- Joined

- 22 Nov 2007

- Posts

- 4,361

/thread

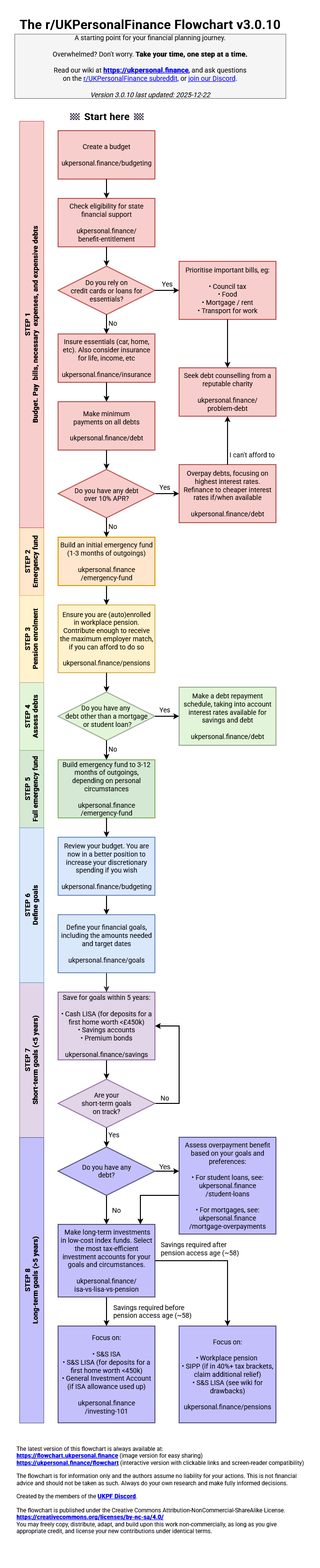

The Flowchart - UKPersonalFinance Wiki

A starting point for your financial planning journey in 8 steps, from the wiki for Reddit's /r/ukpersonalfinance!ukpersonal.finance

Sorry i missed this yesterday, will check it out, thank you.