online orders you want to execute right now... so essentially if you were investing a small amount per month say then this could be useful.

Regardless - it might be worth getting a copy of this book:

https://www.amazon.co.uk/Financial-Times-Guide-Investing-definitive/dp/027372374X

You can't buy fractions of a share and no you're not going to invest exactly £500 in a stock unless the share price exactly divides £500

For example BP's ask is/was 489.45 (that's in pence) so say you bought 100 BP shares you'd have spent £489.45 + commission.

Does that make sense?

US shares tend to be much more expensive, just because... no particular reason other than psychologically they're used to shares of big companies being more like XX or XXX USD whereas in the UK it is more like XXX pence so relatively more shares issued (we're a bit weird vs the rest of the world with regards to this - quoting of shares in the subunit). So you might actually buy a single share in a US company if you're investing rather small amounts.

You ask about brokers - it depends on your needs - if you are only talking about small amounts of money then you might want to look at a tracker as Roff mentioned above or an ETF which have historically tended to be cheaper.... but if you really want to invest in individual stocks and staring with small amounts then perhaps take a look at Halifax Share Builder - it is set up for this purpose, you can get a cheap commission rate (£2) as they essentially lump together orders... granted this is for investments you're looking to schedule in advance, not for online orders you want to execute right now... so essentially if you were investing a small amount per month say then this could be useful.

Regardless - it might be worth getting a copy of this book:

https://www.amazon.co.uk/Financial-Times-Guide-Investing-definitive/dp/027372374X

That makes so much more sense, thanks for that!

That makes so much more sense, thanks for that!

Just a word of advice if your new to investing I wouldn't go balls deep.

Just use money which you can afford to lose in the first 12-18 months it's easy to get carried away on stocks because it looks 'cheap'.

The first few years of investing I made no money.

And here we go. Two separate legal actions being launched against HL, looking to represent in excess of 500 clients so far who claim to have lost money due to HL either misrepresenting the health of Woodford Investments or being derelict in their due diligence and promotion.

Soldato

- Joined

- 13 Jul 2004

- Posts

- 20,341

- Location

- Stanley Hotel, Colorado

That Halifax account does fractional share amounts but its for the benefit of their regular share buy scheme. The company themselves can only own singular shares but for your benefit they'll say you own 0.1 shares of BP, I think it helps the dividend reinvestment idea as thats all % it works as an idea.You can't buy fractions of a share

£500 is going to get destroyed on costs in many accounts but Halifax might be ok or better then most so long as you buy regularly for more. My brother was told its £35 if he wants to add any shares, which is a shame as it discourages involvement

I dont generally advise holding foreign shares like that unless you are skilled (rich, diversified, etc) and able to pay a lot of attention, lots of reading when required, its probably best to hand it off to a fund. Either a passive tracker of tech or a fund like PCT which trades in UK and is way more convenient and probably tax efficient. I advised a relative to buy MSFT in the early nineties, not that I ever liked windows and back then it was basically only file manager but it was useful to people. There were alternatives to windows then but as it turned out MSFT was way more aggressive and successful for a number of reasons.

So they didnt take MSFT but they did buy PCT from launch or 100p like many funds and have sold some but basically still own it a quarter century later, that kind of choice and hold is probably the ideal.

JII was another good fund, it took a bit of time at first but its been a good idea to look at on a number of occasions though it can fall back. So long as India transitions to capitalism and management is good I think its good long term, the majority of India is under 30 where as Japan is near pension age average which is a simple argument on growth.

I actually own more of Japan and developed Asia though

I guess any gold fund did well this year and imo it will over a decade. Asian infrastructure might be one of the best ideas, BNY fund looks more like tech plus other players. I tried to buy a share which owned Indian port developments and built with profit, didnt seem a failure to me but wasnt enough of a success. If I had just kept JII instead they have active management choice and information on the whole market while I'm sitting the other side of the world presuming.

Short term personally owning the share is more agile, but most of us wont be able to do better long term seems like. Owning gold shares seems so risky to me now- ACA resolved by ABX luckily at some cost but great profit was there playing the range dangerously.

If there is upset from imbalance in the world then gold is probably rising but also the risks in many of these countries is rising similarly. If the sector is rising then go with the fund for the majority, seems the best choice.

I'm going to try and be more biased towards funds in future for holds anyhow.

151.66 on GLD for 2019 was my rough target, of course I'd like it to go back to previous highs but I think it has to be a very bumpy road. Near term we might see lower gold in sterling because we've had this news and speculation that dropped our forex. I dont trade forex but it reflects in other prices, it looks as if a break of trend here could be significant improvement in rates vs dollar or euro. Maybe that doesnt happen till Jan or whenever market judges they have actually done something not just talked.

Ben B admitted QE cant be reversed I think, so the landscape is we move away from dollar global reserve.

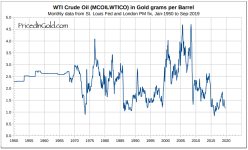

Oil not been this cheap relative to gold many times in history. So got to decide is gold expensive and liable to top here or oil is reasonable longer term. I'm way overweight in gold so I might buy back RDSB I had bought into and sold after merging with BG

or BP which I've not had in two years now. Wasnt this the last actions of Woodford to buy big oil which he famously avoided for many years. Jim Cramer says oil is unpopular and dividends unproven basis. My guess is positive world GDP growth and continued need for oil, China and India have very little.

https://www.dailyfx.com/authors/John_Kicklighter

Last edited:

Soldato

- Joined

- 13 Jul 2004

- Posts

- 20,341

- Location

- Stanley Hotel, Colorado

Chesapeake energy fallen quite a bit over the years with more bad news today (though imo its not new news). Peak frack now a saturated market with poor demand, CNA has a license to import from them so maybe UK benefits.

If energy moved up a lot this is the kind of wildcard that would move most I guess, 300m debt due in next year but this company is a behemoth. Sadly the CEO behind it met a bad end

Chevron refines oil USA has sanctions on

https://finance.yahoo.com/news/pdvsa-chevron-turn-venezuela-crude-143451977.html

Last edited:

The juxtaposition with the laptop there is great...

I think that has just jumped the shark in terms of technical analysis silliness - not content with ignoring time series methods from statistics/econometrics/signal processing/machine learning etc.. this "technical analyst" seems to have ignored technology too!

And here we go. Two separate legal actions being launched against HL, looking to represent in excess of 500 clients so far who claim to have lost money due to HL either misrepresenting the health of Woodford Investments or being derelict in their due diligence and promotion.

the later point would be the one I would be going after...The promotion of the fund to clients was all wrong. To try and maintain some form of Independence you can not a "top 50/100" list as that automatically implies to clients they are the "favoured" funds/better funds. Rightly or wrongly clients think like this.

I very much work on the basis that if something is too good to be true then stay clear but Ive been having a look at different funds on HL (currently have everything with Vanguard and Im aware of the ongoing issues with HL but was just curious) and came accross some funds that seem too good to be true! I appreciate past performance isnt an indicator of future perfomance but just taking one example from their site - Polar Capital, over the past 5 years theyve shown returns of 11% to as high as 40%! On their fact sheet is my interpretation of their performance correct in that if I had have invested £10k in Nov 2015 it would have went up by 34% to 13.4k and then again by 40% in the follwing year to £18,760? My average return with Vanguard is 8% which I thought was pretty good!