Firstly this isn't a thread to discuss if pay increases are deserved or are a reasonable request given working conditions or lack of historic increases as thats a whole new topic to go down.

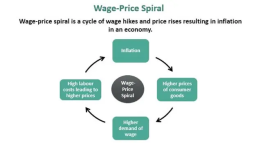

However, it's to discuss the fact we are seeing more industries striking for better pay of demanding better pay in the last 4-8 weeks citing inflation and the cost of living as one of the primary reasons. While it is understandable to demand more pay during a time of inflation this in itself has the risk of pushing up labour costs and therefore prices which in turn, in theory pushes up inflation even higher, wiping out the pay increase and generate more demand for even higher wages

A few examples of recent increases and demands are below

Given:

Sainsburys workers 5.3% increase

PWC 7-9% increase

Rejected/Demanded/Disputed:

Barristers 15% pay increase demanded

Doctors 30% over 5 years demanded

Royal mail offered 2%, offerered 5.5%, rejected both demanding higher

Rolls Royce £2000 payment offered and rejected, 4% increase rejected

Railworkers offered 2% and 4% rejected, 7% demand

British Airways demands 10% increase but only to restore this to pre covid levels

Ryan Air (unsure of demands)

Does anyone think we are on the cusp of a wage/inflation death spiral? Are we expecting more and more industries and workers to start demanding more pay? If so, what is your take on the situation and if you dont think we are at the risk of entering this spiral whats your thoughts on how we are/will avoid(ing) this?