-

Competitor rules

Please remember that any mention of competitors, hinting at competitors or offering to provide details of competitors will result in an account suspension. The full rules can be found under the 'Terms and Rules' link in the bottom right corner of your screen. Just don't mention competitors in any way, shape or form and you'll be OK.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AMD on the road to recovery.

- Thread starter humbug

- Start date

More options

Thread starter's postsSoldato

- Joined

- 30 May 2007

- Posts

- 4,964

- Location

- Glasgow, Scotland

Sorry. VMWare

No worries, I was wondering if NMWare was some kind of underhanded dig I wasn't aware of!

Apparently the latest witch hunt on the driver team don't scare the investors

saw a post on reddit that tracked actual RMAs for given cards, the 5700XT was worst at I believe around 2.3%... that compares with nvidias 2080Ti at I believe 2.8%. Those figures aren’t necessarily entirely accurate as I’m just remembering off the top of my head and reddit is down for me currently, but the 2080Ti for example (notorious for some QC issues) is actually worse in terms of returns than any of the navi cards.

So while this stuff tends to blow up on forums and whatnot, it seems the real world figures suggest the majority aren’t having issues significant enough to return the card.

I definitely want to see them improve, but from an investor stand point I can see why they wouldn’t be particularly bothered at the moment as it isn’t manifesting in a higher return rate. You could argue there is a potential loss of future customers from poor experiences, but that’s hard to quantify at the moment and would likely be drowned out by the success of the CPU side anyway for now.

From this investor’s standpoint though I would welcome a dip - sold about 60% of my shares at $55 and would potentially re-enter at/below $50.

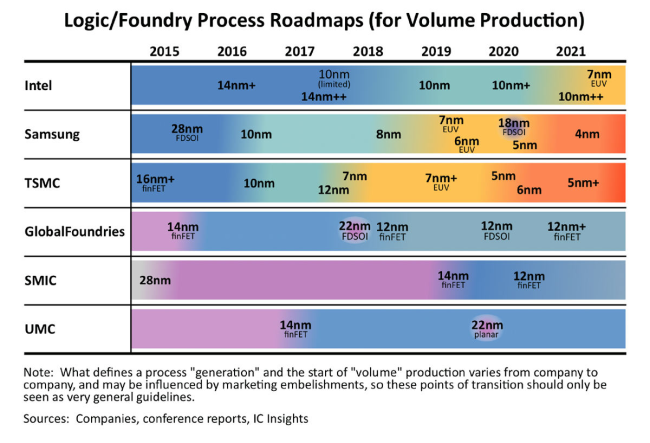

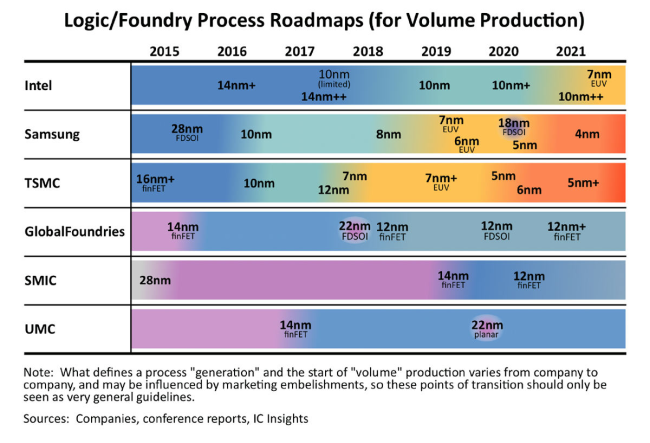

Intel Says Process Tech to Lag Competitors Until Late 2021

https://www.tomshardware.com/uk/new...til-late-2021-will-regain-leadership-with-5nm

https://www.tomshardware.com/uk/new...til-late-2021-will-regain-leadership-with-5nm

https://seekingalpha.com/news/35486...tm_campaign=rta-stock-news&utm_content=link-3

AMD scores $600M supercomputer win

That is one heck of a nice contract for AMD to get its hands on

More info here: https://www.nextplatform.com/2020/03/04/lawrence-livermore-to-surpass-2-exaflops-with-amd-compute/

More info here: https://www.nextplatform.com/2020/03/04/lawrence-livermore-to-surpass-2-exaflops-with-amd-compute/

Last edited:

Associate

- Joined

- 6 Dec 2013

- Posts

- 2,074

- Location

- Nottingham

apparently pandemics don't affect cpu sales  i would imagine people are spending savings whilst they can if they can

i would imagine people are spending savings whilst they can if they can

i would imagine people are spending savings whilst they can if they can

i would imagine people are spending savings whilst they can if they canI'm surprised CPU sales are near double that of March last year..... or at least it has for AMD

Could be partly due to a pulling forward of demand - more people working from home, more people stuck inside so building PCs now, but the economic impacts of higher unemployed and lower discretionary spending not yet being seen. If so figures might drop below average over the following 6-8 months perhaps.

Could be partly due to a pulling forward of demand - more people working from home, more people stuck inside so building PCs now, but the economic impacts of higher unemployed and lower discretionary spending not yet being seen. If so figures might drop below average over the following 6-8 months perhaps.

I don't think so, total sales have been on a steep up curve since July and only peeked in December as normal. What did happen in July was more availability of Zen 2 parts, which explains that very steep rise in sales to AMD's advantage since then. The amazing thing though is market share in the space of 1 year, AMD from 69% to 88% and INTEL from 31% to 12%....................most companies in any sector of a market would kill for sort of a move if they were targeting the market leader. Although of course, even last March Intel had already lost the market lead.

I don't think so, total sales have been on a steep up curve since July and only peeked in December as normal. What did happen in July was more availability of Zen 2 parts, which explains that very steep rise in sales to AMD's advantage since then. The amazing thing though is market share in the space of 1 year, AMD from 69% to 88% and INTEL from 31% to 12%....................most companies in any sector of a market would kill for sort of a move if they were targeting the market leader. Although of course, even last March Intel had already lost the market lead.

AMD have competitive (and usually better) CPUs for less money. Intel can't respond and have a load of security issues. This might be the new normal, at least for a while.

Associate

- Joined

- 15 Feb 2014

- Posts

- 767

- Location

- Peterboghorror

That was my reason. I would have bought a new graphics card but a decent upgrade from Nvidia is too expensive and AMD don't even have a decent upgrade at the moment.Could be partly due to a pulling forward of demand - more people working from home, more people stuck inside so building PCs now, but the economic impacts of higher unemployed and lower discretionary spending not yet being seen. If so figures might drop below average over the following 6-8 months perhaps.

AMD's investing heavily into its R&D - Spending is up over 18%

https://www.overclock3d.net/news/mi...avily_into_its_r_d_-_spending_is_up_over_18/1

When the original Zen was released back in Q1 2017, AMD was spending $271 million on R&D but now in early 2020, they are up to $442 million, an increase of over 60%!

I think this shows nicely how successful the Zen architecture is and its good to see AMD willing to invest big into R&D.

https://www.overclock3d.net/news/mi...avily_into_its_r_d_-_spending_is_up_over_18/1

When the original Zen was released back in Q1 2017, AMD was spending $271 million on R&D but now in early 2020, they are up to $442 million, an increase of over 60%!

I think this shows nicely how successful the Zen architecture is and its good to see AMD willing to invest big into R&D.

AMD's investing heavily into its R&D - Spending is up over 18%

https://www.overclock3d.net/news/mi...avily_into_its_r_d_-_spending_is_up_over_18/1

When the original Zen was released back in Q1 2017, AMD was spending $271 million on R&D but now in early 2020, they are up to $442 million, an increase of over 60%!

I think this shows nicely how successful the Zen architecture is and its good to see AMD willing to invest big into R&D.

Good. And that's just in one quarter, if they keep this up they will be spending $2 Billion annually on R&D, that's healthy, good things will come from this.

They also brought their total Debt and liabilities down from $2.359 Billion to $1.985 Billion Year over Year, they still made $177 Million net profit this quarter.

Cash and cash equivalents: $1.33 Billion.

Total Assets: 5.864 Billion

Market Cap: (Company value) : $65 Billion.