Hi Guys,

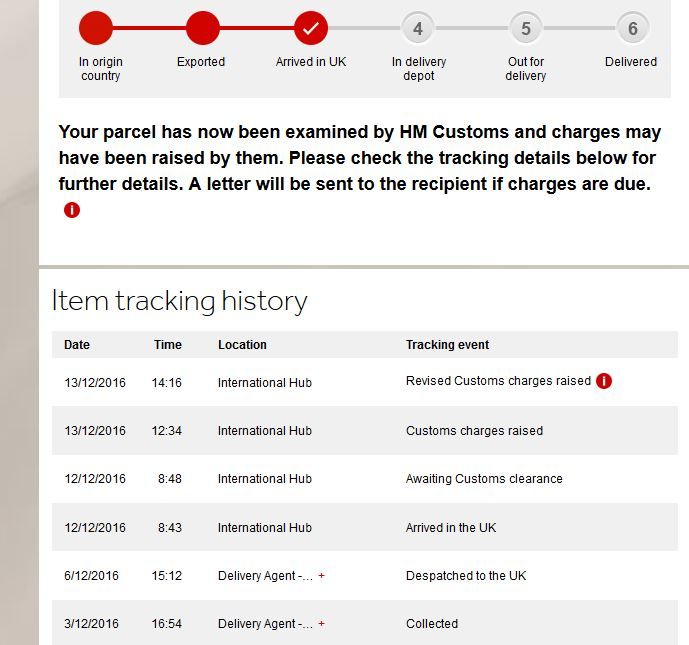

About 2 weeks ago i ordered a product from the USA which came to a value of $160 then i payed $33 for USPS priority mail international which takes 6-10 days. I have been tracking the order through both USPS and Parcel force's site and finally after all this time, i get the following:

17-01-2008 17:54 International Hub En route to delivery depot

17-01-2008 17:27 International Hub RELEASED WITH REVISED CHARGES

17-01-2008 17:26 International Hub RELEASED WITH CHARGES

15-01-2008 20:16 International Hub AWAITING CUSTOMS CHARGES

15-01-2008 20:00 International Hub Arrived in destination country

What does RELEASED WITH REVISED CUSTOM CHARGES mean? How much do you think custom will charge, i hope not a lot, as this was 2 small items in one box, that don't hardly weigh a thing. One cable and 1 CD in a box that measures i don't know something like 30cm by 20cm by 3cm I should have asked the store to send the item as a gift.

Can anyone help me on this please

Much appreciated

Many thanks

About 2 weeks ago i ordered a product from the USA which came to a value of $160 then i payed $33 for USPS priority mail international which takes 6-10 days. I have been tracking the order through both USPS and Parcel force's site and finally after all this time, i get the following:

17-01-2008 17:54 International Hub En route to delivery depot

17-01-2008 17:27 International Hub RELEASED WITH REVISED CHARGES

17-01-2008 17:26 International Hub RELEASED WITH CHARGES

15-01-2008 20:16 International Hub AWAITING CUSTOMS CHARGES

15-01-2008 20:00 International Hub Arrived in destination country

What does RELEASED WITH REVISED CUSTOM CHARGES mean? How much do you think custom will charge, i hope not a lot, as this was 2 small items in one box, that don't hardly weigh a thing. One cable and 1 CD in a box that measures i don't know something like 30cm by 20cm by 3cm I should have asked the store to send the item as a gift.

Can anyone help me on this please

Much appreciated

Many thanks