-

Competitor rules

Please remember that any mention of competitors, hinting at competitors or offering to provide details of competitors will result in an account suspension. The full rules can be found under the 'Terms and Rules' link in the bottom right corner of your screen. Just don't mention competitors in any way, shape or form and you'll be OK.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AMD on the road to recovery.

- Thread starter humbug

- Start date

More options

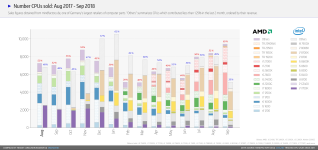

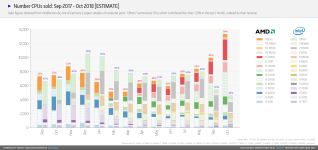

View all postsThe September figure has to be taken in the context that an Intel CPU launch is imminent and many potential Intel buyers will be waiting to spend then. What will be interesting is to see what the Oct/Nov/Dec charts look and if AMD still maintains their lead.

Oh of course it must be, i mean it simply cannot be that people are choosing to buy AMD CPU's instead of Intel, that would be preposterous.

The 8700K is near 3 times more expensive than the 2600, for that massive price difference its 15% better in games, Intel have real competition and yet despite this have gradually pushed the prices up even more these past few months, that's the real reason.

... and with all those things in the 2600's favour the 8700K's numbers have been consistently good even in this last month. You have to be really blinkered if you can not see how that a new Intel CPU launch in October might adversely affect sales in September.

There are even threads in the CPU section with potential buyers of 8700K's been told to wait so why would you just put it all down to AMD's superiority? I love what AMD are doing but I also know how to read a chart and apply it to the context of it's relevant space.

My main playmate gaming group consists of about 5 people, up until about a year ago all of them, including me were Intel, a mixture of Devils Canyon and SkyLake, 4 of us are now Ryzen, the other one Threadripper.

Ryzen has been around for about 18 months, a lot of people have been sitting around waiting to see what Intel are going to do about Ryzen, including some of my gaming playmates, they have seen what Intel's reaction is, yes its to match AMD on core count but at the same time push the prices up, they know the 9800K and 9900K are coming but they also know they are going to be £450 and £550 at least, they are getting tired of Intel constantly jacking prices up and up and up....

Its not just Intel, its Nvidia as well they are getting more and more greedy as it becomes increasingly difficult to keep growing revenue by appealing to new customers, so they stretch brand loyalty to its absolute limits by pushing prices up a lot for not much performance gain.

The fact is the more expensive your products become they less people buy them, AMD are the only ones these days offering a lot more bang for a lot less buck, that shows in the sales figures.

How does your mate with threadripper fare fps wise?

I keep looking at it given the prices.

I don't know, he only got it the day before yesterday and i missed him yesterday, his name is @Raumarik

I'm not sure why you quoted me as what you just wrote has little to do with what I wrote. Just to recap: You were having a go at me for suggesting that the 8700k's slightly lower sales in September over August might be in part due not only to the 2600's resurgence but also that a new Intel CPU is due in October.

My reply was purely reinforcing the sensible and impartial notion that sales of a brand of CPU might dip the month before a refresh CPU launch (same for AMD as well).

You're reply, while perfectly anecdotal and I'm in total agreement with is what we refer to as non sequitur.

You might as well have talked about how good the Barton CPU's were (forgive the slight hyperbole but you should get my point)

Look at the chart again, removing your AMD tinted glasses, and rather than just looking at the 2600's meteoric rise, look at the 8700k's numbers; even with the swing to AMD in terms of percentage of total CPU sales, the 8700K sales since May 2018 have steadily increased each month till August and then have taken a slight dip in September, one month before their new CPU launch.

While I'm in total agreement with you and your mates as to Intel practices and short changing us customers, the sales numbers in the last chart should help give some indication as to the consensus view outside of these forums.

Using Language like this "removing your AMD tinted glasses" is what makes your motives obvious, i have had more Intel than i have had AMD, i go where ever my money gets me the best, that right now is AMD.

Even though AMD have said themselves that Zen 2 is aimed at Ice Lake, i really can't see them surpassing Intel in gaming performance, but we'll see.

All Intel have is clock speed, that's it, if 7nm gets Zen 2 to to 4.6Ghz (not at all a stretch over current 4.2Ghz) Intel are down to mid single figure percentage gaming advantage, and that's assuming 0 IPC gain on Zen 2.

Since the Intel price hikes, one of Germany's largest online retailers are selling 70% more Ryzen sales over the last few days compared to Intel.

In other words, at least seven out of 10 buyers have opted for a Ryzen chip >> https://digiworthy.com/2018/09/29/amd-ryzen-sales-intel-prices/

Intel's price trend with AMD's sales figures just a coincidence?

Google game stream service, Intel making noises about 10nm, nothing new, still delayed till 2019 but they are making noises and that alone spooks some people.

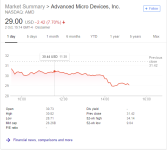

AMD (AMD -3.4%) is heading in the opposite direction possibly because of yesterday’s launch of Google’s Project Stream in-browser gaming test program. But the company also had an analyst downgrade yesterday and dropped last Friday as rival Intel updated its 10nm chip supply.

https://seekingalpha.com/news/3394533-semi-stocks-trade-catalysts#email_link

Last edited:

Here... this is Intel's statement, nothing has changed but the mere fact that Intel speaks has some people moving thier money around because they think Intel speaking spells the end for AMD.

https://seekingalpha.com/news/3393776-amd-minus-4_5-percent-intels-10nm-supply-update

https://newsroom.intel.com/news-releases/supply-update/

Its nothing, its a blip by idiots who somehow don't know 10nm was always due to its delay in 2019 and think its some sort of turn-up for Intel, the next financial results, due soon, will push AMD back over $30, its going to be better than expected.

https://seekingalpha.com/news/3393776-amd-minus-4_5-percent-intels-10nm-supply-update

https://newsroom.intel.com/news-releases/supply-update/

Its nothing, its a blip by idiots who somehow don't know 10nm was always due to its delay in 2019 and think its some sort of turn-up for Intel, the next financial results, due soon, will push AMD back over $30, its going to be better than expected.

We shall see... think it might be slightly optimistic or naive to think AMD will ride this high forever.

This high? they have been a lot higher, this is a normalisation of where they should be.

AMD may regain 30% global desktop CPU market share in 4Q18

https://www.digitimes.com/news/a20180925PD204.html

https://www.digitimes.com/news/a20180925PD204.html

After returning to profitability in 2017, AMD has continued gaining momentum to perform better in 2018, with its share price hitting a 12-year high recently and its global desktop processor market share likely to rebound to 30% again in the fourth quarter of the year, thanks to full foundry support from Taiwan Semiconductor Manufacturing Company (TSMC) and Intel's delay in launching 10nm processors, according to industry sources

The sources said that AMD has drastically changed its foundry strategy, loosening ties with Globalfoundries and contracting TSMC to fabricate its GPUs, server and PC processors on 7nm process. The policy change has sent AMD share prices rallying all the way since mid-2018 amid market expectations for better chip yield rates and performances as well as normal shipments to customers.

In addition, Intel's failure to carry out process transition from 14nm to 10nm in the second half of 2018 and the ensuing supply shortfall have prompted PC vendors to adopt AMD processors, further pushing up AMD's share prices to new highs in 12 years since late August.

Desktop and motherboard vendors including Asustek Computer, Micro-Star International (MSI), Gigabyte Technology and ASRock have ramped up production and shipments of devices fitted with AMD processors, driving up the chipmaker's share of the desktop processor market to over 20% in the third quarter. The company is very likely to see the figure further rebound to the level of 30% again.

In terms of server processor market, AMD's EPYC 7000 series processors have been well adopted by Mellanox and Samsung Electronics since their launch in June 2017, and the firm's expanded EPYC series have also won robust support from heavyweight clients including Microsoft, Baidu, Dell, HP and Supermicro, as well as Taiwan's Inventec, Wistron, Asustek, and Gigabyte. It is expected that the EPYC series sever processors will help AMD win a 5% share of the global x86 server platform market by the end of 2018, which has been 99% controlled by Intel.

AMD's latest EPYC processor, codenamed Rome and adopting Zen2 architecture, is slated for volume production in 2019 using 7nm process at TSMC after the delivery of samplings by the end of 2018.

With 8 business days still left, AMD is already set for another record breaking month at Mindfactory!

Sales of AMD's 2700X has exploded while the 2600 remains the biggest seller for a second month in row!

Intel's previous top seller, the 8700K continues to fall while the 8068k sees a small sale increase this month.

Wow ok.... this is still happening too...

Hope you bought the AMD shares now they are low...

https://semiaccurate.com/2018/10/22/intel-kills-off-the-10nm-process/

This is Intel conceding their process leadership.

Intel must have a plan B, they probably have a new architecture ready to lay out on 12nm.or some such or they could go down the AMD route and stitch together a few of their 4c/8t high perf chips ala Ryzen and play AMD at their own game?

Cannon Lake will be refactored for 14nm++++++++++ which is delayed until second half of 2019, in other words the years end, maybe, if it doesn't get delayed again.

Running your own fabs is expensive and when you no longer have the market practically to yourself its starts to become unsustainable, AMD sold their fabs more than a decade ago, for this reason.

How long till AMD start cranking prices and turning the thumb screws just as Nvidia and Intel have done over the years of dominance.

That is a good question, my hope is AMD continue with low prices in a bid to claw back tones of market share from Intel, it seems to be working.

It may or may not be naive but I genuinely believe that AMD have a better business "ethos" than Nvidia or Intel. Maybe it just comes from having their hand forced as the underdog for the past while. But I don't know. I just believe a lot of the staff, company and Directors just "play fair" more than green and blue. (Open source this and that being a good example). I certainly trust Lisa as a person a lot more than Jensen and whomever Intel have as *CEO *insert current CEO at given time here. Dunno. I just much prefer them as a company. They seem plucky and genuinely don't want to rip their customers off. I've met a few AMD staff over the years and they seem to really really believe in the company and are passionate about their customers. Intel is just uber corporate and Nvidia uber greedy.

I think its probably forced, but i know what you mean, i have had conversation with some AMD staffers and they do seem genuine. Robert Halock for example https://youtu.be/vZgpHTaQ10k?t=221

AMD have also been at the receiving end of some really dodgy stuff from nVidia and particulary Intel over a lot of years and i think that has also shaped their attitude and thinking.

They are the underdog and as a personality they do feel more like geeks passionate about their work and the PC enthusiast industry.

This may trigger some people but i feel Intel are much more like soulless accountants and sales men than impassioned engineers, AMD always have been and still are more innovative than Intel, perhaps by need of being the underdogs but IMO AMD are more about thinking outside the box and finding clever solutions to technology problems, i could list examples but i think most know what i'm talking about, 64Bit, First true multicore, integrating the Memory Controller, GDD5 Memory, HBM memory, HSA..... Infinity Fabric, a very clever solution to the problems of very high core count CPU's, and capable, yes Bulldozer was a pile of crap but they dusted themselves down and made a CPU with the same IPC as Intel latest and greatest when the school of thought was there was no way Intels IPC could be touched, no way back for AMD, in fact AMD's SMT is more efficient than Intel's when everyone said; well Intel has the experience with it so how could AMD match it....

Well ok so listed most of it, AMD's capabilities have always been underrated, they are clever guys, they know what they are doing, and they make mistakes, they are human.

AMD plunges 22% on Q3 revenue miss, weak guidance; crypto revenue vanishes

So they missed their targets, however, they still made $102m after tax, which is really good. http://ir.amd.com/financial-information/quarterly-results

For those that don't know the difference between GAAP and Non-GAAP is basically GAAP is an industry standard of calculating profit and Non-GAAP is AMD's way of calculating profit.

So mixed news, Mining has dented their gross taking a little but they are still making a lot of money, this is money in their pockets, $102m of it.

So they missed their targets, however, they still made $102m after tax, which is really good. http://ir.amd.com/financial-information/quarterly-results

For those that don't know the difference between GAAP and Non-GAAP is basically GAAP is an industry standard of calculating profit and Non-GAAP is AMD's way of calculating profit.

So mixed news, Mining has dented their gross taking a little but they are still making a lot of money, this is money in their pockets, $102m of it.

Just topped up a bit more of their shares. Missed the drop below $20, but oh well. Though kinda disappointed with AMDs inability to convert Intels shortages into their own benefit

Well, there is a lot of evidence that AMD are selling a lot more Retail CPUs than Intel right now.

For example.

AMD have made $270m pure profit in the last 6 months