The help is for families who then almost immediately pay it back in taxes. All this spree buying is clocking up 20% vat on tons of it, fuel duty and so on. Normal people cant avoid tax, a giant global enterprise that can drift between regimes cannot be asking for a bailout from 1 particular country. The airlines if they cant handle the burden would have to be partially nationalised and at the call of government or military for any logistics. Thats not ideal but a fair choice I guess.

Lloyds recovered and repaid its subsidy, I actually think they are worth buying now tbh. RBS was not a success, that was far more a global mix (Lloyd was previously straight lace, RBS a mess). Barclays refused any bailout, totally boomed right after the worst sell and is now right back to sub 100p I noticed. All finance qualifies as unpopular but all the loose money is continually a boost for them I think. Just like oil is a gift to any heavy user.

Only the advice not to sell housing makes me think twice at all, I wouldnt want that market to be disrupted but underlying fundamentals are good. My neighbour just sold his house for 900k, nice house sure but it was 90% less when he moved in the 80's, the reason being that loose money makes mortgages despite previous mistakes profitable and safe business for the banks. If we ever get defaults, hard money and all that then its far more a question but QE is not ending right now imo. The ending is likely to be an unwinding of any standard ie. 70's style inflation which gives assets the advantage vs debt.

https://www.telegraph.co.uk/investi...t-coronavirus-bail-says-40-year-veteran-fund/

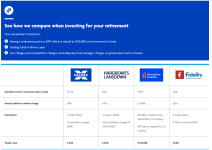

What companies/brokers do folk on here use for investing into index funds? Any recommendations?

Go via a SIPP and they add on 20% or more on top which is hard to beat. Also stops the bad idea of taking a short term perspective as it cant be taken back out to cash until retirement but the restrictions on cashing out are pretty lax nowadays.

You can always adjust contributions to reflect gains within the SIPP, net effect being you see a gain in your available cash same as an ISA but with +20%

Taking up 20% of a company that gets easy money is a fair compromise and it makes them think twice and search for alternatives.

Taking up 20% of a company that gets easy money is a fair compromise and it makes them think twice and search for alternatives.