You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Energy Prices (Strictly NO referrals!)

- Thread starter DXP55

- Start date

More options

Thread starter's postsNot fully, but it plays a major part.You are blaming 15 years of low interest rates on the 2022 inflation?

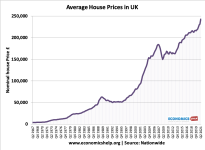

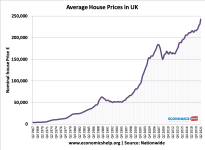

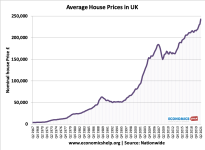

House prices have steadily increased over those 15 years, which fits exactly with QE and ultra low interest rates. The central banks have created an "everything bubble" though with their poor policies and like all bubbles, it pops once the artificial stimulus is taken away. The alternative is hyperinflation which is a far worse outcome.

Soldato

The way things are going they should be having a weekly meeting...Main reason I was expecting 0.5 is fed and no meeting next month?

Ideally 0.25 month on month would be better. But with a missed meeting 0.5 seems required

Today's rate setting meeting is going to be interesting. There's a chance inflation can be controlled should a 0.5% materialise and that those rate rises keep coming.

I think they may chicken out with 0.25%, however that would just be delaying the inevitable as rates will have to go up much further at a later point. Central Banks know where things are headed, all led by the Fed.

I think they may chicken out with 0.25%, however that would just be delaying the inevitable as rates will have to go up much further at a later point. Central Banks know where things are headed, all led by the Fed.

Today's rate setting meeting is going to be interesting. There's a chance inflation can be controlled should a 0.5% materialise and that those rate rises keep coming.

I think they may chicken out with 0.25%, however that would just be delaying the inevitable as rates will have to go up much further at a later point. Central Banks know where things are headed, all led by the Fed.

Think they might chicken out at 0.25 too.

Without knowing the ins and outs.

And just taking an ordinary person

Big Rate rises will hurt mortgages/house prices

Small rate rises will devalue the pound with USA's big bump.(gas price, imports expensive, ie oil/gas!)

So fairly trapped.

Seems basing our economy on house prices wasn't such a great idea.

What’s the current opinion on fixing? My OVO fix is up next week and I’m offered elec at 35.79 unit / 54.1 standing and gas at 9.82 unit / 27.52 standing. I think that’s 32% above the current cap. I’m thinking it’s worthwhile to do that for piece of mind and see what a state were in come next June.

Soldato

Heating still on ?

I'm not sure, house prices were rising faster in the years before the crash it really took off about 1997, the market just resumed trend after the crash cant really pin it on low interest rates.Not fully, but it plays a major part.

House prices have steadily increased over those 15 years, which fits exactly with QE and ultra low interest rates. The central banks have created an "everything bubble" though with their poor policies and like all bubbles, it pops once the artificial stimulus is taken away. The alternative is hyperinflation which is a far worse outcome.

The pattern is almost identical now to the 2004 to 2007 pattern.

What happened next? Oh yeah.

On plus side even the massive correction in 2008 only corrected for 3 years.

Apart from FTBs in the last couple of years a significant correction back to pre pandemic wouldn't be the end of the world.

To me this shows how ridiculous the stamp duty break was

Agreed on house prices before QE and low interest rates before 2008, however 2008 is the time house prices should have crashed as they were already too expensive. QE and low interest rates allowed the party to continue. Now the punch bowl is taken away (finally), I wonder where prices go next?

And when I say crash, I don't mean a blip like that chart shows in circa 2008. That fall would have been much further without QE and low interest rates.

Even with a 50% crash, houses are still unaffordable, more so if fuel, energy and food prices continue to increase.

Even with a 50% crash, houses are still unaffordable, more so if fuel, energy and food prices continue to increase.

10-20% crash.

I'd concur. That's the limit in expecting.

Well I hope it won't be more than that!

And when I say crash, I don't mean a blip like that chart shows in circa 2008. That fall would have been much further without QE and low interest rates.

Even with a 50% crash, houses are still unaffordable, more so if fuel, energy and food prices continue to increase.

A 50% crash takes us back to house values as they were in 2001 - we're not talking about impacting a small number of home owners here, large swathes of the entire population will be in negative equity, basically anyone with a mortgage. Affordability of houses is a moot point because 2/3 of the population will be unable to buy / sell. Unless a homeowner dies or moves into retirement / care home, houses will not come onto the market.

I do agree, but we're not in normal times. The gift that was QE will have huge consequences one way or the other. An economy based on ever-increasing house prices is only going to end in disaster.A 50% crash takes us back to house values as they were in 2001 - we're not talking about impacting a small number of home owners here, large swathes of the entire population will be in negative equity, basically anyone with a mortgage. Affordability of houses is a moot point because 2/3 of the population will be unable to buy / sell. Unless a homeowner dies or moves into retirement / care home, houses will not come onto the market.

Soldato

Reckon the rate will go up 1%, people gonna **** themselves.

Probably not today, but these piddly 0.25% raises are only going to add up over time, so eventually it comes out in the wash whilst prolonging people's agony in the meantime.Reckon the rate will go up 1%, people gonna **** themselves.

Soldato

Just got a email from octopus our monthly bill is going from £138 to £378

I do agree, but we're not in normal times. The gift that was QE will have huge consequences one way or the other. An economy based on ever-increasing house prices is only going to end in disaster.

Inflation is a natural outcome of capitalism, so either we switch to a different type of economy or ever-increasing house prices is a normal outcome.

The issue we have is that house prices have increased far and above the rate of inflation due to a lack of supply and cheap / easy credit.

Price stagnation / increases below the rate of inflation is a more palatable approach so prices drop in the longer term rather than a crash.

Soldato

- Joined

- 25 Nov 2005

- Posts

- 12,504

Eight million Australians urged to turn off lights

Australia's energy minister urges households to use less electricity in the face of a power crisis.

www.bbc.co.uk

Surprised to see that news about Australians being asked to reduce their energy use in case there isn't enough energy

However, that cap was below the cost of production for several generators, who decided to withhold capacity.

Is is possible we could see the same here at some point if they choose to withhold energy because it isn't profitable ?